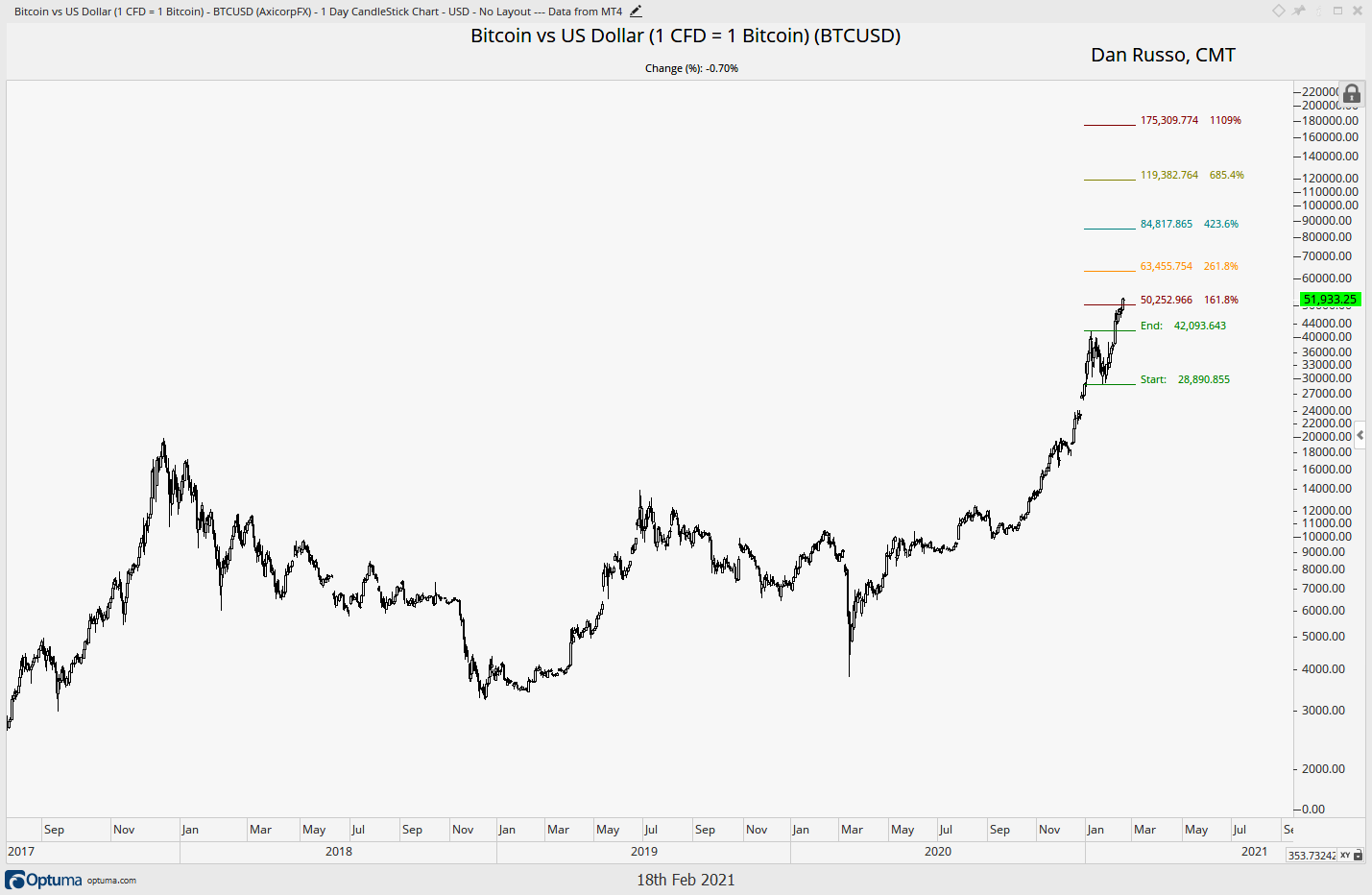

This was a big week for the bitcoin fanatics along with anyone else who is interested or involved in the asset. The price crossed $50,000 for the first time. Back in April when it was trading around $7,000, I made the decision that I was going to dollar cost average into it. Buy a set dollar amount twice a month and not worry about. I have been doing that ever since. In hindsight, I can now say that that was bad call, I should have pushed all-in. But, it was the decision that I made with the information that I had at the time.

Based on some Fibonacci extension analysis, I can make the case for a continuation to the upside in the near-term as long as $50,252 holds.

Clearly, bitcoin and its underlying blockchain technology are catching on. Increasingly, we are seeing more and more companies in the financial services space adopt or at least explore blockchain. PayPal, Square, Visa, Mastercard and many others are involved in the space. There is good reason for this. Blockchain technology and the decentralized finance that it enables, is in a position to disrupt much of the traditional finance space. From payments, to cross border transactions to trade clearing and settlement, there is room for things to be done better. In fact, I would be willing to venture that if trade settlement and clearing already used this technology, the GameStop drama might not have happened.

