So after dropping a tape bomb late in the day yesterday, the President walked back the comments on stimulus and actually called for some specific actions around the airlines, PPP and direct payments to citizens. If there is a stronger argument for knowing your levels and waiting for the trends to develop, I don’t know of one. But the market liked what it heard and rallied throughout the day. But just to be clear, if playing the ping pong game, we would be doing the following:

Selling on Friday - President in the Hospital

Buying on Monday - President out of the Hospital & Rising Stimulus Expectations

Selling on Tuesday - “No Stimulus For You” Tweet

Buying Today - “I was just kidding, here’s what I want”

Thankfully, I sat out that game.

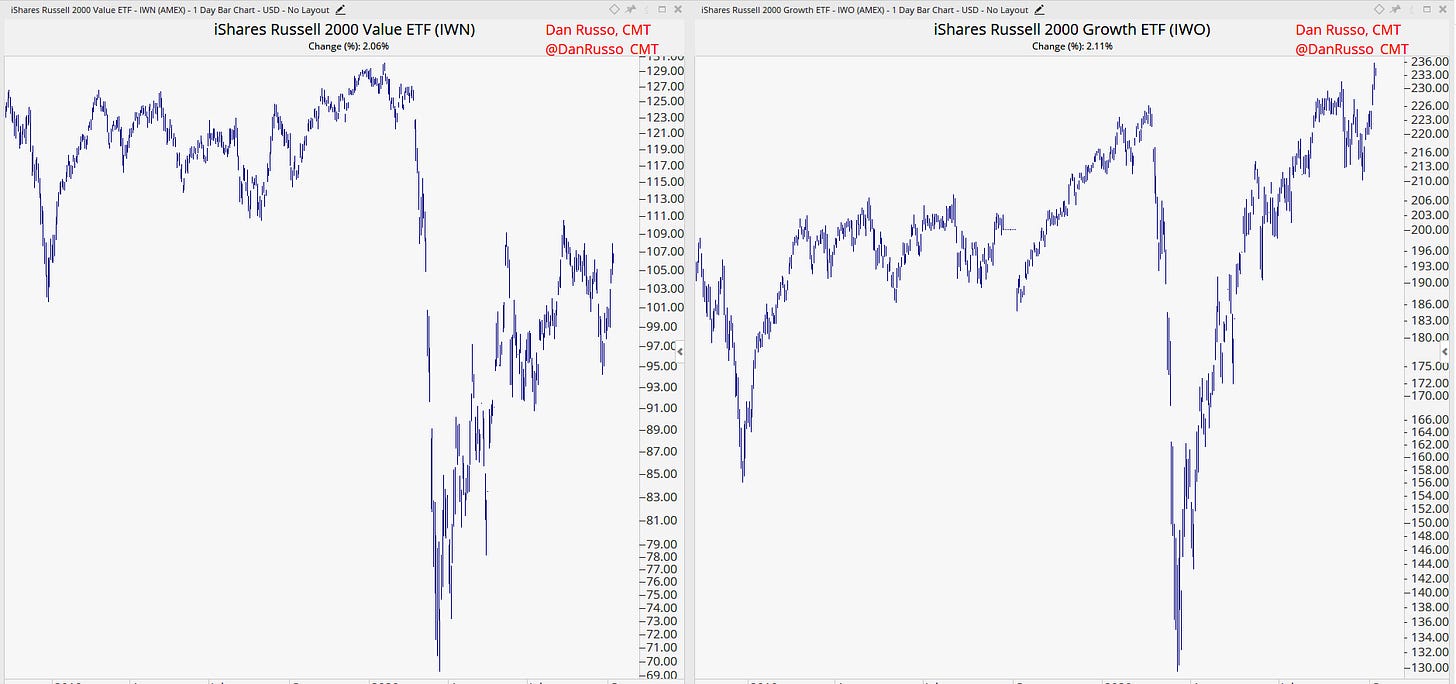

In reality, from a trend perspective, there is not all that much that has changed. The SPY closing above $340 is encouraging but the bigger hurdle for me is $343, near the September highs. I guess the biggest change is the relative strength in small caps, which is playing out in growth and value. Market seems to think that a Biden win and the prospects for more spending is a positive for the smalls so we aren’t going to argue with the market for now. I will say that IWO, small growth, closing at a new high is more compelling to the trend-follower in me. The recent move in IWN, small value, is a bit of a win for the contrarians out there but there is a lot of wood to chop just overhead. Plus the growth fund fits with my stagflation theme for now.

