It’s Friday, so it’s time to discuss bitcoin again. It seems that that is all anyone is talking about. I see it on the financial news channels. I read it in the financial papers…rather web pages, I have not picked up an actual news paper in years. I see it mentioned all over Twitter. This has to mean that we are close to a top, right? I mean who is left to buy if literally everyone is talking about it and it has moved from nearly $4,000 in March to over $18,000 today?

Enter Google search trends. I live in a bit of a bubble when it comes to the financial markets. They are staring me in the face everyday. Sometimes this is a good thing. For example, investors were talking about the COVID risks a few weeks before the main stream media had it on their radar. But sometimes it’s easy to forget that the majority of the people that I come across, away from work, are not that attached. So with the financial world echo chamber going wild for all things bitcoin, I wanted to see if the “hype” had gravitated out into the real world. I did a quick worldwide search for “bitcoin” in the Google Search Trends function and moved the data into my charting software to see if there was a spike in searches to go along with a with a the greater than 4x run that bitcoin has had since those March lows.

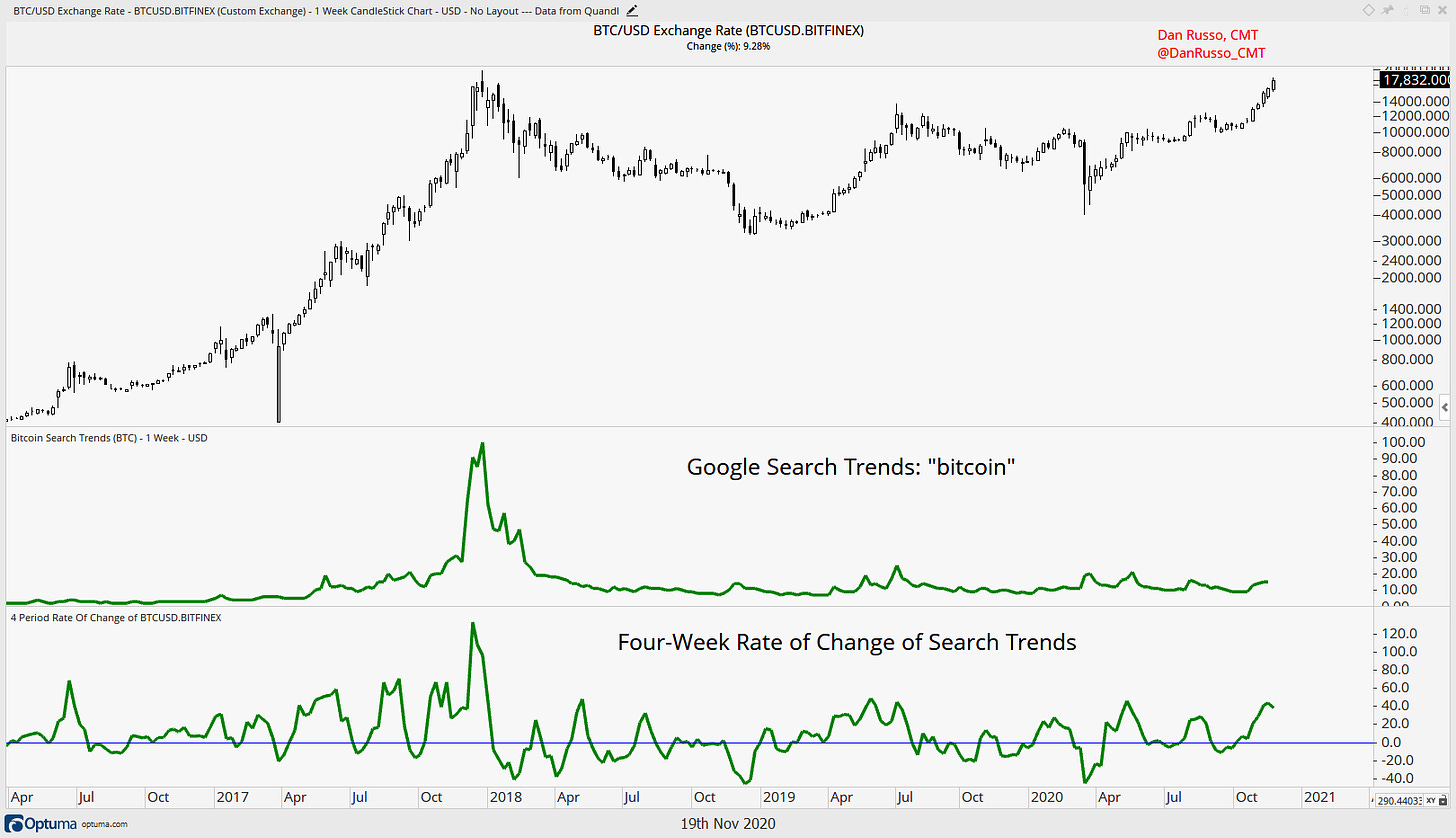

Here is the price of bitcoin (top), Google Search Trends for “bitcoin” (middle) and the four week rate of change of trends (bottom). It seems that there has been an increase over the past four weeks but that bump is well within the “normal” ranges that we have seen over the past five years. What should jump off the page is the huge search spike in late 2017 (this is when I first got involved and had my embarrassing fat finger buy order).

The story of 2017 & 2018 goes something like this.

Bitcoin had been steadily moving higher.

Millennials and Gen-Xers go home for Thanksgiving and talk passionately about it.

Everyone at the Thanksgiving table searches for “bitcoin” on Google.

They all rush out and buy it.

Bitcoin crashes by more 80% over the next 12 months.

I have taken some liberties here, but you get the point.

Bitcoin is running again but we are not seeing the same spike in interest that was seen in late 2017. Aside from the the bubble in which I reside for 18 hours a day. And with Thanksgiving limited to no more than 10 people this year, the audience is going to be a lot smaller. I guess I can understand it. Anyone who was there for an 80% + drawdown is probably not in a rush for a second helping.

Clearly there are risks involved and as I said in my first post on this subject, I am not a fanatic. I like to think I keep a fairly open mind and I like to think that by now, I won’t buy something without knowing the risks.

