Being focused on the market for most of my day, it is easy to forget that it is still hard out there from an economic perspective. After all, the Nasdaq and the S&P 500 traded at all-time highs in early September. This creates what looks like a disconnect between the market and the real economy.

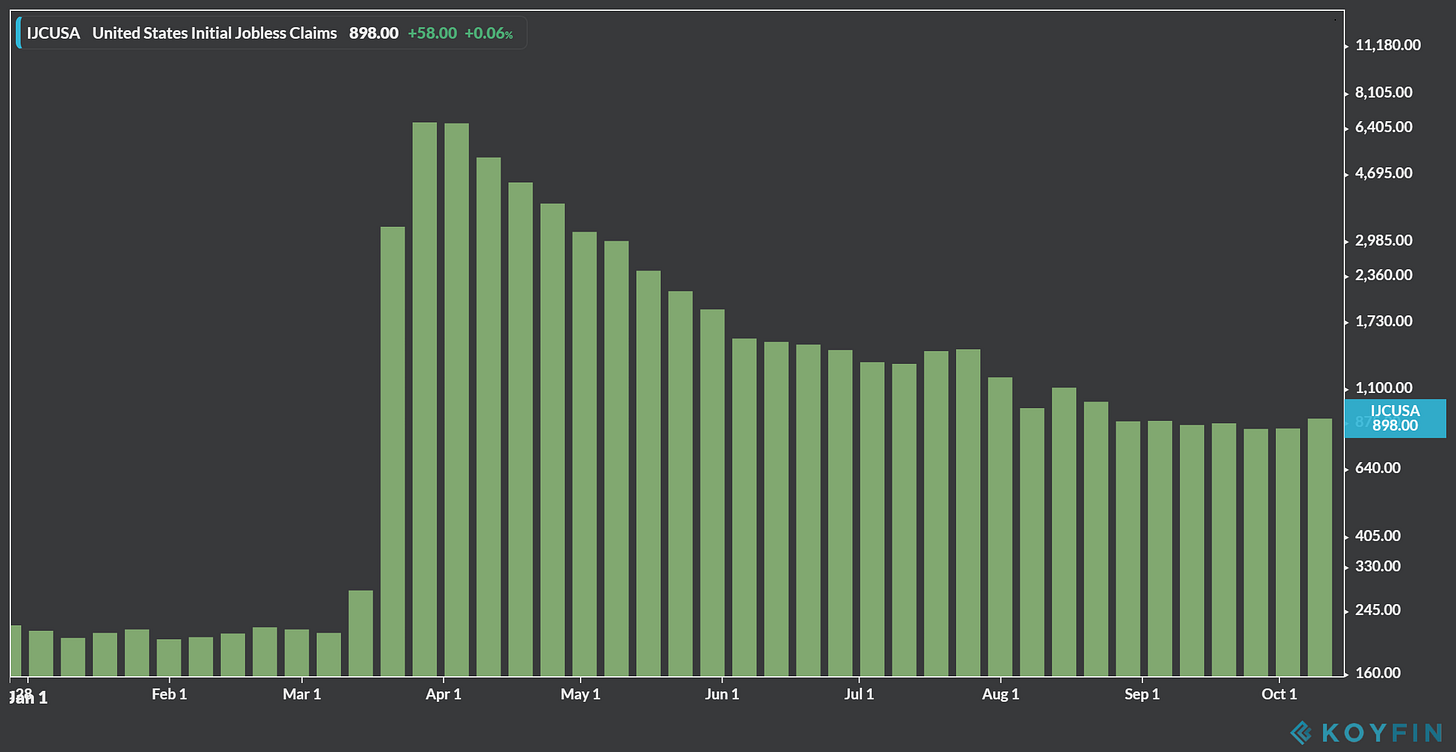

Every Thursday we get a statistic that drives the point home in the form of initial jobless claims, the amount of people who file for unemployment benefits for the first time. Here is the YTD chart clearly showing the extent of the damage that has been done. Yes, things are better since the initial spike in March but the decline that we have seen since appears to have leveled off just under 900,000.

