Some quick reminders before we get into it since there are more of you reading this now than there were last week. First, this is my diary on the market. It is in no way shape or form investment advice. These are the conversations that I am having with myself as I take in all that is happening in the market while trying to square it with the prevailing narratives and fundamentals. I do this to give some clarity to my thoughts. If you like what you are reading, please consider passing it along to others who might like it as well.

Next, if you have an opinion, I would love to hear it, especially if you disagree with something that I am thinking. I promise you that after starting in this business as a summer intern at the New York Stock Exchange when I was 16 years old, I have extremely thick skin.

Finally, nothing I write here should be considered investment advice. It is highly likely that I have a different timeframe and risk profile than you do.

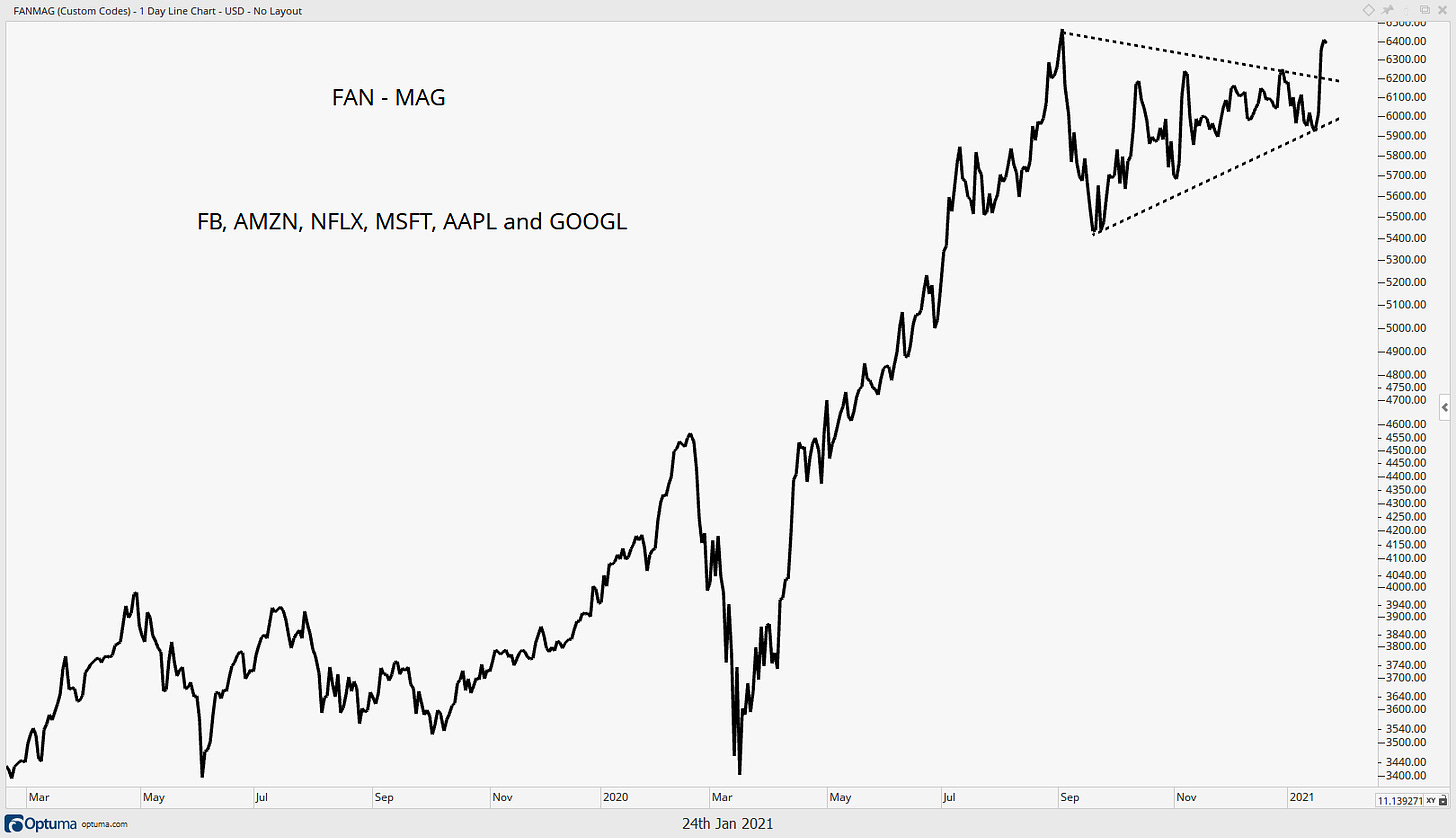

Winners Win! While the investment world is caught up in SPACs, IPOs and GameStop. The biggest theme in the markets last week was the return of the mega-cap trade. They have been out of favor since late August / early September. What’s fascinating to me me is the fact that the general market was able to keep grinding to the upside despite the lack of participation on the part of the “generals.” That has been a big confirming data point to my bullish view on US Equities. Participation has been and remains extremely broad. That is not what what tops are made of.

