Five Charts to Start the Week

Some quick reminders before we get into it since there are more of you reading this now than there were last week. First, this is my diary on the market. It is in no way shape or form investment advice. These are the conversations that I am having with myself as I take in all that is happening in the market while trying to square it with the prevailing narratives and fundamentals. I do this to give some clarity to my thoughts. If you like what you are reading, please consider passing it along to others who might like it as well.

Next, if you have an opinion, I would love to hear it, especially if you disagree with something that I am thinking. I promise you that after starting in this business as a summer intern at the New York Stock Exchange when I was 16 years old, I have extremely thick skin.

Finally, nothing I write here should be considered investment advice. It is highly likely that I have a different timeframe and risk profile than you do.

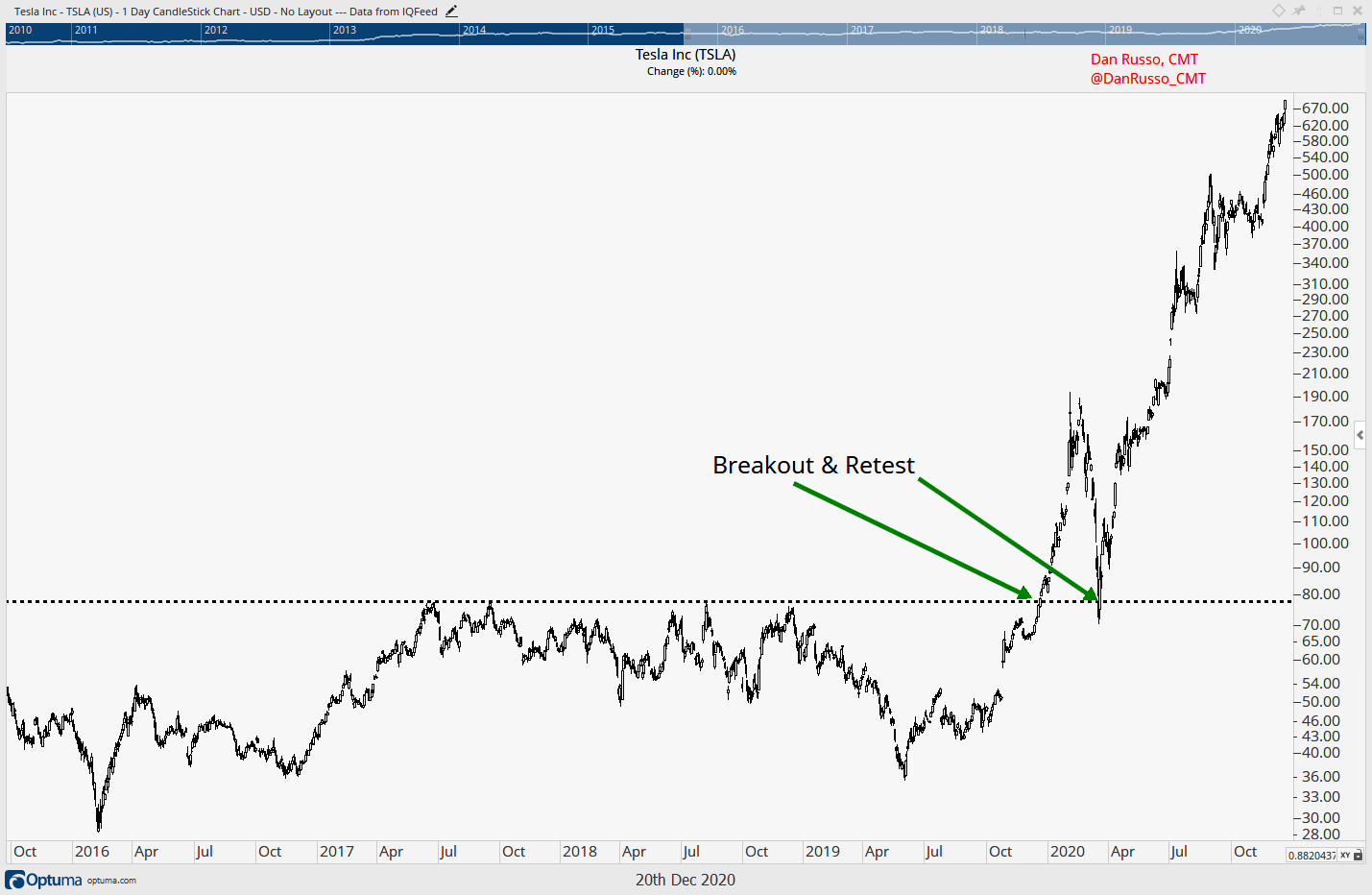

Happy Monday! It’s a holiday-shortened week this week with the equity markets open for full days of trading Monday - Wednesday, a half-day on Thursday and closed for the Christmas holiday on Friday. I would fully expect volumes to be gradually decline over the course of the week but today could be extremely interesting since it will be the fist day that Tesla trades as member of the S&P 500. The electric car maker was added to the index on Friday at the close. Because of this addition, all of the index funds and other products that track the S&P 500 had to buy the stock and hold it in its proportion to the index itself. Tesla will be the largest company ever to be added to the S&P 500 and will be the sixth largest stock in the S&P 500. TSLA is similar to bitcoin in that it has rabid fans who defend the stock and its CEO Elon Musk no matter what. At the same time there are likely just as many haters. People who call the company a fraud or people who just think that the stock is perpetually overvalued. It is one of the more interesting debates to watch and it plays out on social media daily. I have a been on both sides of the coin but I am currently a holder. My story with TSLA is a true exercise in having a bias that cost me before I came around to the facts. I had been betting against TSLA in the summer of 2018 when Elon Mush tweeted out that he was considering taking the company private, causing the stock to spike and costing my on my bet. Musk went so far as to say that the funding for the deal was secured despite the fact that it wasn’t. He and the company ultimately settled fraud charges. Needless to say, this left a bad a taste in my mouth. Fast forward to October 2019 and TSLA reported a profitable quarter for the first time, causing the stock to gap higher and continue to run. I distinctly remember reading the press release and watching the stock move higher. I said to myself, “I should really buy this stock, it’s breaking out.” But I didn’t…that was a bad miss on my part. The stock continued to run until it was sold off with everything else during the COVID bear, a move that brought the stock back to the breakout level, I still didn’t buy it. I was scarred by my loss and “hated Elon Musk” for costing my money. It wasn’t until the stock began to pass it’s pre-COVID highs that I finally woke up and bought it. I have traded in and out of it since and am ahead on the trade but my bias cost me.

