Earnings: A Sell the News Event

Once a week I commit sacrilege for technical analysts, I read up on what is happening with corporate earnings (during earnings season). It’s not so much that I am trying to forecast earnings or make an assessment on valuation, it’s more to get a sense of how companies are doing relative to expectations AND how the stocks are reacting to the earnings reports…this is the information that I am truly after.

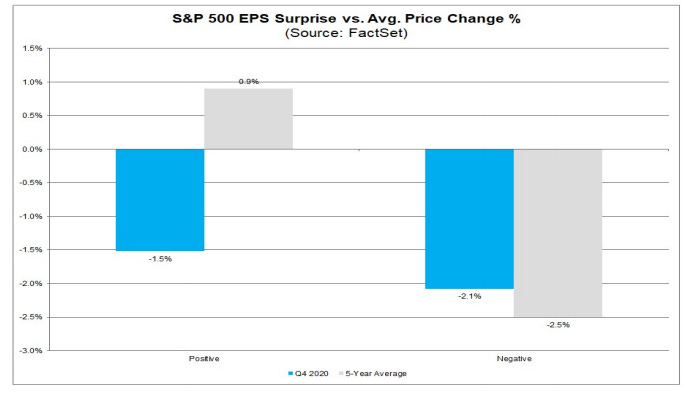

According to Fact Set, for Q4 2020 (with 37% of the companies in the S&P 500 reporting actual results), 82% of S&P 500 companies have reported a positive EPS surprise and 76% have reported a positive revenue surprise. That sounds really good, stock must be off to the races, especially the ones that are delivering these positive surprises. Not so fast. Companies that have reported a positive earning surprise have seen their stocks trade down by 1.5% on average (vs +0.9% over the past five years). At the same time, stocks that miss expectations have traded lower by 2.1% on average, which is actually better than their five year average.