The bifurcation is real. Those who have been able to save and invest and have kept steady employment are most likely dealing with the crisis and the pandemic much differently than those who have been put out of work and who do not have the ability to save and invest in order to participate in the upside in asset markets. Add in rising COVID cases around the world and there are fears of further slowdowns.

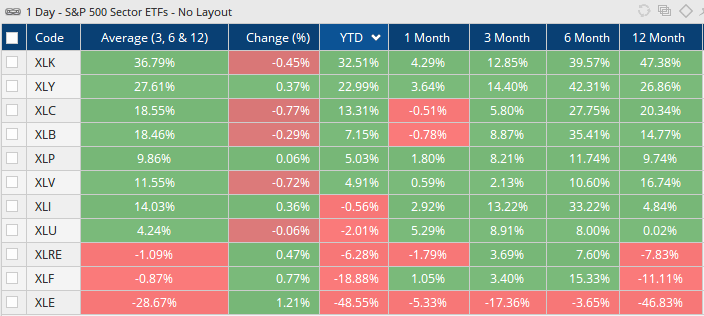

The bifurcation is also real in the market itself. Take the technology sector which is higher by more than 32% YTD. The companies here are clearly benefitting from the added spend needed to ensure that we are able to work from home, school from home, zoom from home, etc… Next on the list is Consumer Discretionary. This is the home of Amazon. It is also where we find the homebuilders (everyone is leaving the cities, buying in the burbs, right?). We also will Home Depot and Lowes in this group (who’s adding a home office?). In the number three slot is Communication Services where we find Netflix, Google, Facebook and Twitter. The video game companies are here as well.

At the bottom of the list is Energy. We also find the financials here. Yes, I am intrigued by both of these groups, no I am not bullish. These sectors are more exposed to the real economy.

That brings we to my bigger thought for today. There has been a new-found love affair with stock trading during the pandemic. Trading is free and can be done very easily from your phone. Buy AAPL and NFLX and ROKU from your iPhone while while streaming Schitt’s Creek to your TV through your Roku box. When everyone knows that technology is benefitting, they tend to look to the highest flying names in the strongest space and simply buy what’s going up, pretty easy.

Wednesday night after the close, a relatively new company called Fastly announced their revenue for the most recent quarter and the rest of this year is going to be lower than they expected. It seems that their biggest customer, TikTok, had pulled back on spending in light of their own issues ( possibly being banned in the US). Here is what the company had to say in their release:

Due to the impacts of the uncertain geopolitical environment, usage of Fastly’s platform by its previously disclosed largest customer did not meet expectations, resulting in a corresponding significant reduction in revenue from this customer.