The fist chart to think about as the new week begins is of the FAN-MAG stocks (Facebook, Amazon, Netflix, Microsoft, Apple and Google). These are the generals that I mentioned above. After leading the charge from the March lows, the group has been going sideways since September 2nd. However, now they are beginning to move up and out of the consolidation and I have to wonder, “if the market was able to move higher with the generals lagging, what happens if the generals ride up to the front to lead the way once again?”

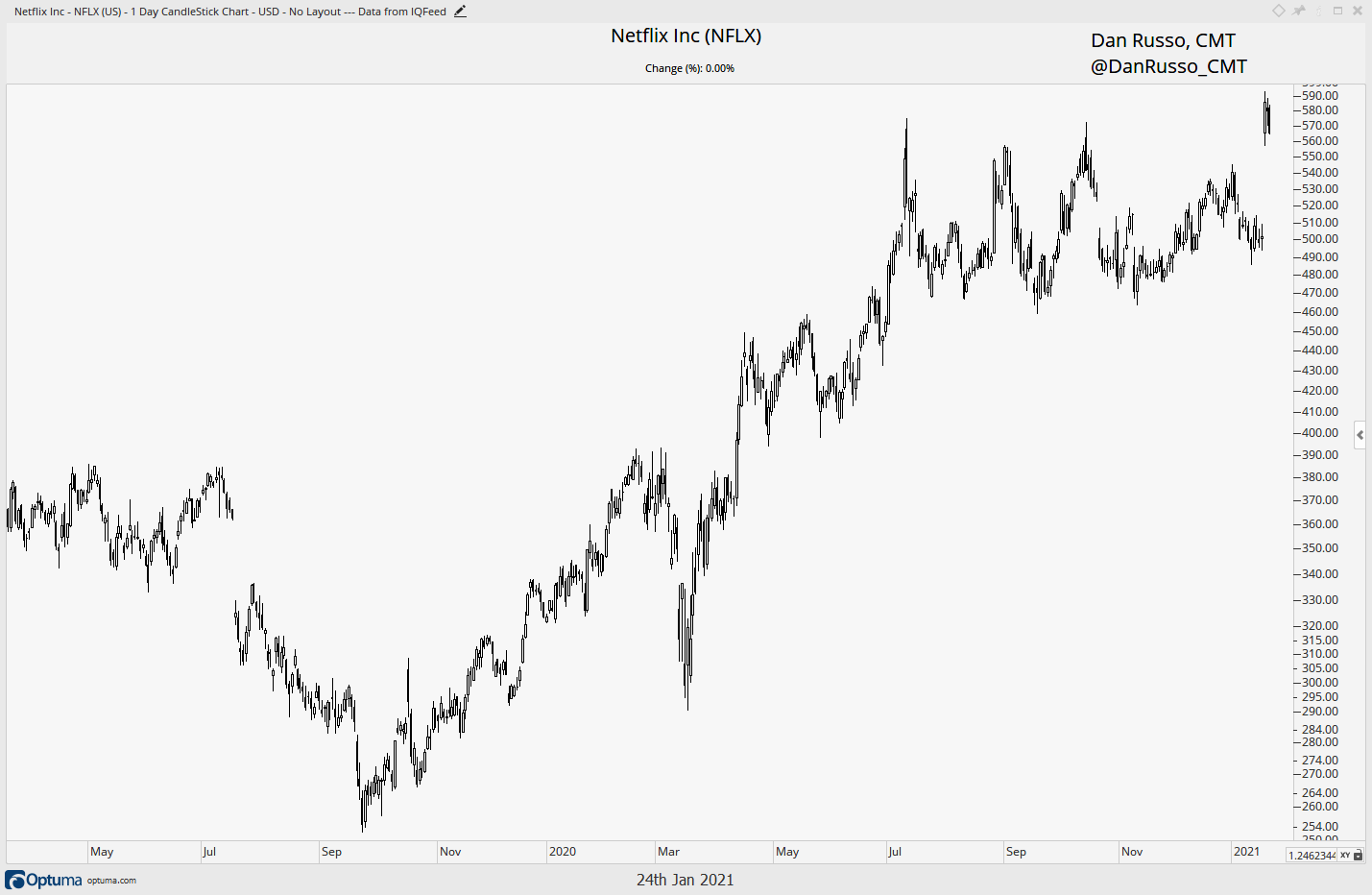

The spark for this new strength was the earnings report from Netflix. The company reported that they added more subscribers than investors were expecting in the quarter. At the same time, they lest us know