If You Give It, We Will Spend

If you can count on anything, it is the fact that if you give Americans money, we are going to spend it. Yesterday, we learned that retail sales for January rose by 5.3%. This was after the $600 stimulus checks were mailed, presumably. The economists who try to predict such things were looking for an increase of 1%. Another reason that I am glad that I am not an economist and another reason why trying to predict anything is virtually futile. I do like this line from Joe Weisenthal in this morning Bloomberg note. After all this time, the U.S. economy is still being underestimated.

As an aside, the Producer Price Index (PPI), a less cited measure on inflation also exceeded expectations. rising by 1.3% vs estimates of 0.4% and up from 0.3% in the prior reading. Getting back again to Joe’s comment…the surprises continue to come to the upside. We know that if you give an American money he / she will spend it, and we know that there is potential for more stimulus to make it into the hands of the people. My guess is that Joe will have a lot more chances to write this line in the weeks / months ahead.

This all lines up with my “things are getting better” thesis. And since things are getting better, we have found something else to worry about. By “we” I mean permabears. They are up in arms about the rise in interest rates. And in fairness, this is something that should be watched closely but there is going to be a lot of nuance around it.

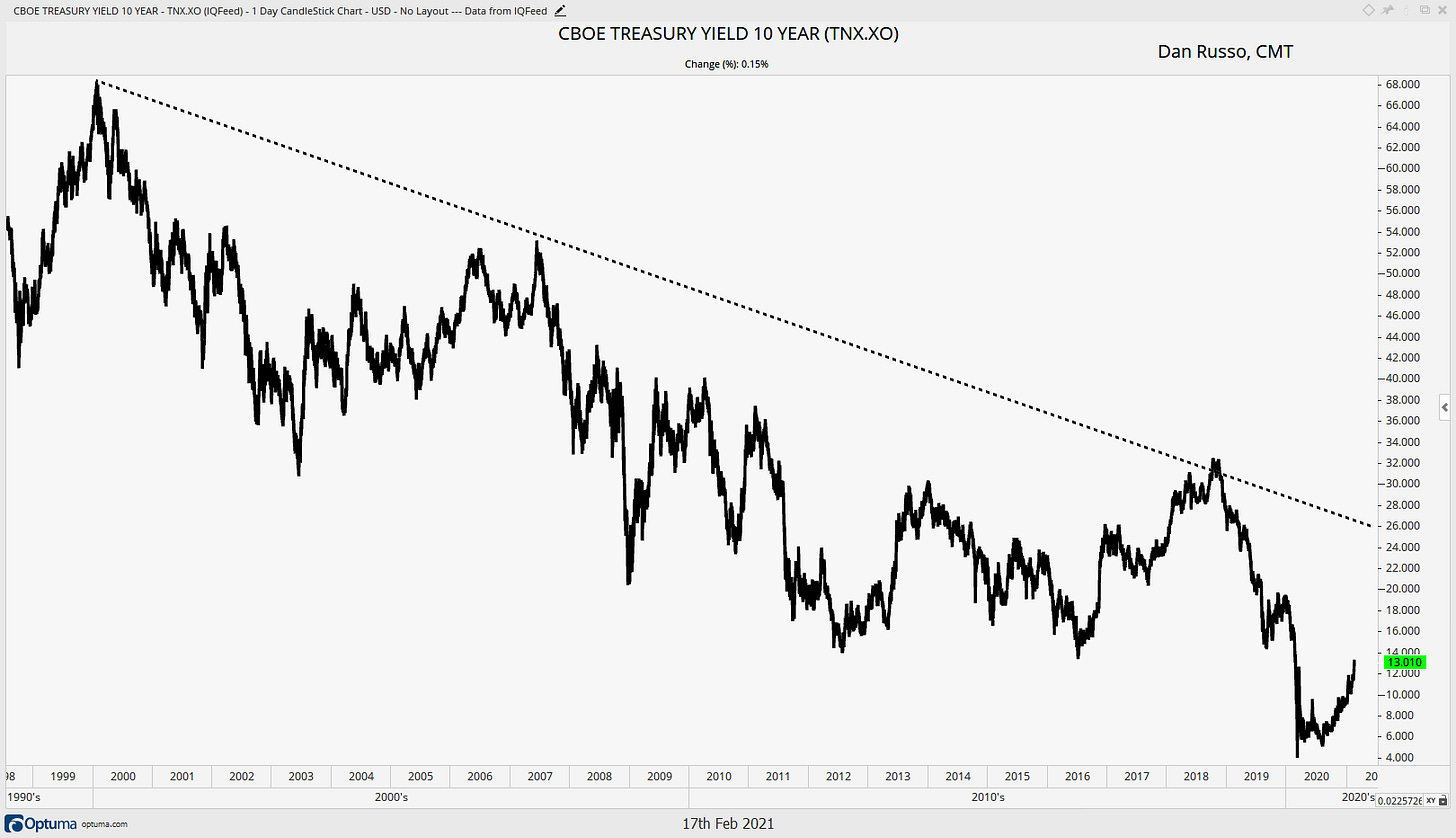

The 10-year treasury yield has moved from a COVID low of 0.4% to a recent reading closer to 1.3%. