Commodity Super Cycle?

Last week I wrote a note for clients where I said that I can see scope for a commodity super cycle. Needless to say, that generated a lot of interest from our clients, it sounds like a big deal and I think it could be. First let me start by sating that this is not something that I think has be attacked all at once, right this very second. My guess is that as it plays out (assuming I am correct, which is never certain) there will be ebbs and flows, puts a takes and winners and losers along the way and it will take years. I have been gradually increasing my exposure over the past two months.

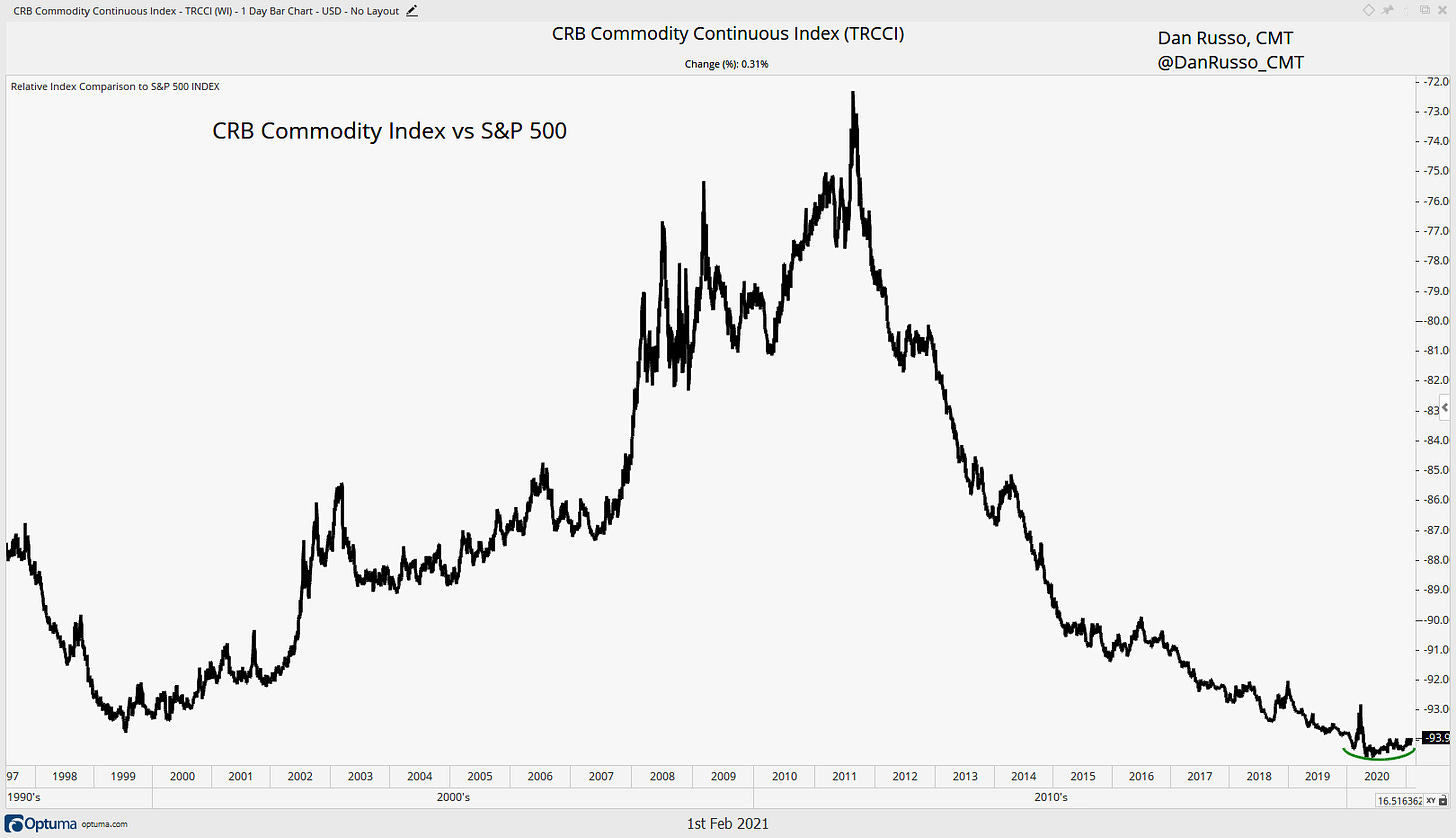

Yesterday, we looked at the chart of commodities vs the S&P 500 and how is was on the verge of changing its trends. But the question is, how big of a trend is being reversed…the answer is: Massive and it may just be getting started.

Here is a look at the CRB Commodity Index. The thing about commodities is that their cycles tend to be very long. On the way up, the trend was in place from ~2001 until it topped in 2011. I remember this period vividly because it was right after the dot com bust. My boss at the time told me about his friend who was buying gold, the physical commodity, and storing it. That sounded fascinating and slightly crazy to me at the same time. But it ended up being a good trade. I also remember 2011 because I was out to lunch with a friend / client who asked me what I thought of gold and I told him that I loved it…it might have been the absolute top for the cycle! Anyway, there is more to commodities than gold but those two stories bookend the last cycle. Then from 2011 until 2020, commodities were in a strong downtrend. These are big tidal shifts in the market when they play out.