that they have over 200 million total subscribers (let that sink in). But there was much more to the story. Despite their size, they are still growing revenues by more than 20% and are now on the verge of becoming free cash flow positive. The stock has made zero progress since July but the story may be changing.

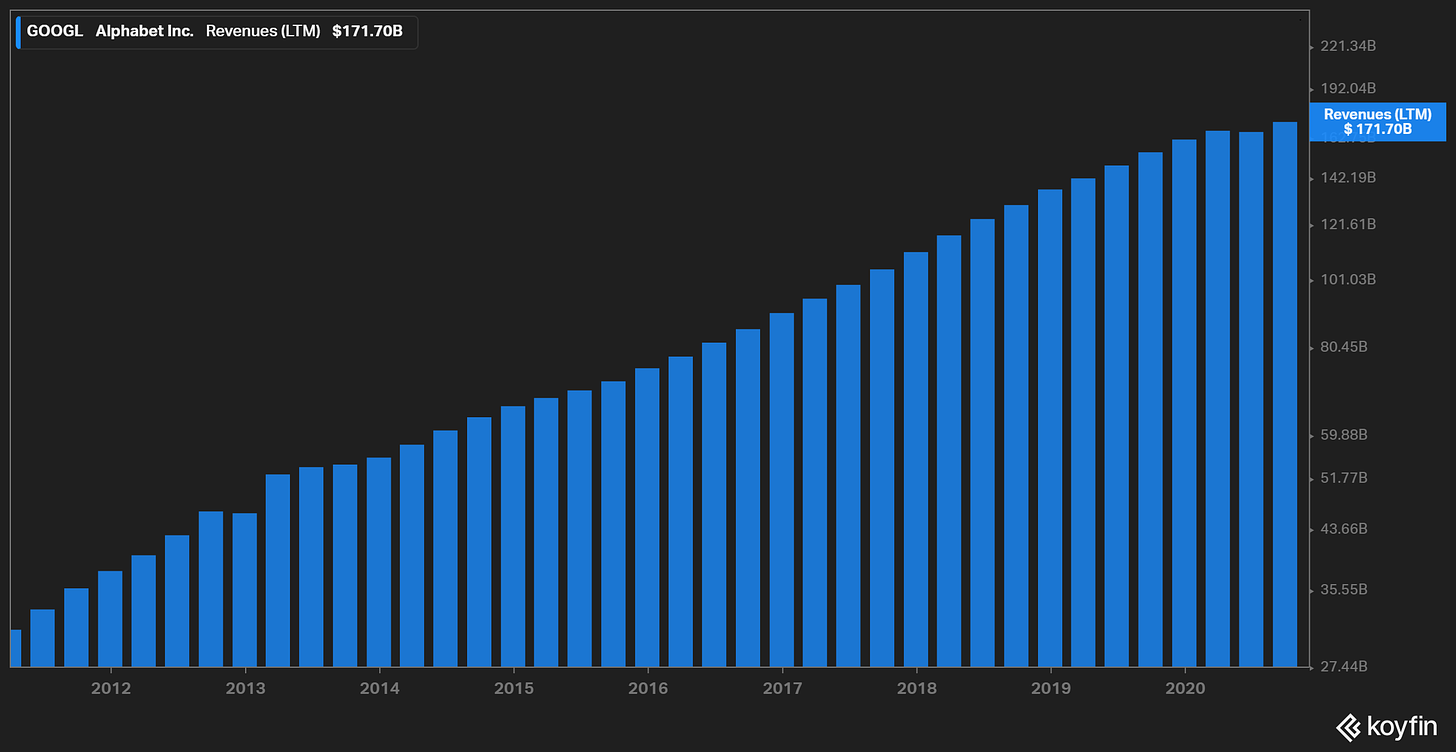

The other driver of the FAN-MAG strength was Google (GOOGL). This name has been on my radar for a while but I have not been involved. There was nothing that came from the company to drive the stock higher but Merrill Lynch did add it to a focus list and another bank initiated coverage with an overweight rating. I bought some GOOGL as it moved higher on January 20th and will look to make this a core position.

