Got Any Good Books to Read?

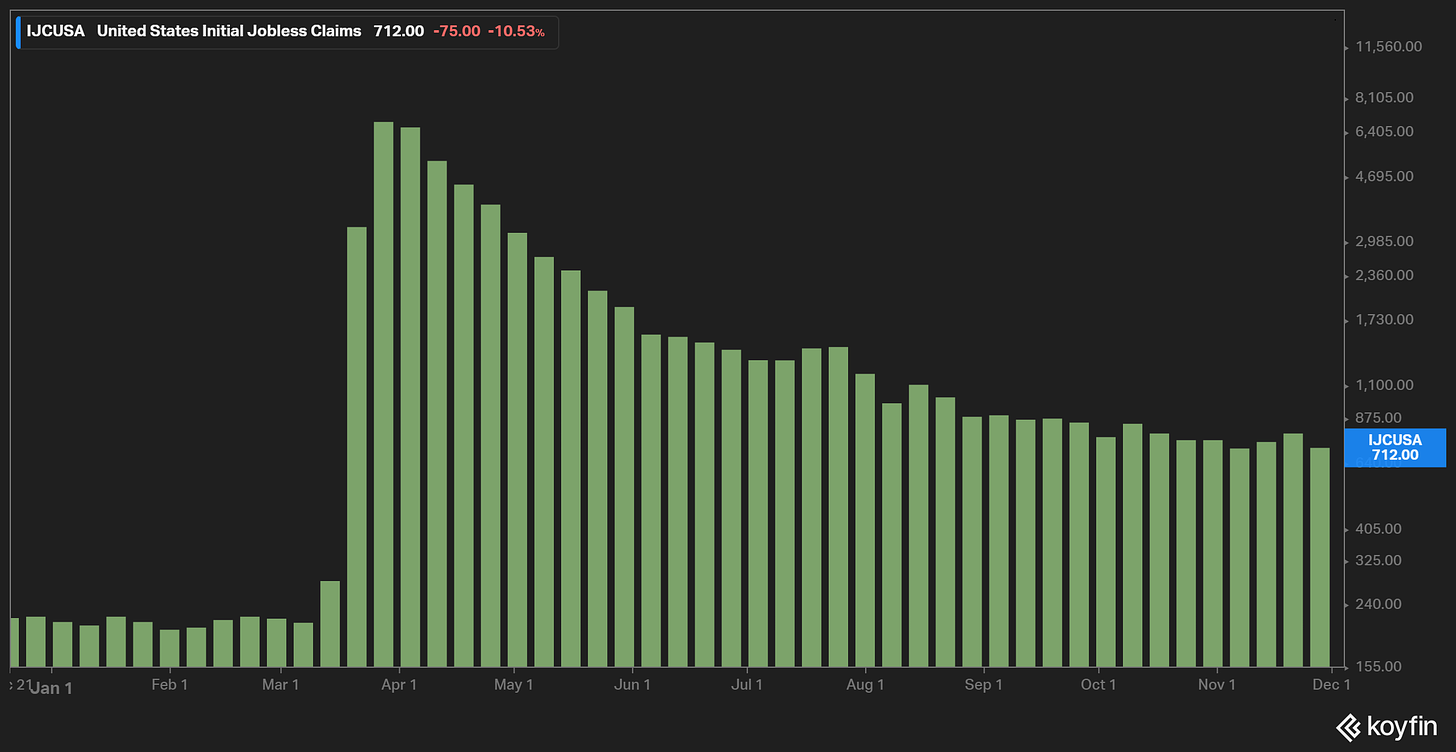

Not much in the past day has changed my views on the market. I still think there are good odds that stocks drift higher into the end of the year. The rally is fairly broad, which I have touched on here. At the same time, the traditional haven assets such as treasury bonds, gold and the dollar have been under pressure. This tells me that investors are willing to take on additional risk. There will come a point when this gets pushed too far, but I don’t think we are there yet. Yes, everyone seems to be bullish but the surprises from an economic perspective have been more positive than negative so that is likely enough to keep the train moving along for now. Just yesterday we learned that initial jobless claims declined after moving higher the prior two weeks and they have been trending lower since the initial COVID spikes in March and April.

Twice a week I hold a call for clients to discuss what is happening in the market. Every now and then, I am asked about books that I have read that I have found helpful as it relates to trading and investing, so I figured I would list some of my favorites here.

Start with the “bibles.” I like to broadly classify investors into three buckets: Technical, Fundamental and Quantitative. Some are combinations of two or all three. I am mostly technical but I pay close attention the fundamentals because all else being equal, I would rather own a good business than a bad one. As luck would would have it, each of these buckets has plenty of great books that are full of information but I like to start with the main book in each subject, the one that lays the ground work:

Fundamental: Security Analysis: The Classic 1934 Edition This is the book that sent Warren Buffett on the path of becoming one of the most successful investors to ever live.

Technical: Technical Analysis of Stock Trends Required reading for anyone who likes my charts. This is arguably one of the building blocks for earning the CMT designation that I hold.

Quantitative: What Works on Wall Street, Fourth Edition: The Classic Guide to the Best-Performing Investment Strategies of All Time The investment world is becoming more quantitative and Jim’s book is never more than an arm’s length from my desk.

After that, Reminiscences of a Stock Operator is a classic with timeless bits of information. It is based on the life of Jesse Livermore. Traders love Jesse but I personally don’t get the love affair. He went broke twice and then committed suicide but I digress. The book is still useful. I have read it more than once.

All of the Market Wizards books by Jack Schwager are extremely useful. He sits down and interviews traders and investors across markets and styles.

Make what you want of his thinking and political views but The Alchemy of Finance by George Soros is a must read if you want an inside look at how one of the best macro (big picture) traders looks at the world.

Speaking of the big picture, it is helpful to understand that the world moves in cycles and so do the markets. We move at all times somewhere between greed and fear. To get a sense of what this looks like and how to take advantage of other people’s emotional decisions in the market, Mastering the Market Cycle: Getting the Odds on Your Side is a great read.

Finally, investing is a lot like playing poker. I am not talking about gambling. Done properly, neither one is gambling. No, instead, what we are doing is making decisions with incomplete information. Come to think of it, that is just everyday life, so fine. Anyone who remembers when Texas Hold ‘Em became popular and the World Series of Poker was on ESPN will likely know the name Annie Duke. What you may not know is that prior to becoming a professional poker player, Annie was awarded a National Science Foundation Fellowship to study Cognitive Psychology at the University of Pennsylvania. Her book Thinking in Bets: Making Smarter Decisions When You Don't Have All the Facts is great and would be a benefit to anyone, even if you aren’t putting money at risk at the tables or in the market.

So if you have the interest and find yourself with some time into the end of the year, these are books that I think are helpful. All are listed with a live link to Amazon…a good business whose stock has been going sideways for three months but has been in an uptrend for years. I own it.

Thank you all for taking the time to read this note everyday. If you are enjoying it, please consider sharing it with others who may find it useful. Have a great weekend!