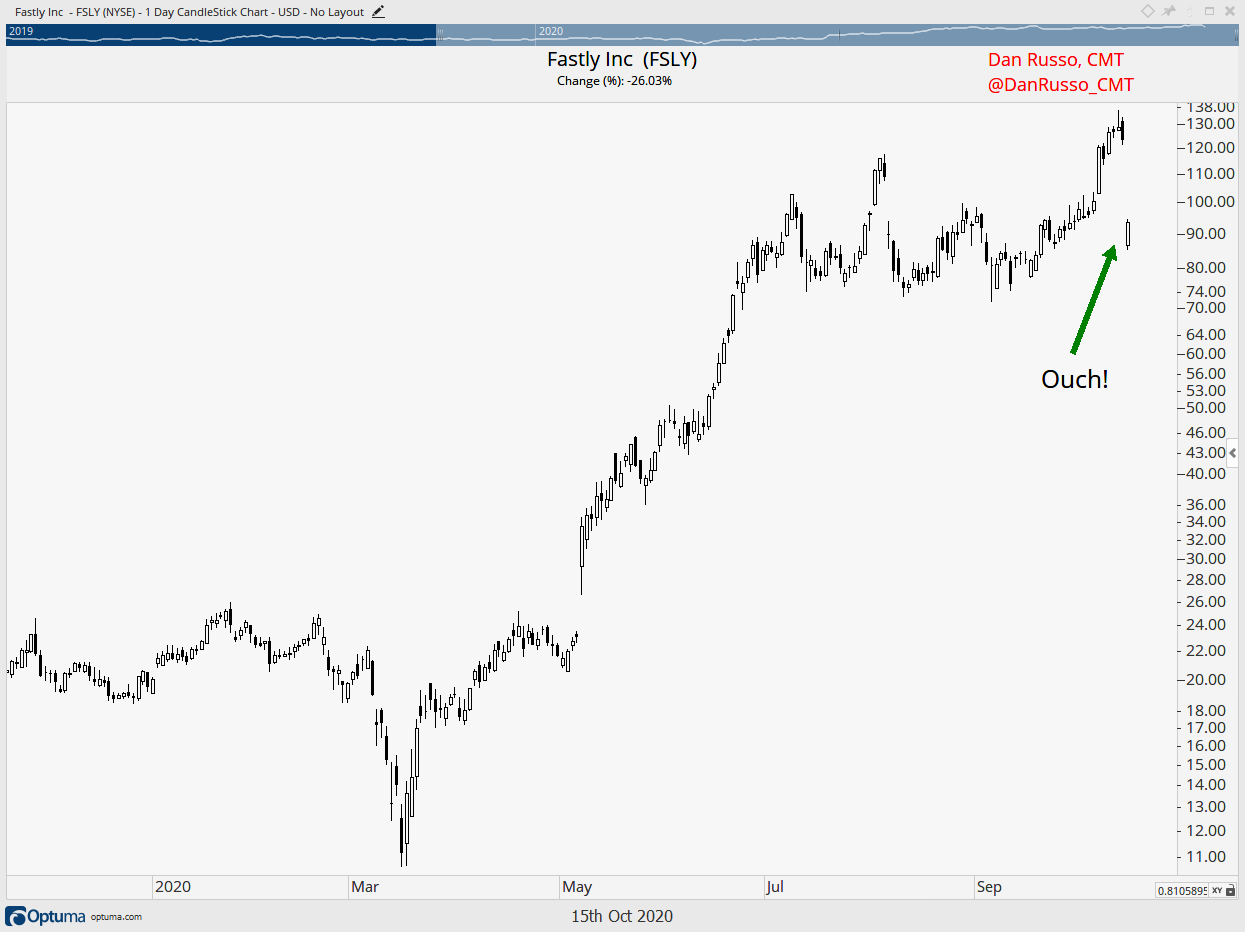

Fastly is a momentum stock. Momentum stocks go up because they have been going up. Investors see this and they pile in making the stock go up more. Now, I love momentum. I use a momentum strategy to manage my own money. The difference is, I use momentum in diversified portfolios through ETFs. I run them through an added filter via my firm’s ETF rating model. I do not use momentum alone to own individual stocks. I look into their businesses and then decide if I want to own them. The reason is simple, when momentum stocks that go up a lot have fundamental issues that come home home to roost, the stocks can get slammed. Fastly is down 26% as I write.

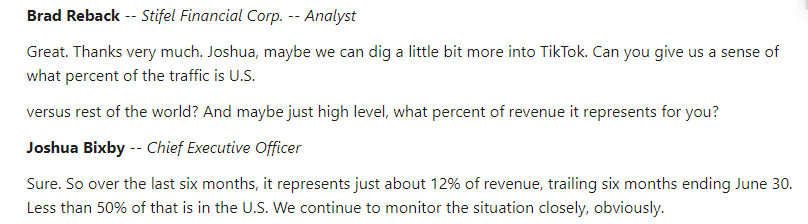

I saw how well Fastly was doing as a stock since March and I have thought about buying it many times over the past few months but didn’t. Then when I saw the stock break to new highs last week, I looked at it one more time. I took it seriously enough to read up on the company and checked out their earnings calls and one thing jumped out at me from their 2Q call:

The company that has been in the cross hairs of the US government and was at risk of being banned here accounted 12% of the revenue at Fastly in the first half of the year. This is the “previously disclosed” largest customer mentioned in the presser. This is known as customer concentration risk and it is something I look into before making an investment.

The market is hot and technology is hotter. There are a lot of highfliers that are simply going along for the ride. It has never been more important to know what you own.

For the record, our model had a bearish bias on Fastly before the announcement.