Are Rising Rates Really That Bad for Stocks?

I have been making comments that it is is not so much the fact that rates are rising that causes the stock market to throw a tantrum but rather the pace at which they rise. I took a look at data going back to 1998 and what we have just witnessed is the fastest spike in rates ever in that period. And, yes, the stock market is throwing a bit of a tantrum. So I decided to take a look at how this truly impacts the stock market over the next 63 days (one quarter of trading).

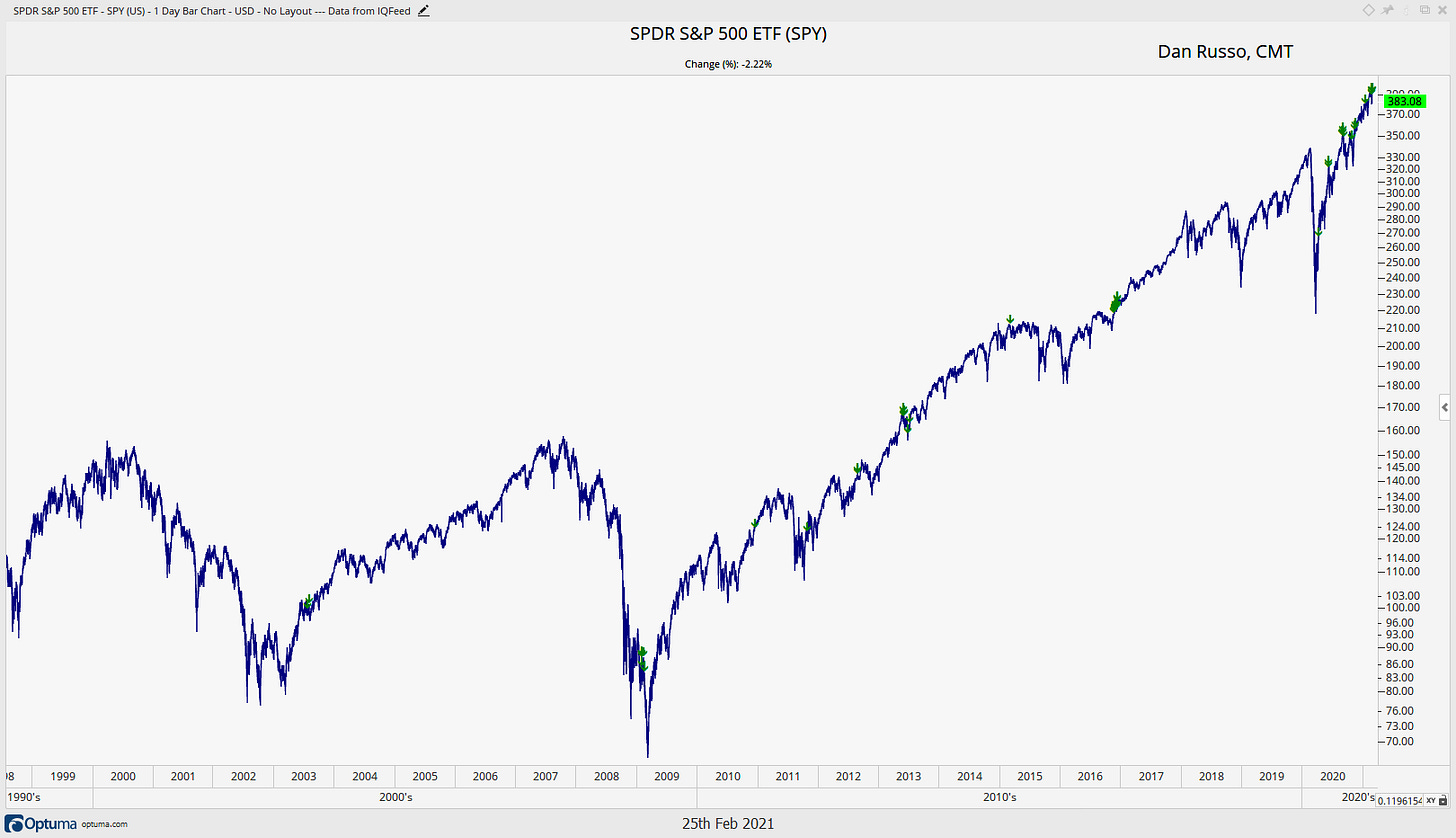

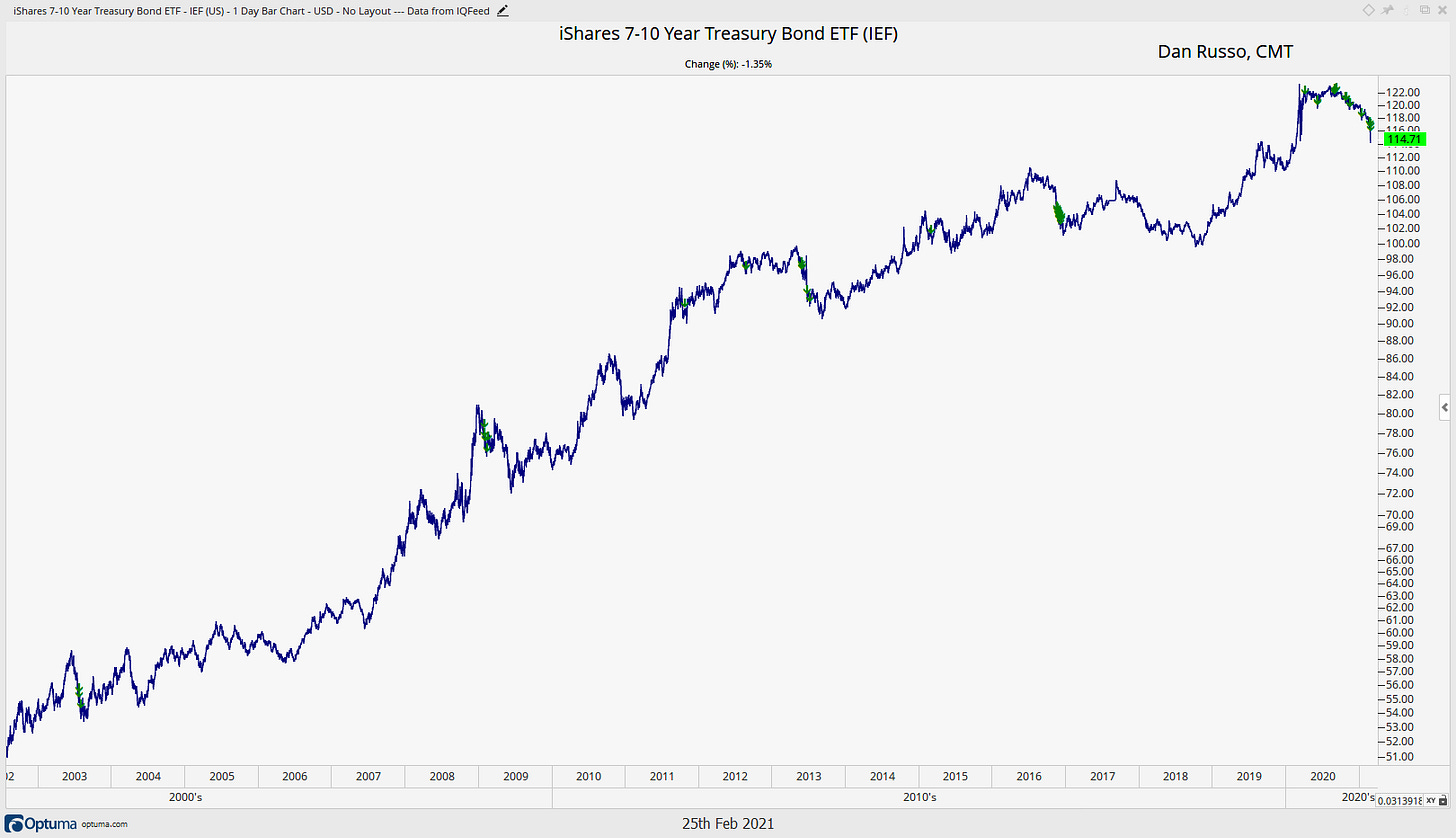

I ran a test that looked at all instances where the 20 period rate of change of the 10-year yield was greater than 25. This is admittedly a small sample size at only 51 instances but there are some interesting results. The green arrows on the charts.

For the SPDR S&P 500 ETF (SPY), the fund is actually higher one quarter later 89% of the time for a median return of 6.79%.

The same is true for small caps. The iShares Russell 2000 ETF (IWM) is higher 91% of the time for median return of 6.31%.

The Invesco QQQ Trust (QQQ) takes the longest to get going to the upside but it eventually does. It finishes higher a quarter later 95% of the time for a median return of 11%. This one actually surprised me.

Interestingly, bonds tend to keep falling (rates keep rising), closing lower 63% of the time for a median loss of 0.36% over the next three months. Here is the iShares 7 - 10 Year Treasury Bond Fund (IEF).

This begs the question, are rising rates all that bad for the stock market? I guess it comes down to, why are they rising? Rates generally rise as the economic outlook is improving. That should be a positive for stocks once they adjust to the initial “shock” of the spike in rates. Here is a look at Initial Unemployment Claims ticking lower again yesterday.

I have no idea if it will play out the same way this time or if rates are going to continue to rise. I simply found this study interesting. This is buy no means a call on some future outcome. As always, trend work will continue to dominate.

I write a daily note for clients with a more in depth view of what is happening in the markets, you can check it out by going here.

Thank you taking the time out of your day to read my thoughts. If you enjoy them, please consider sharing with your network. Have a great weekend.