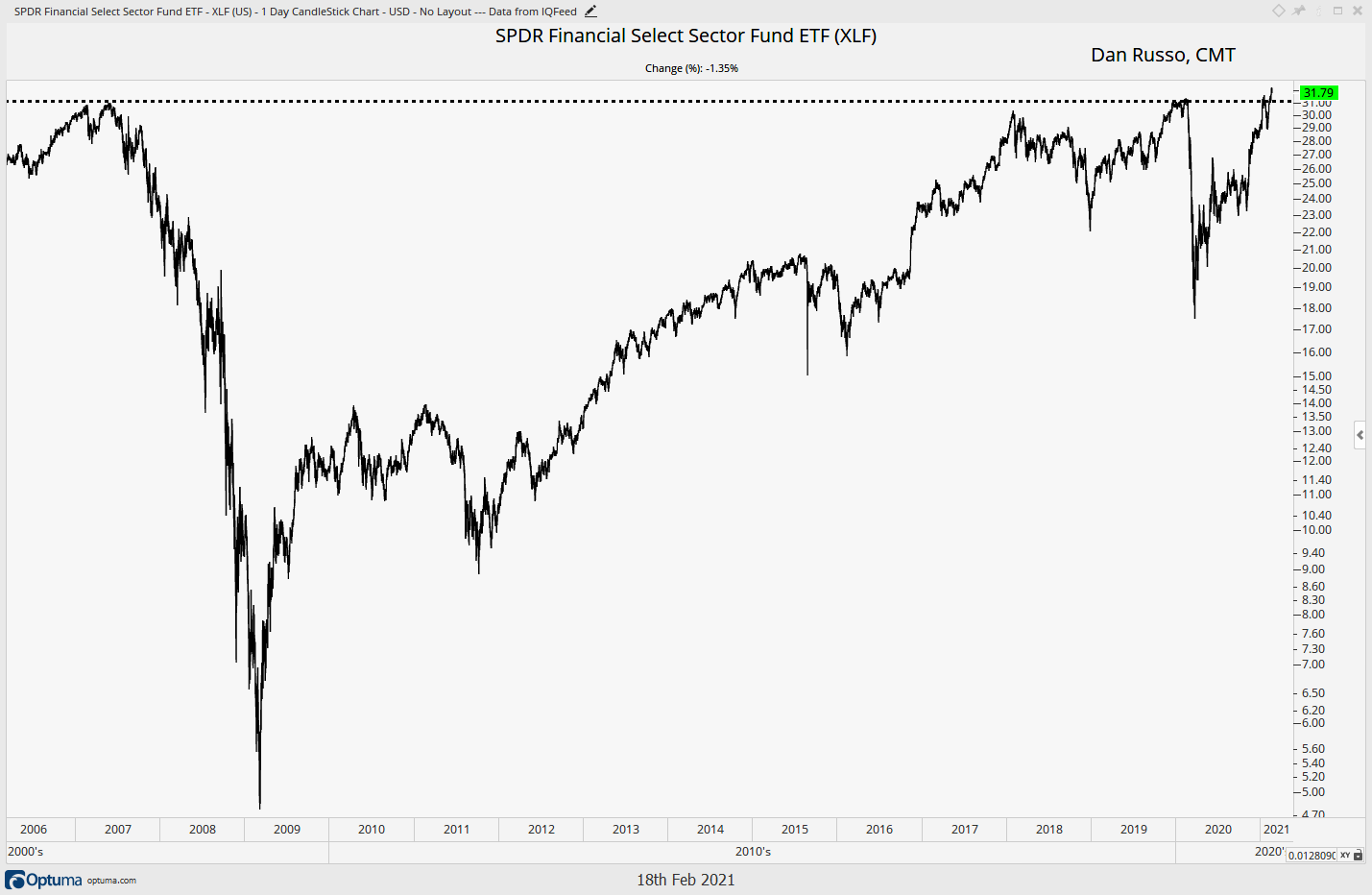

One of the mantras of many in the bitcoin community is “long bitcoin, short the bankers.” The traditional banks were a big reason for the Global Financial Crisis. It seems that not a month goes by, even now, that we don’t hear about a bank paying a fine for some infraction. Blockchain eliminates the need for a trusted third party. It was created because the traditional “trusted third parties” have proven over the years to be anything but!

This might cause many to think that traditional financial companies are going to be bad investments. They probably are in secular decline and they probably will be disrupted in a big way. But, their stocks have not looked as good as they do now in nearly 15 years. Here is the SPDR S& Financial Select Sector Fund (XLF) trading to levels not seen since 2007…right before the financial crisis.

It’s usually pretty easy to see which parts of the economy are ripe for disruption once there is a new product or technology that is going to do the disrupting. Is anyone shocked that the US Postal Service is facing financial hardship? We have email. What is hard, is timing when these businesses are actually going to die. I mean, Polaroid cameras are still around and my daughters both have one.

