A Few Random Thoughts

Random thoughts as I go through the week:

As I was going over charts on Tuesday night, I wrote in my notebook that some of the leading themes were a bit stretched to the upside. Noting impactful for the long-term trend in the market or my view that we are in a cyclical bull market, just something to note. I like to think of it as a way to gauge how aggressive to be. Knowing when to lay back and knowing when to attack. Here is a great example, the iShares Micro-Cap ETF (IWC), my poster child for the new bull market. I added the 21-day (red) and 200-day (green) moving averages. The green arrows tell me when the price of the fund is more than two standard deviations above both. Clearly, this is not sell signal but I like to use it as a wakeup call to decide how aggressive to be. There are similar dynamics at play across the other small cap funds that I track.

Again, nothing to be overly concerned about, just noticing.

I have gone over my thoughts on commodities and now it seems that the theme has caught the attention of the financial media. In fairness, this is the Financial Times (arguably the more sophisticated of the business news outlets). I would be more concerned if this was on the cover of something like Time magazine. A few of the bigger banks have caught on to this theme as well. It was bound to happen. Copper has nearly doubled from the COVID lows. So while this lines up with my “things are getting better” thought process, it is hard to think that eventually others were not going to notice. The view is no longer non-consensus.

Those who like to bake may have notice that the cost of making a cake or cookies is probably heading higher. Wheat on the left and Sugar on the right.

These are all probably a bit stretched to the upside as well in the near-term.

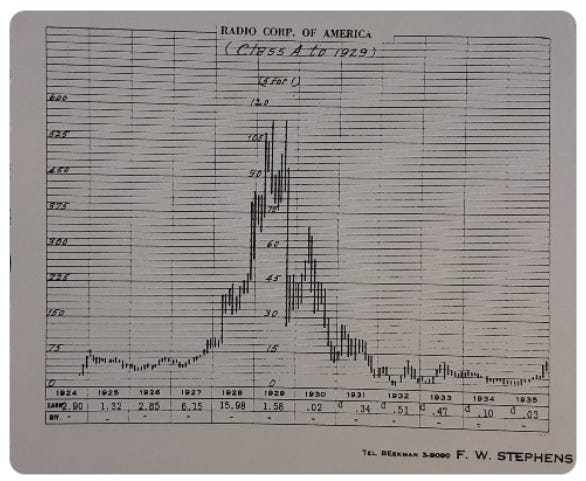

The media is going on an on about how the Reddit traders have changed the trading and investing landscape and how trading in GameStop was some kind of once in a lifetime event. Those of us who have been doing this for a while know that there is truly nothing new under the sun when it comes to human behavior…because we really never change. Walt Deemer, a longtime market pro and technical analyst posted this chart on Twitter.

That’s RCA from the late 1920’s. The peak is actually in 1929, right in front of the Great Depression. Radio Corporation of America was the “Apple” of its day, “or some other company what was going to change the world” of its day. Speculation and Mania are nothing new.

I am taking tomorrow off.

Thank you taking time to read my thoughts, I truly appreciate it and I hope that you find some value in them.

*As a reminder, nothing in these pages is to be considered investment advice.