Google is the definition of secular growth. Here is a look at their quarterly revenues over the past 10 years. They have been able to maintain their margin profile and do not trade at an egregious valuation. At the same time is Google is a company that takes up a lot of real estate on the first page of my iPhone.

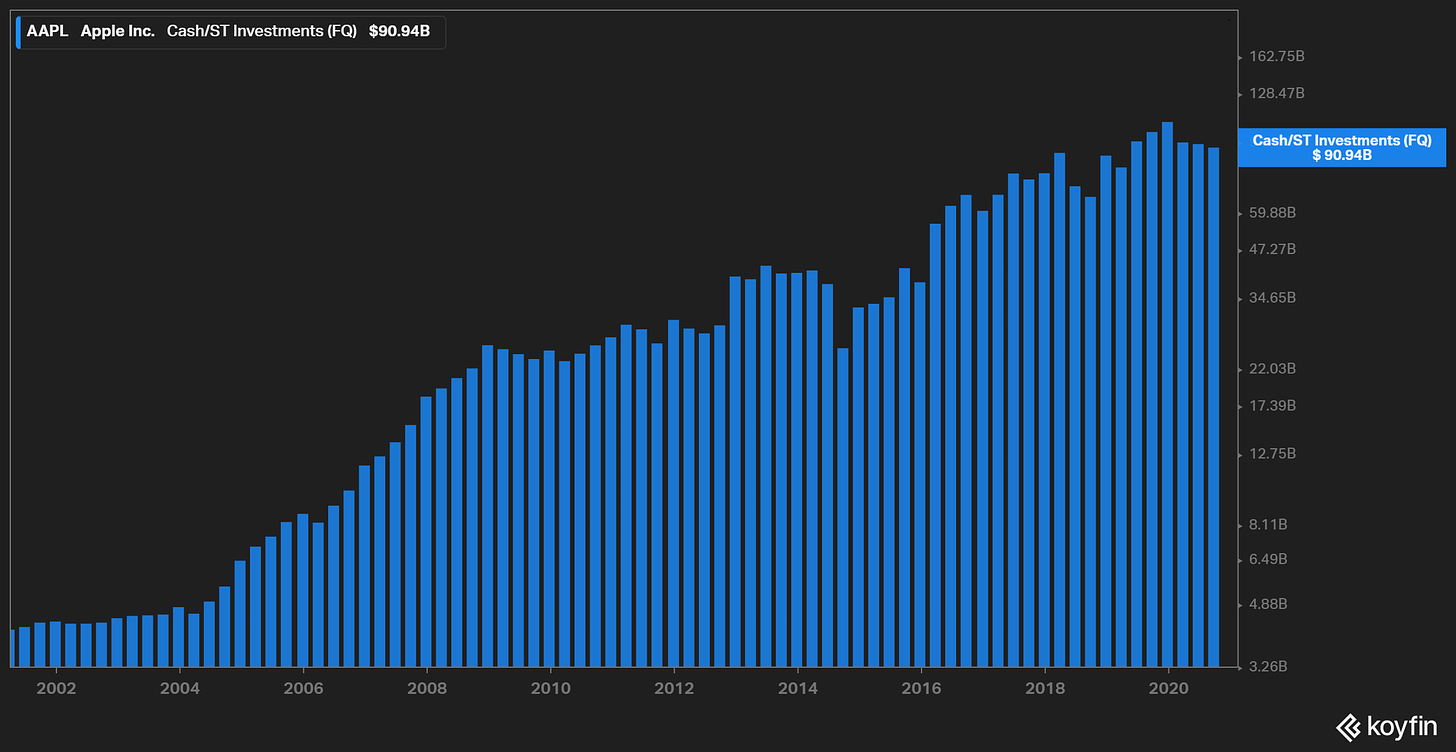

I would be remiss if I did not bring up Apple after walking through why I think they have a great business and how I view them as shifting to becoming a wellness company. Apple closed at an all-time high on Friday after making no progress since since September.

In fact, I think that Apple should buy Peloton to solidify its place in the wellness space. I am not saying that this is going to happen but have a look at the way the cash is piling up on Apple’s balance sheet. With interest rates at extremely low levels, putting cash to work has to be a better option than letting it sit on the BS. Or perhaps there is another store of value that has recently been added to balance sheets of other public companies?

Ok that was six charts. I think that they fact that these market leading mega-cap stocks are getting back in the gear with the rest of the market argues for a continuation of the bullish trend that has been in place since March. Staying the course makes the most sense to me now.

*This is not investment advice.