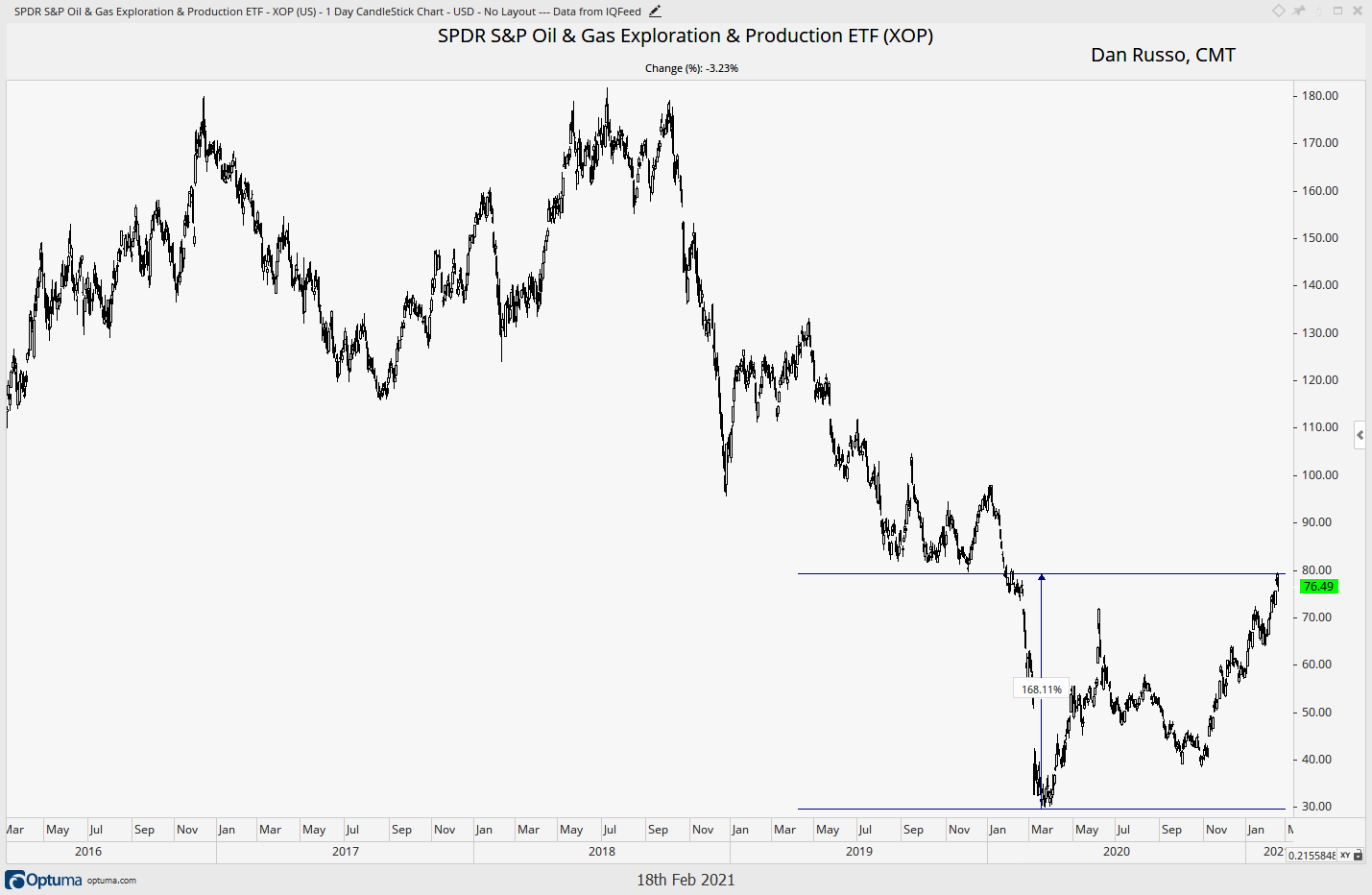

Take the energy space as another example. Is there anyone who wants to debate if this is an industry that is in secular decline. We have clearly reached the inflection point in the adoption of clean energy and clean technology. Just notice how many more Teslas you see on the road today vs a year ago vs two years ago. Yet the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) has rebounded 168% from the March lows and is in the process of reversing a three year trend to the downside.

The point is not that traditional finance and legacy energy are great sectors, they aren’t. But, they also probably aren’t going to go away overnight. These dying sectors tend to have a long tail as they are disrupted away. And while “everyone” is writing their obituary, there is usually an opportunity or two for investors who are willing to look past the prevailing narrative.

Thank you for taking the time to read my thoughts this week. Please feel free to share them with your network.

*Please remember that nothing in these pages should be considered investment advice.

Thank YOU for sharing your thoughts here. They are extremely helpful as I think through my own strategies.