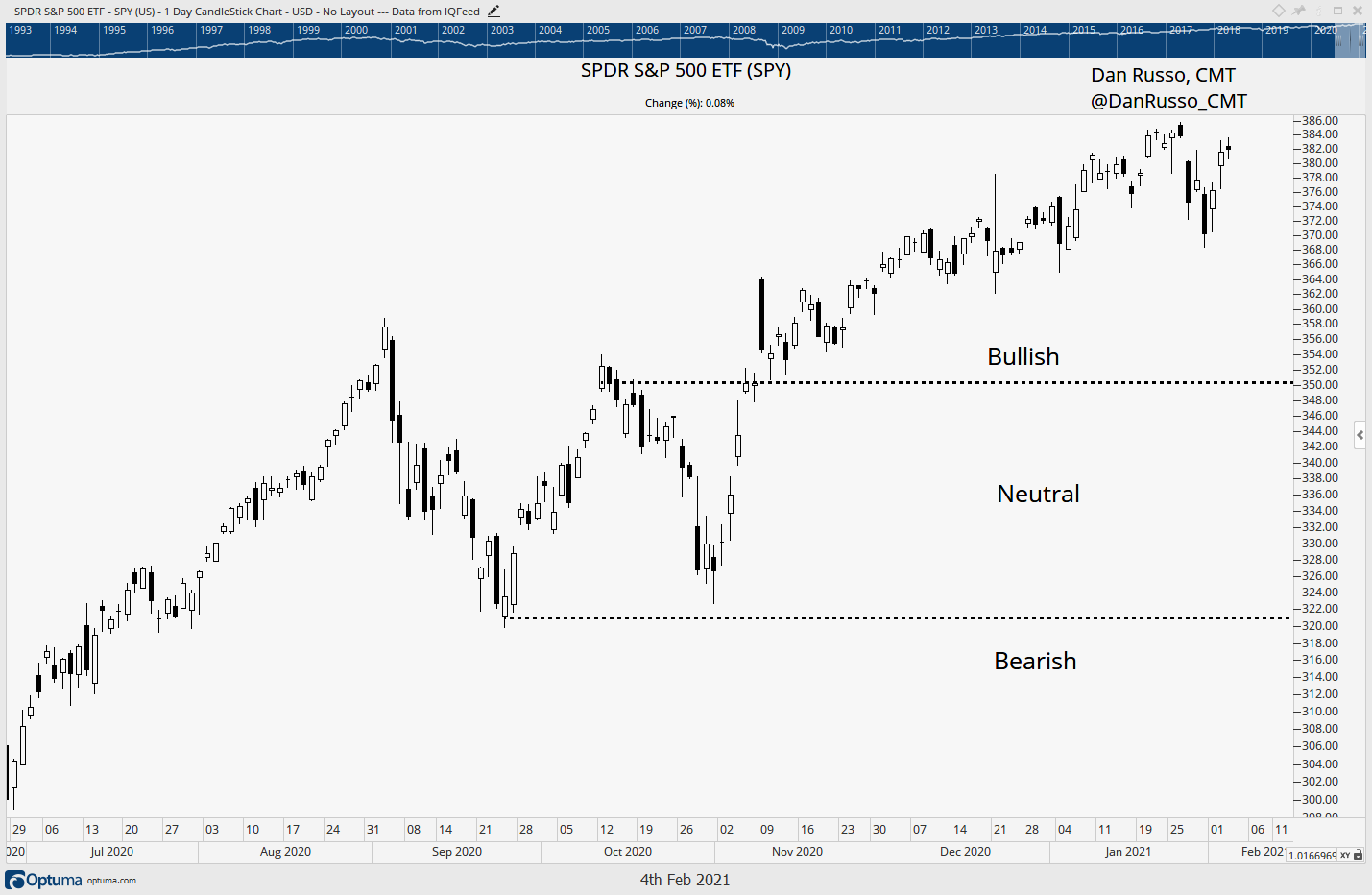

So it seems that investors were expecting companies to report good numbers and the reports have become sell the news events…Discounting Mechanism. That’s useful information, expectations are fairly high. And given that the first half of last year was terrible for reasons that we all know, analysts are looking for some substantial growth in the first half of 2021 (especially in the second quarter), again according to Fact Set.

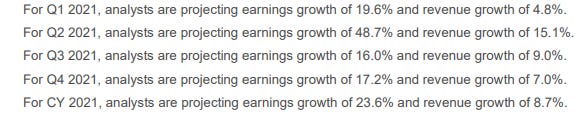

How to think about this from a technical perspective. First, the trend in the market remains to the upside. However, given elevated expectations and the fact that February is a down month on average, I would not be surprised to see some choppy trading in the near-term. For the SPDR S&P 500 ETF, the road map that I laid out on Monday remains in place: $350 is important in the near-term, between $320 and $350 the trend is neutral, below $320 my bullish view is wrong.

From an economic standpoint, the fact these companies are quickly returning to earnings growth is important. This lines up nicely with my view that things are probably getting better. So the question is, if things are getting better, will there be appetite for a $1.9 trillion stimulus bill? I have no idea what the answer is, I am guessing the average citizen likes the idea of “free money.” Republicans are discussing something closer to $600 billion. So the two sides are miles apart and we can add this to the list of reasons that trading could be choppy in the near-term.

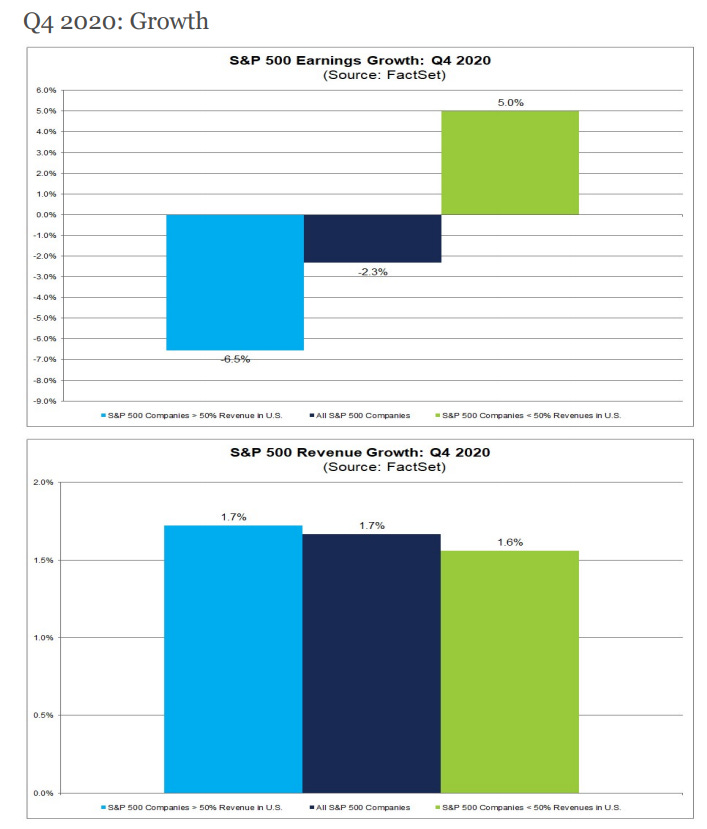

Something that jumped off the page at me was this chart. We care about the green bar the most, companies with < 50% of their revenue in the US. These companies have seen earnings grow 5% while revenue has grown 1.6%. Part of this is likely due to the weakening dollar but I have to wonder if there is more to it. By contrast, companies with > 50% of their revenue in the US have seen earnings decline by 6.5% on 1.7% revenue growth?

This is interesting and something that I will have to watch, especially if the dollar stops dropping (not my base case), since I have been thinking more and more about opportunities outside the U.S. China and Japan are still interesting to me. India is probably the most compelling from a demographic standpoint. If I am right on a commodity super cycle, I want to pay attention to the places that could benefit: Russia and Brazil come to mind. I have been tilting my stock ideas in this direction.

*Nothing in these pages should be considered investment advice. Please do your own research or talk to a professional.