Some quick reminders before we get into it since there are more of you reading this now than there were last week. First, this is my diary on the market. It is in no way shape or form investment advice. These are the conversations that I am having with myself as I take in all that is happening in the market while trying to square it with the prevailing narratives and fundamentals. I do this to give some clarity to my thoughts. If you like what you are reading, please consider passing it along to others who might like it as well.

Next, if you have an opinion, I would love to hear it, especially if you disagree with something that I am thinking. I promise you that after starting in this business as a summer intern at the New York Stock Exchange when I was 16 years old, I have extremely thick skin.

Finally, nothing I write here should be considered investment advice. It is highly likely that I have a different timeframe and risk profile than you do.

Pouring over my charts this weekend, I would describe the the technical position of the market as pausing within an uptrend. There are a lot of stalling activity in the major market ETFs here in the US. The S&P 500 lost about the 1% on the week though it did trade at a record high before fading. The same can be said for the Nasdaq which closed lower for the fist week since November 13th. In terms of excuses / reasons for the decline, it was more of the same. We still don’t have the next stimulus package and COVID cases continue to spike, leading to further restrictions. However, these have both been with us for a while. I am going to chalk it up to froth.

We have known for some time that pretty much everyone is bullish for the most part. This point was hammered home further this week when two high-profile companies went public. According to Fact Set, Doordash (DASH) ended the week up 72% from the $102 offering price and Airbnb (ABNB) leaped higher 108% from the $68 offering price following the IPOs of those companies this week. Airbnb was the 19th company this year to double in its first day of trading, the most since 2000. This naturally prompted comparison to the IPO frenzy of the late 1990s leading to the bursting of the internet bubble in March of 2000. So now every also seems to be looking for bubbles. The thing about the stock market is, it will try to inflict the most pain on the greatest number of people at any given time. The fact that “everyone” is bullish would lead you to believe that we are heading lower, that seems like it would hurt the most people. But at the same time, if everyone is seeing a bubble, it probably means that we aren’t in one…or maybe it is just getting started. People hear the term the bubble and they immediately think that they should fade it. However, if it is just getting started, shouldn’t we want to get involved. After all, people were calling the Nasdaq a bubble in 1996 and 1997 and it inflated for another three to fours years. This reminds me of a quote from George Soros from 2009:

When I see a bubble forming, I rush in to buy, adding fuel to the fire.

