Geopolitics Trump the Themes

I love to think about the markets thematically. If I can identify a theme that is likely to persist, it uncovers a lot of different opportunities to invest and therefore a lot of “shots on goal.” One of the big themes in the market right now is the growth to value shift that is playing out. I have been pretty vocal in my views on global growth picking up, talking about my copper to gold ratio to anyone who will listen. The beauty of the theme is that there there a number of way to play it:

Value stocks

Small cap stocks

Japanese stocks

Energy stocks

Financial stocks

Materials stocks

Industrial stocks

Within this framework, investors can identify the two or three best performing groups within the theme and focus on ideas there. Investing in all of them would not be the best idea because if I am wrong, they will likely all go against me.

Another theme that I am only going to bring up to prove a point (because honestly, I am getting tired of writing about it) is the inflation theme. Within this theme, I can look at more ideas:

Commodity Currencies

Commodity-Rich Countries (global equity exposure has been another theme of mine)

Mining stocks

Agricultural stocks

Inflation Protected Treasuries

The real interesting opportunities come when these themes intersect. I have been thinking a lot about Brazil of late. The country is leveraged to commodities and can also be considered “value” by some metrics. It is also a foreign market. So Brazil checked three of my boxes. I have not invested there because I am still doing my reading. While reading yesterday, I was reminded that when you leave the US, all the analysis in the world and all the best themes can line up but there will always be geopolitical risk. Here is the headline in the FT:

Brazilian markets rattled by Bolsonaro’s Removal of Petrobras Chief

The president of Brazil removed the CEO of the country’s flagship company. While not quite the same, the Brazilian state holds about 36.8% of Petrobras, but 50.5 percent of voting rights, This would be akin with President Biden removing Tim Cooke from Apple.

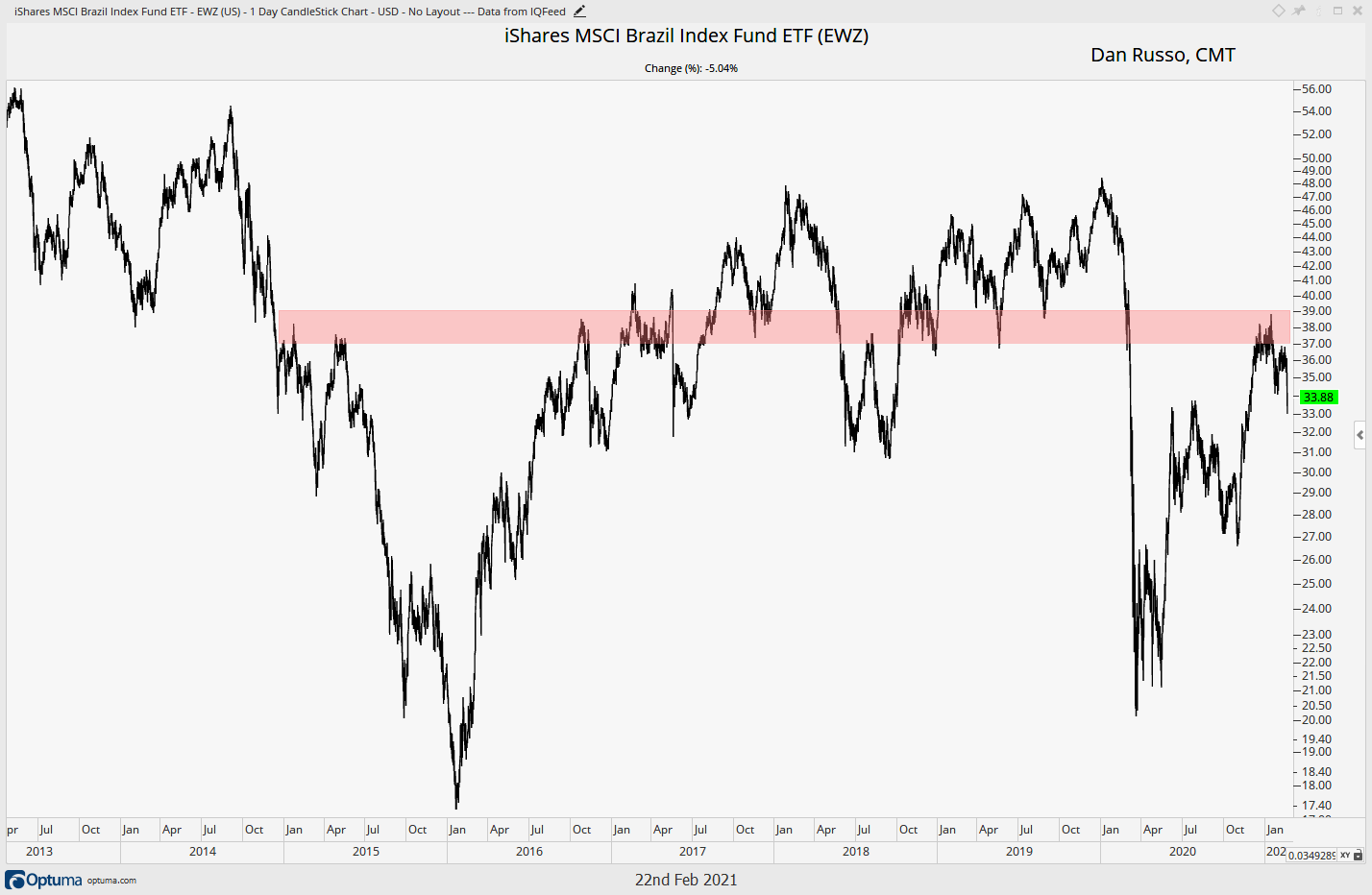

Petrobras lost ~20% on the day and the broader market in Brazil lost more than 5% at one point in the day. The iShares Brazil Index Fund (EWZ) has made a strong move from the March lows but has been running into some trouble of late. Then the Petrobras news was reported and the fund cratered, negating to some degree all of the thematic positions that put it on my radar to begin with.

Investing is and will always be about making the best decision possible with incomplete information. Brazil seems to check all of the thematic boxes but it still could not break to new highs like many of the other themes on my radar have. That was a big reason that I was continuing to do the work but had not acted yet. The Petrobras news was a wakeup call that there is an added risk when going abroad. This is not to say that it isn’t worth it (I still think it is) but that there is an extra amount of work to be done.

By the way, Russia checks all of the same boxes as Brazil. But Russia is on the verge of trading to new 52-week (not all-time) highs. I am not invested yet and this book is always in the back of my mind when I think about Russian companies.

Geopolitical risks noted!

If you are interested in seeing more in depth views on the markets, you can see my daily work here:

Nothing in these pages should be considered investment advice.