Now that the stock is being added to the S&P 500, the 1999 comparisons are in full swing with many of the TSLA bears comparing the addition of TSLA now to the addition of Yahoo (YHOO) at the end of the dot com bubble. This is a really good thread on the subject. I don’t know how it is going to play out so I will simply manage my risk the way I do on all of my ideas. For now the trend is up and the stock closed at an all-time high on Friday so I am content to stick with it.

The comparisons of the current market to 1999 have been loud and frequent of late. Maybe all of these people are correct but I continue to take the other side of the argument and believe that we are closer to the start of a cyclical bull market than to the end. The rest of the charts in today’s note support that view in my opinion.

Banks are extremely sensitive to economic developments. The SPDR S&P Bank ETF (KBE) topped in 2018 and moved lower into the COVID bottom. They have been performing well since March. On Friday night, the Federal Reserve gave banks the permission to restart buybacks. JP Morgan (JPM) and Goldman Sachs (GS) wasted no time in making announcements that they would commence buying their own stock. If banks saw trouble on the horizon, I would think that they would not be so quick to deploy capital in this way. KBE is trading into resistance and we will see if Friday’s news, after the close of trading, sparks an attack on the 2018 highs.

I have used them as a supporting data point before, but I will look at them again. The small caps are trading at record highs as we can see with the iShares Russell 2000 ETF (IWM). Small stocks are riskier and more economically sensitive than their larger peers. The fact that they are so strong is important. The fact that they are just now emerging from a two plus year consolidation speaks to the fact that we are closer to the start of a new bull market than to the end, at least that’s how I see it.

Long-term treasury bonds are under pressure. Investors favor treasuries, which are backed by the “full faith and credit of the US government,” when they are concerned about the economy or as a way to protect wealth in the event of a move lower in equity prices. The iShares 20+ Year Treasury Bond ETF (TLT) has been moving lower since making a high in March as the pandemic was broadening.

A lot of stocks are in uptrends. The 200-day moving average is a way to determine the long-term trend of a stock or an index. When looking at all of the stocks traded on the New York Stock Exchange, we can see that over 80% of them are trading above their respective 200-day moving averages…they are in long-term uptrends. Importantly, the current reading of 82% is the highest level that it has reached in ten years. More importantly, it is making this record high as the major market averages do the same, lending a level of confirmation to the price strength. Normally, if the averages are getting ready to roll over, the percentage of stocks above their 200-day moving averages begins to decline first. So far, that is not the case.

Maybe I am completely wrong. I have been wrong in the past. But until the facts change, I will stick with my current views on the trends in the market. That being said, there is fair amount of “good” priced into the market at current levels. For instance, congress agreed on the next round of fiscal stimulus last night and index futures barely reacted. The slowdown into the holidays may be a good time to take a hard look at my current positions and weed out some of the names that have not kept pace, freeing up capital to look for opportunities should a near-term pullback arise. This is not being bearish, it’s simply being mindful of the environment and understanding that trends don’t persist in a straight line.

I write about the market in more detail everyday for our clients. You can find out more here: