I could not disagree more with this story…

“Why it is usually a mistake for investors to take profits”

The gist of it is, if you find a great company, buy the stock and hold on. However, the article goes on the explain the flaw in the strategy that it advocates, citing research on the matter:

Research by Hendrik Bessembinder, a professor at Arizona State University, has found that nearly 60 per cent of global stocks over the past 28 years did not outperform one-month treasury bills. That might seem a case for not investing in equities at all.

We all know what a great company is in hindsight. It is easy to look back now and say that the iPod reinvigorated Apple and changed the company forever. At the time, it was anyone’s guess. Home Depot seems so obvious now but was it always this way. Amazon lost over 95% of its value in the dot com bust before becoming the monster that it is today.

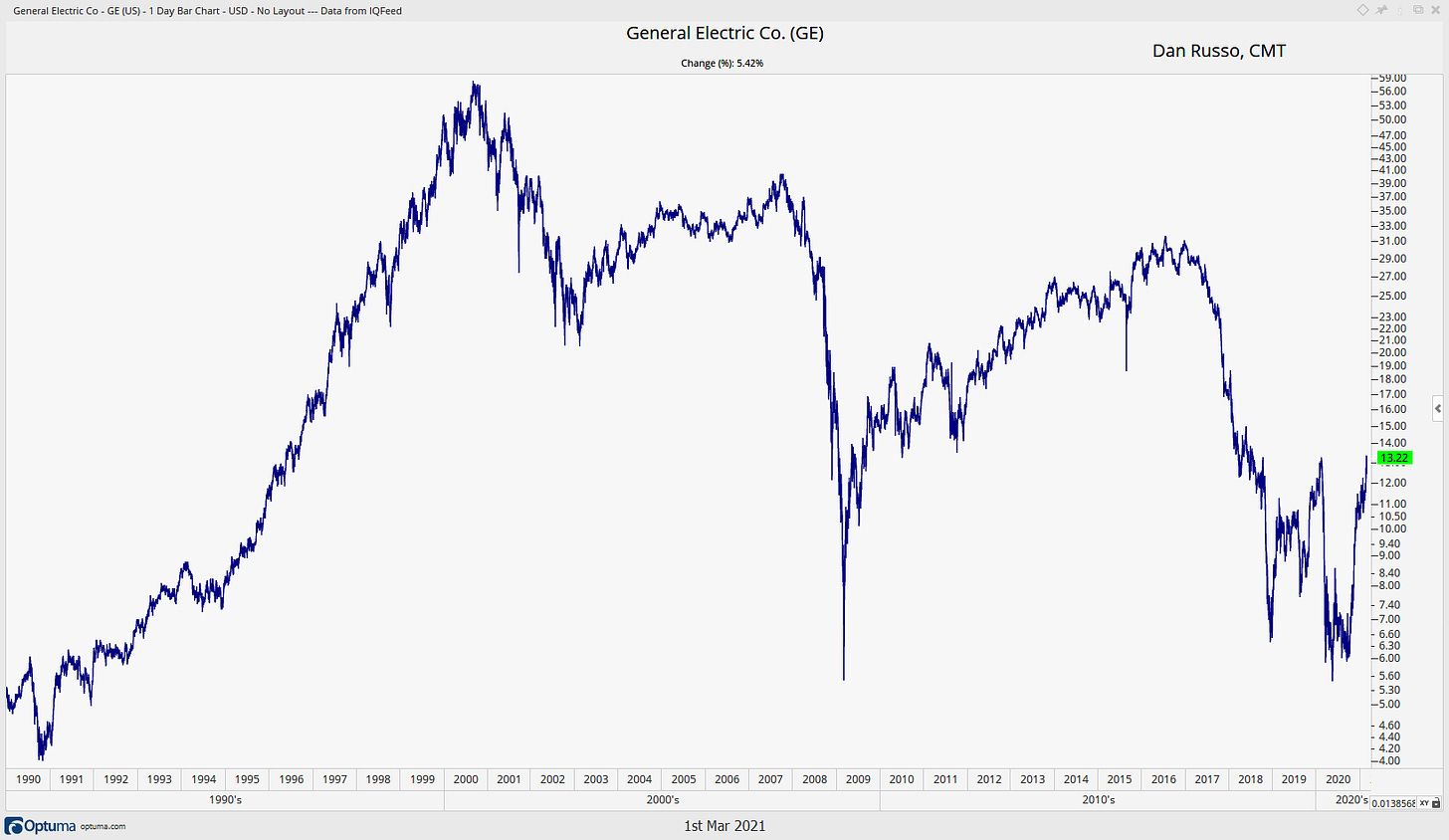

If 60% of the stocks listed don’t even beat one-month t-bills, what are our odds of picking the next AAPL, HD or AMZN? General Electric was once a great company Have a look at the GE chart. This was an American icon, but you can make the case that it has not mattered since the turn of this century. Even after more than doubling from the COVID lows, GE is still more than 77% below its highs from the year 2000.

In my mind opportunity costs matter. What would you have missed out on while holding GE for the past 20 years?

This is why technical analysis comes first and the fundamental analysis come later. I may have thought that GE was the greatest company in the world, but that would not have changed the fact that the stock was going down. Fundamental analysis is the subjective part of investing. We all love a nice story, but if no one else believes the story, who cares.

Buying a stock or anything in the market for that matter, and just holding it, seems like a bad idea to me. Creative destruction is the lifeblood of capitalism. Maybe there will even come a time when AAPL, HD and AMZN no longer matter. Would holding those stocks, if they begin to suffer the same fate as GE, make sense?

Take it a step further, what if the US loses its position as the dominant economy in the world, would it make sense to continue to simply a hold a portfolio of US stocks and bonds?

I genuinely want to know how people view this subject. Buy and Hold vs Active Management. Here is a better idea. What stock do you like today, under $10 billion in market cap, do you think will be in the top five market caps of all stocks in 20 years? Feel free to drop a comment:

I love this stat. Do you have a source?

“If 60% of the stocks listed don’t even beat one-month t-bills, what are our odds of picking the next AAPL, HD or AMZN?”

Thanks!