There was pure carnage in the certain pockets of the market yesterday. In particular, the area of the market that is home to fast growth companies which are not earning a profit now (many might not ever make money). I am fairly certain that before lunch time in New York yesterday a lot of investors were down a lot of money, and this was likely a continuation of a trend that has been in place for the past six days. If all you did was look at the S&P 500, it would probably not register, but something may have shifted in the market last Tuesday…stress “may have.”

First the background. Why do I think a lot of people have lost a lot of money? Because of the Cathie Wood effect. Cathie is the rock-star fund manager of the moment. At this time last year her firm, ARK Invest, was managing about $3 billion. Now they are managing more than $50 billion. A combination of tremendous performance in 2020 and massive amounts of inflows led to the big spike in assets under management.

Cathie and her team believe in transparency. They make a lot of their research and analysis public, a big shift from the traditional way of doing things. When I was interested in learning about CRISPR Gene Editing Technology, I read their white papers. When I wanted to understand the investment opportunity for Square as it related to CashApp and bitcoin, I read their white paper. I learned much of what I know about bitcoin itself from their work. They host a podcast called FYI (For Your Innovation). That is the focus, innovation. They are making investments in innovative companies that have the potential to disrupt the current business ecosystem. They even embarked on a savage marketing campaign with a shot directly at their passive investor competitors.

I am a believer in their way of investing, for a portion of my portfolio. I understand that when it works, it works really well. In 2020, all of her funds were up more than 100%. I also know that when it does not work, it is painful. Very painful. Cut in half on your investment is painful.

The potential problem now is that Cathie has become the most followed investor in the US, if not the world. And we can literally follow. Every night, after the close of trading, you can get an email of what she bought and sold on the day. It is not uncommon to see a stock move higher after it becomes known that Cathie bought a big position. Take a look at Palantir Technologies the day after we all learned that ARK bought five million shares:

Cathie has made it easy for many follow her lead. And clearly, based on the jump in assets many people have.

So here is what may have changed last Tuesday. The interest rate environment. The yield on the 10-year treasury bond gapped higher and has been moving up ever since. Now this is all part of my “things are getting better” thesis...so I have been expecting higher rates, and rates have been drifting higher since October. But if rates rise too quickly, the equity market will throw a tantrum. And the part of the equity market that will be kicking and screaming the most will be the types of stocks that Cathie owns. The unprofitable growth stocks! I have written about why this is, here. Fed Chairman Powell seemed to sooth some of the fears of rates rising too far too fast when we spoke in front of Congress yesterday, stating again that, despite hopes that a fading pandemic will vastly improve the economy’s prospects, the Fed has no plans to start tapering its monthly bond purchases or raising its overnight interest rate target anytime soon. Yields are also trading into resistance (not shown).

Cathie owns expensive stocks, many don’t make money now. Remember, she takes a five year plus view. Her average holding trades at nearly 10x its book value and has a negative P/E ratio (because they don’t make money now).

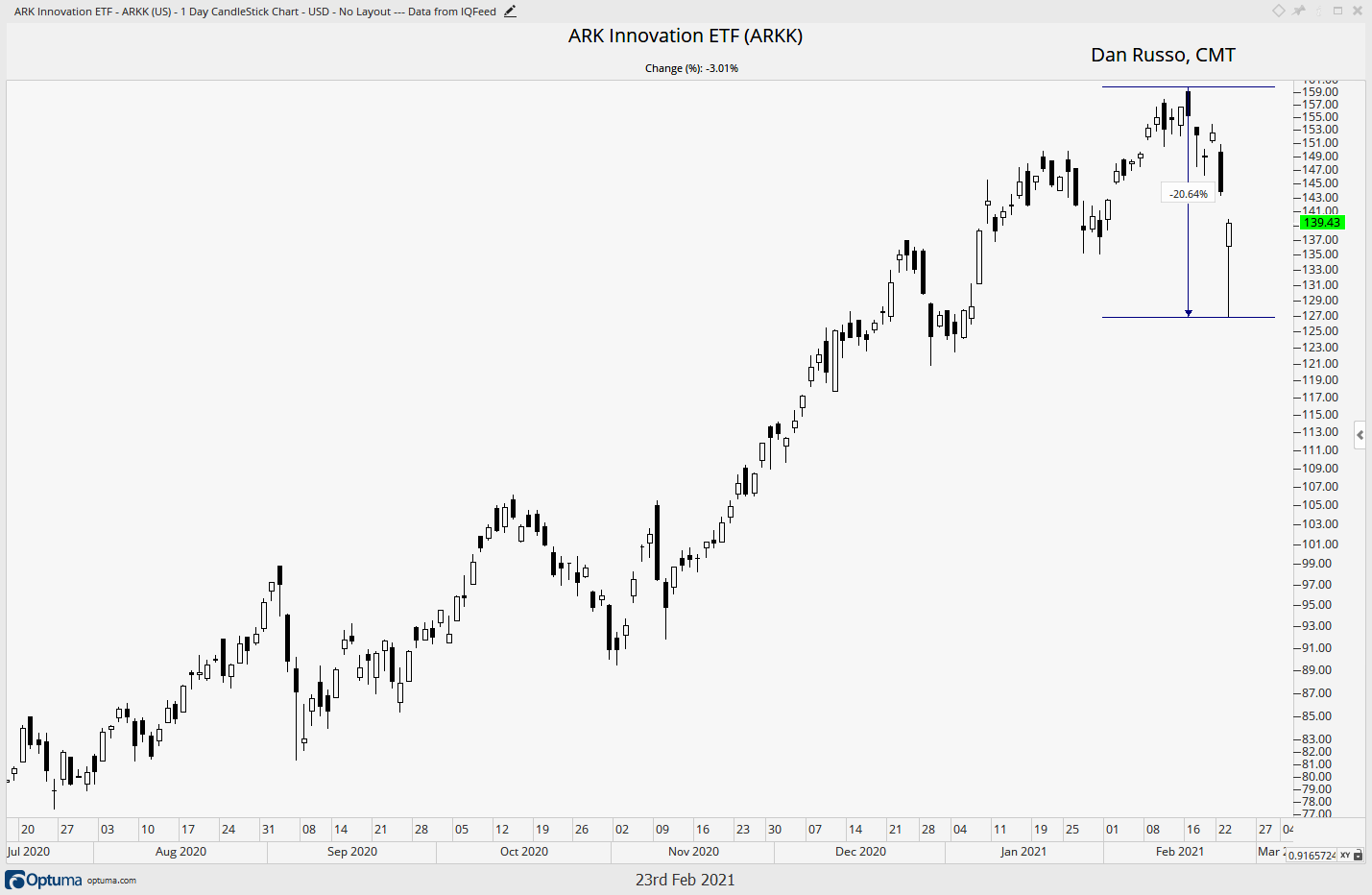

And the fund has paid the price over the past six days, with a high to low move of more than 20%. The biggest holding in the fund, Tesla, was down more than 30% from its peak to yesterday’s trough. For reference, the high to low move in the S&P 500 was 3.66%.

Cathie has stated over and over that she and her team take a long term approach to investing. I am very curious to see what her fund flows look like over the next few days. This will determine if her followers truly believe in her long-term view. A five-day selloff should not scare you from a five-year investment.

My guess is that there were many “weak hands” in many of these names. Over the past week, they may have been shaken out. Yesterday morning there may have been capitulation. Stocks likely moved from weak hands to strong hands. I have nothing to back this with! Time will tell.

*Nothing in these pages should be considered investment advice.