More recently, commodities have broken to the upside. Assuming that they simply reach the prior peak, there is 45% upside. That could be good or bad, depending on how long it takes to get there.

But, more interesting is how they do relative to stocks. During the last bullish cycle for commodities, they outperformed the S&P 500 by ~20%. Here is the chart from yesterday but expanded.

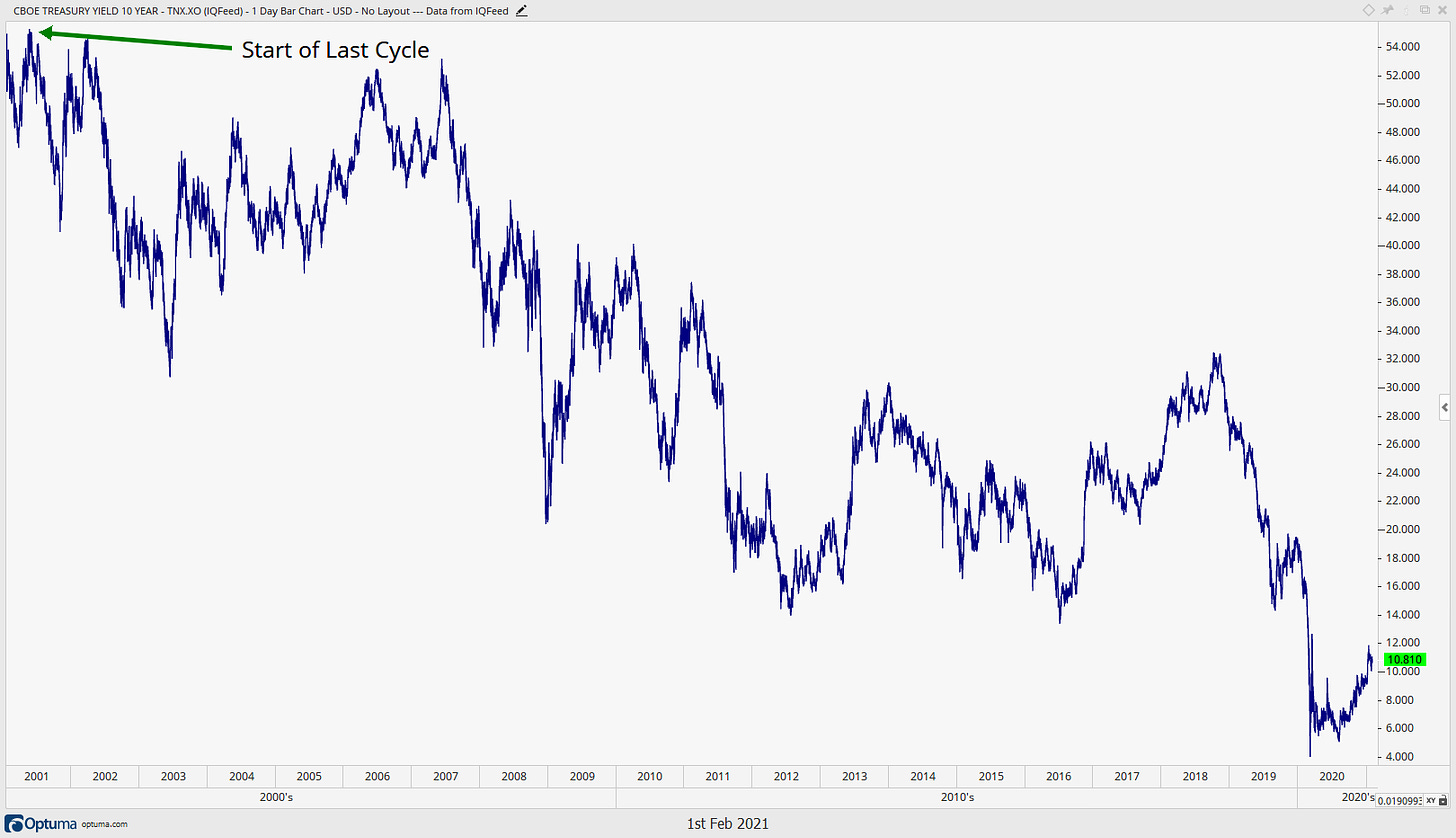

I have already laid out how I think inflation is the catalyst for a rally in commodities, but that is just the spark. What is going to keep it going? I think the key is the low starting point for interest rates. When the last bull cycle started, the 10-year yield was over 5%, now it is 1%.

Why does this matter? Most model portfolios that I see have little to no commodity exposure. At a very high level, they are mostly a mix of stocks and bonds. From an asset allocation standpoint, most of these models are “short” commodities.

If inflation is the concern that I think it will be, it will eat at the purchasing power of the interest payments that treasuries provide. Some quick math:

If your bonds pay you 5% and inflation is 2%, your real return is 3%

If your bonds pay you 1% and inflation is 2%, your real return is -1%

The models were able to coast with a mix of stocks and bonds and not feel a major impact from inflation. That is not going to be the case going forward. In the future, preserving purchasing power will be important and traditional bonds and traditional asset allocation models may not get the job done. Commodities are generally hard assets that do well in an inflationary environment but they are under-owned. So what happens if these models adjust?

Thank you for taking the time to read my thoughts. Please consider sharing this note with your network.

*As a reminder, nothing in these pages should be considered investment advice.