Everybody's in the Boat?

On Tuesday, there was a lot of talk in financial circles about the latest monthly edition of the Bank of America Merrill Lynch Fund Managers Survey. As the name implies, the bank conducts a survey of various investment fund managers to get a sense of their current market views and how they are positioned based on these views. My friend Ryan gave it a nice recap on Twitter.

So as the market has gone higher, investors have become more bullish (this is the only place in the world where we want more of something as it goes up in price). Does this mean that the market is ripe for a fall now that it seems that everyone is in the boat? After all, the cash levels are now at their lowest reading since before COVID upended the world. Stats like this might look scary on the surface, but are they a signal to act in the here an now? I guess that depends on what you are trying to accomplish as an investor. For someone who is trading the market on a daily basis, trying to make short-term profits, these stats may give them a slight sense of pause. For someone who is investing for the long-term, putting money into the market at predetermined intervals and in pre-determined amounts, it’s probably not something to be all that worried about…assuming that they are not going to need the money until much further into the future. Like everything else in investing, the keys are with the individual and what they are trying to accomplish.

For me, these stats are the market’s way of recognizing what I have been writing about for a while now. Things are probably getting better. Investors are looking past the near-term headwinds to a future that supports better economic growth. A future with a COVID vaccine (we had more good news from Pfizer yesterday). A future that more closely resembles what we knew before March 2020. Jason Zweig from the Wall Street Journal framed up investor expectations nicely:

The financial markets tend to reflect expectations six to 12 months down the road. Investors are looking past the headlines about the raging spread of the coronavirus toward the time, presumably next year, when one or more vaccines and other countermeasures could get the disease under control.

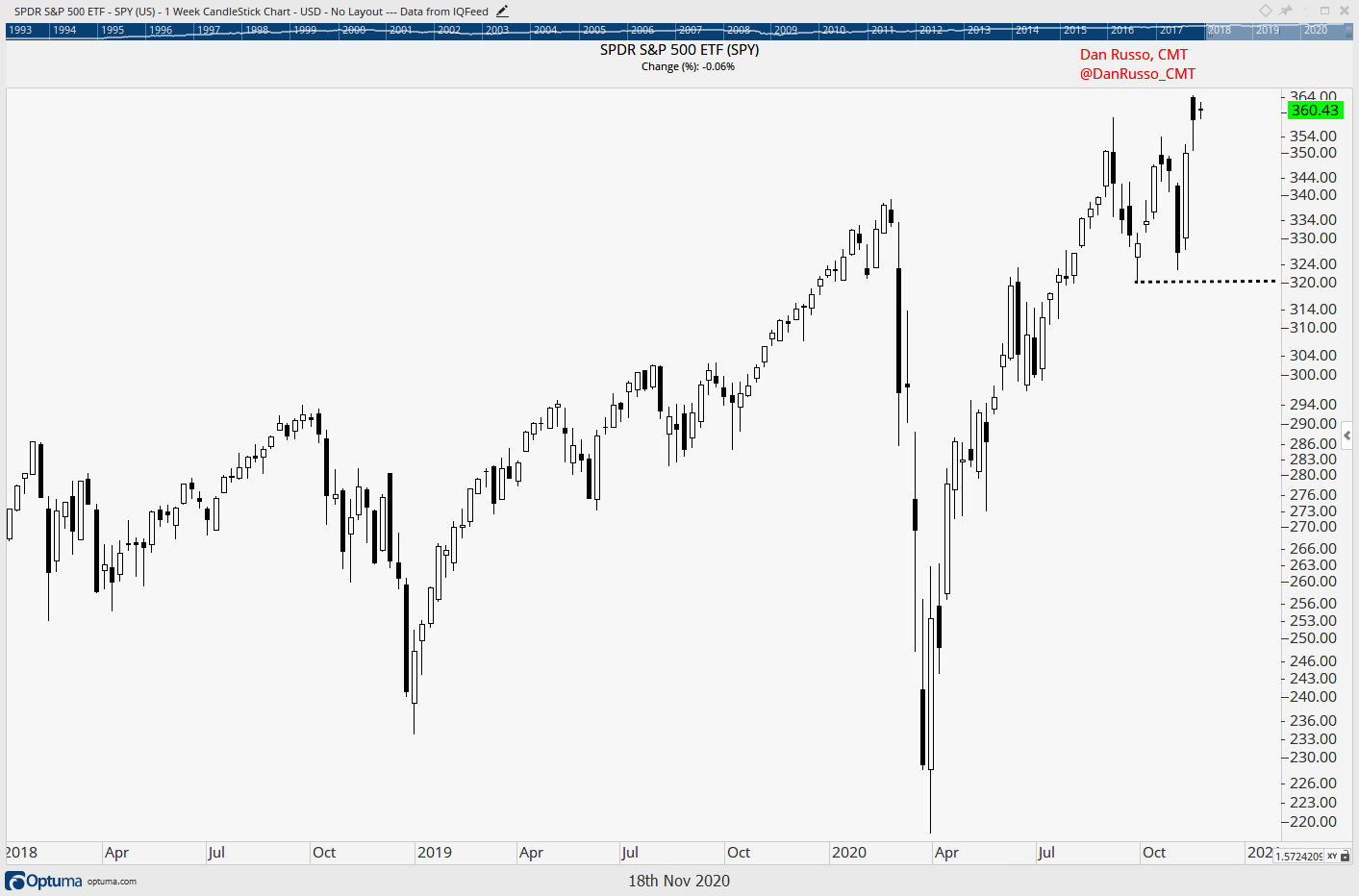

Jason does end this thought with a view that now is the time to be cautious, but again time frame and goals matter. So maybe the near-term might be a bit choppy, we may even see a bit of a sell-off in the market if there are no further upside surprises in the near-term. But if I zoom out a bit, I still think that we are closer to the beginning of bull market than the end. I could always be wrong on this and I certainly would not hesitate to change this bigger picture view if the trends changed. Looking at the ETF for the S&P 500, I would need to see a weekly close below $320 for me to alter my thoughts.

I would also expect to see Treasury Bonds rallying in a “flight to safety” that sends their yields lower. Notice how strong treasuries were in the early part of the year and how the trend accelerated to the upside as COVID spread. We are not seeing that type of buying pressure now.

Finally, I would expect to see much of the recent strength in global markets also begin to give way. So far, a broad measure of markets outside the US is holding above the highs from earlier this year.

I stand by my view that things are getting better. The degree to which this view is fully baked into asset prices is what we are likely going to find out in the next couple of months.

*Nothing in these pages should be considered investment advice.