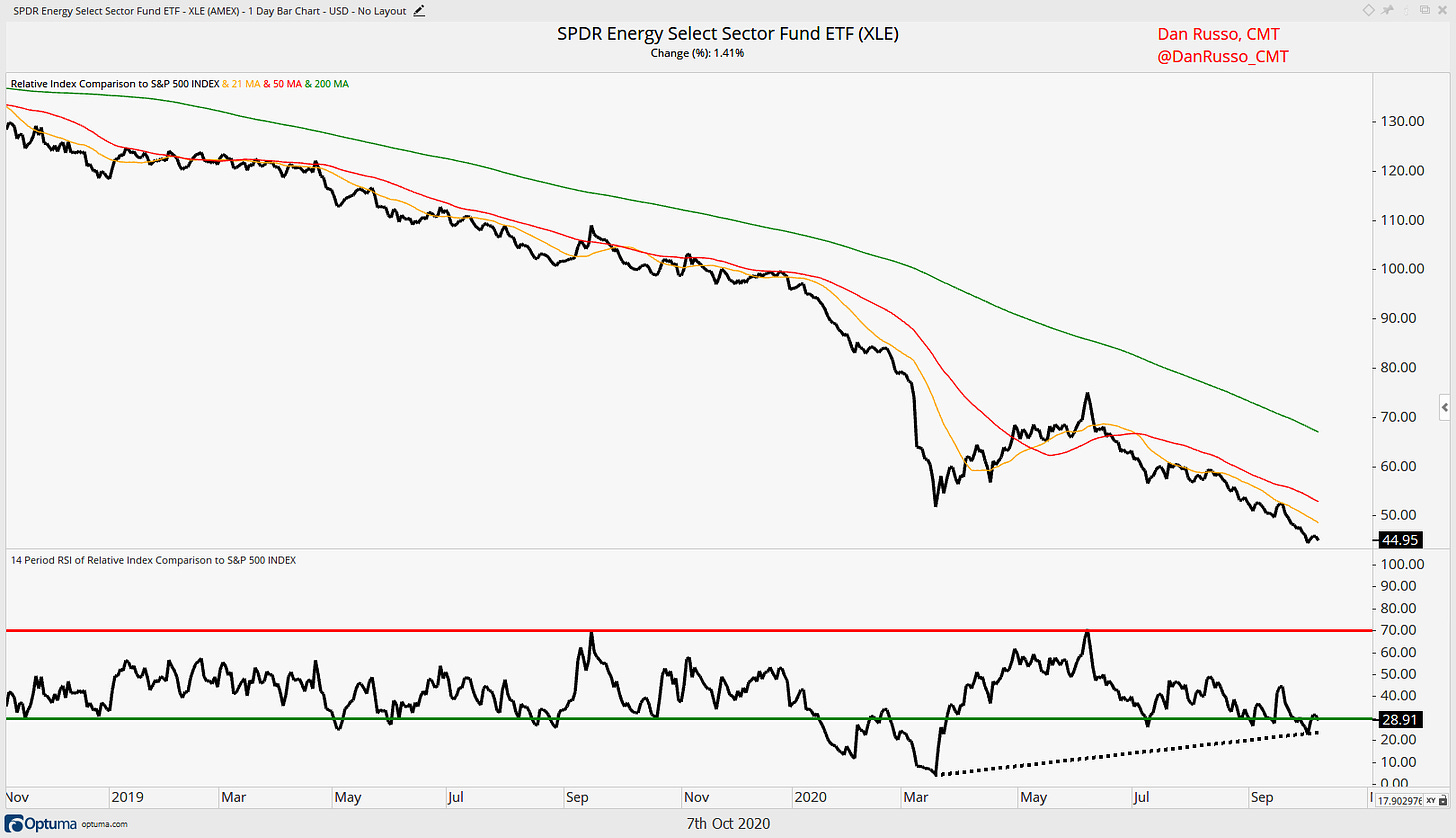

Speaking of contrarians, I have heard the argument being made that now is the to buy energy, traditional energy, not solar which has been on quite a ride. But one phrase keeps coming to mind, “being early is the same as being wrong.” I want to get there but I just can’t. First, there are better ways to play the inflation theme for now: Materials, Ags, pockets of the Industrial sector. Energy just does not have what I am looking for. With Energy vs the S&P 500, the case for taking the contrarian stance could have been made many times over the past two years…and it would have been early. The case can be made now, I guess, but it is still early. Facts: XLE vs SPX made a new low last week. The ratio is below the declining 21, 50 and 200 DMAs and 21 < 50 < 200. The only case that could possibly be made is that the RSI is higher now than it was in March while the ratio is lower.

Jesse Felder, whose work I like, makes the case from a sentiment perspective here. I am not going to push back, sentiment in the oil patch is terrible. But, I would rather miss the low and be there when a better trend is in place.

Now, Financials look like they at least deserve some attention an a relative basis, especially with the curve steepening. This is one to watch closely in the weeks ahead but not quite there yet.

I like the Wave logo.