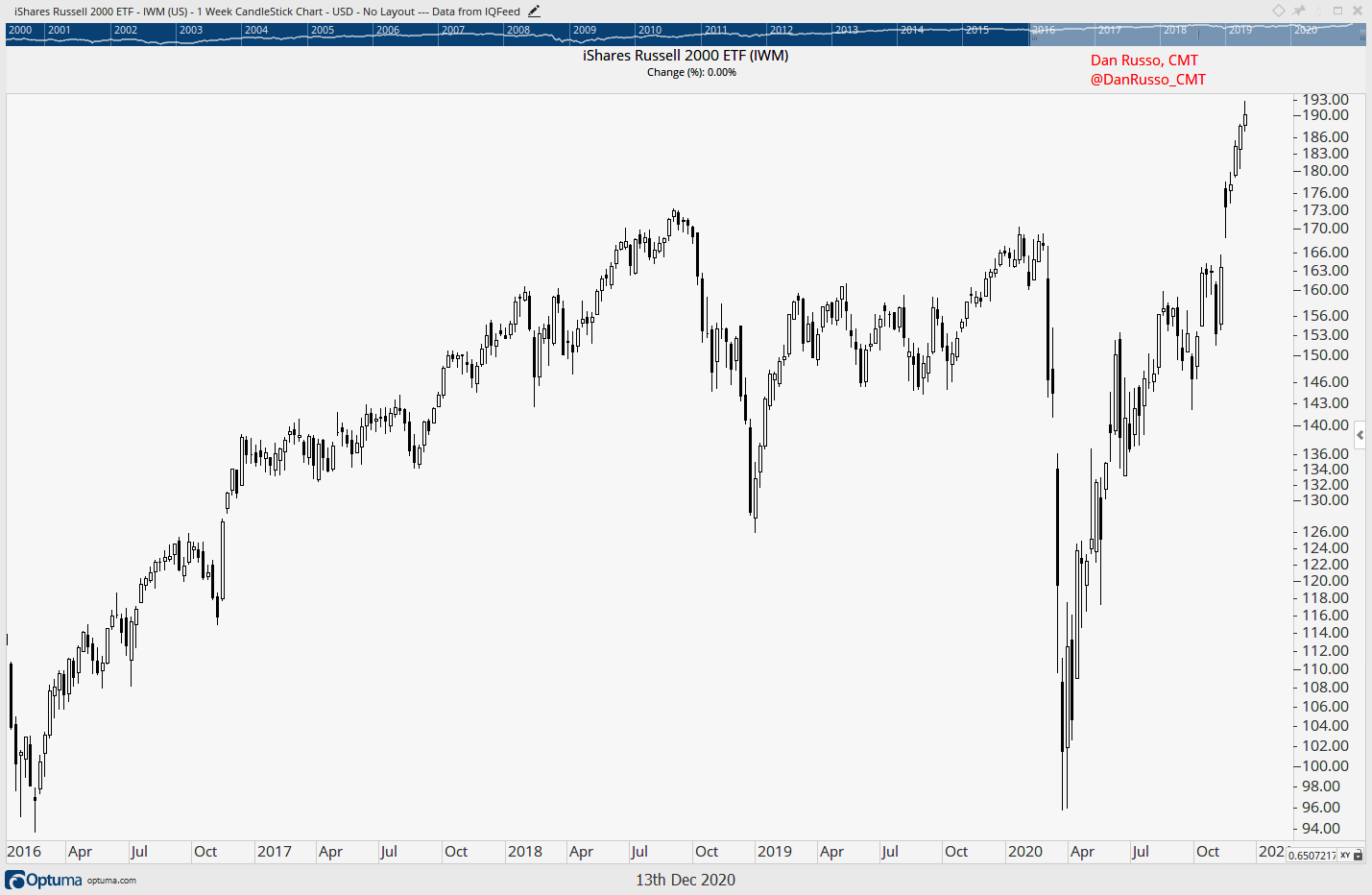

So, the Nasdaq and the S&P 500 pulled back last week. What didn’t pullback? Small cap stocks. The Russell 2000 was higher by over 1% and continues to outperform the broader market. This is important because it points to increased risk appetite on the part of investors, smaller stocks are riskier. It also points to a continuation of the breadth expansion that we have discussed. I would also point out again that the Russell 2000 went nowhere from the beginning of 2018 until recently. If this is a bubble it is probably just getting started and Soros’s quote may appear to make sense, time will tell.

The reason that the strength in small caps is important and impressive, is because they are holding the market up. The big, former leaders that we all know and love. The companies whose products we use multiple times a day in some instances (how many times a day do you pick up that iPhone and check Facebook or Instagram?) have been under pressure for more than three months. These stocks are the “FAN-MAG” (Facebook, Amazon, Netflix, Microsoft, Apple and Google). I built a price weighted index to track this group of extremely large and important companies. The dashed lines frame this dynamic of making no progress. At the bottom is the group’s performance vs the S&P 500. It’s actually breaking down. All we heard from bearish investors off the March low was that the market was only being led higher by this group of monster stocks and how that unhealthy. The bears also argued that when these stocks stopped rising, the market would fall. But now, the market is still going higher without them. That is what we call “debunking the bear case.”

My view is and has been that the majority of stocks were in a bear market for more than two years and that a cyclical bull market is just getting underway. My view is that from 2018 - 2020, investors were hiding out in the biggest and best companies. Now, it appears that things are getting better. The data last week to support this view was mixed. From Fact Set: Initial jobless claims jumped to 853K in the week to December 5th, the highest since September 19th, while continuing claims also rose for the first time since August. Michigan Consumer Sentiment was better however, up 4.5 points month / month to 81.4, better than 76.2 consensus. Claims jumping is not what we want to see. However, the consumer makes up roughly 70% of the US economy. While we have been locked down for most of 2020, a funny thing happened, we have been paying down our credit card debt. According to Experian: Individuals in the U.S. have seen their average credit card balance decrease by $879 since 2019, according to Experian data. That represents a 14% drop and marks the first time since 2011 that average individual credit card debt shrank compared with the previous year. Not only that, but credit utilization has ticked down by four percentage points year over year in 2020.

Last week, we learned that Pfizer’s COVID vaccine was approved. If I were to make a wager, it would be that as the economy opens up, we are going to spend. I would argue that there is a fair amount of pent up demand. We just have to make it through the winter. That may not be easy. Right after my story about eating out in New York City, we found out that indoor dining was now off the table. Fingers are crossed for these businesses and the employees who rely on them. I was saddened to learn of the closing of the 21 Club, a staple of the New York City business lunch scene where I have been more times than I can possibly count.

Speaking of spending, it is the holiday season. I went to get a gift for my older daughter yesterday. I hate going to the store and I truly don’t know what I was thinking by venturing out on a Sunday in December, but the I have always found that shopping for some holiday gifts puts me in the spirit. The stores are decorated and it feels good to put thought into a gift idea and going to buy it, in person. After parking “a mile away” I made it to the store to find a line around the corner. See, we spend! I had too much on my agenda and was not about to wait. I got in my car, pulled out my phone and ordered the gift from the company website, it will be here in four to five business days. I will get my spirit somewhere else this year. But I am grateful for online retail. Apparently, so are a lot of other people judging by the Amplify Online Retail ETF (IBUY), which closed at a new weekly high.

Finally, I will leave you with Disney (DIS), which I discusses here on October 14th. Last week, they told us that they it is now targeting up to 260 million Disney+ customers by 2024, up from the current level of nearly 87 million (with two young daughters, I am one of those 87 million). Disney had previously said that it hoped to reach between 60M and 90M subscribers by 2024. Disney will also will also release a lot of new programming for the streaming service. Ten Marvel series, ten Star Wars series, and 15 Disney and Pixar-produced series and features will all debut on Disney+ in the coming years, according to Vijay Jayant, an analyst with ISI Evercore. Disney also announced that they are going to raise the price of the service by $1 per month to $7.99. How many people are actually going to cancel their service because of this? If you have kids, you probably won’t. This is part of the playbook that was laid out by activist investor Dan Loeb when he wrote a letter to the Disney board of directors after amassing a large stake in the company. This is also what got me interested in the stock. Here is what I had to say after news of Loeb’s letter was released: I did add a little to my own account. I will add more when/if the technical side of the bet gets in line, getting over $136 would be a good start. The stock gapped up through the $136 level in early November on the Pfizer vaccine news. The updated subscriber numbers last week broke the stock out to new all-time highs and added 14% from the previous week to close at $175.72.

As the year comes to close, it is likely that volumes will begin to decline. I would not be surprised to see some wide swings in either direction but the overall trend remains to the upside.

I write about the daily ebb and flow of the market for clients here.