This article does a fairly good job of laying out some of the risks. Here are the ones that I think about most. I have my views on these and I have already taken them into consideration. I am not going to pushback, make of them what you will but I am sure that there are “real life” examples that you can think of where these same risks apply.

Regulation - there is always going to be a risk that governments will try to regulate bitcoin. The reason that that green piece of paper in our wallets has value is because the government tells us that it is our medium of exchange, they probably won’t give up that power very easily. We attach value to a lot of assets, but most of them are not going to put that turkey on the table next week. China has taken steps to regulate cryptocurrency as have others. Some have even tried to ban it.

Quantum Computing - when you buy bitcoin, it is stored in a “wallet.” This can be your own wallet in digital form or one on the exchange where the bitcoin is traded. These wallets are encrypted with a “key" or a long series of random numbers and letters. As computing power increases, there is a risk that the resources will be available to hack your keys.

Alternative Technology - what if something comes along that replaces bitcoin? Technology is all about disruption. Google was not the first search engine. Apple didn’t come up with the first mobile phone. Blockbuster was the here long before Netflix. Take it a step further, that $1.50 coffee from the truck on the corner by your office was fine before Starbuck came along.

Massive Power Outage - you need access to the internet to access your bitcoin. Fine, but given that the blockchain on which bitcoin, is based if decentralized, the outage would have to be so widespread that virtually the entire world was impacted. Honestly, in that environment, you probably will have much bigger issues to contend with.

Volatility - yes, the price is volatile. It dropped over 80% in a year and 50% in a day just this year. That kind of movement is not for everyone.

These are the risks as I see them, I am sure there are others as well as derivatives of the ones mentioned here. There are plenty of people who are deeper in the weeds than I am and they have explored these risks and have written about them. Whenever I am asked about any investment, I always tell people to do their homework and to make sure they understand what the downside could be. I freely admit that there is a non-zero chance that bitcoin could be a zero. The same can be said for a stock. The same could be said to anyone who runs their own business.

I write on the markets everyday for our clients. You can check out how to access here:

Have a great weekend!

*Please remember that nothing in this note should be considered investment advice.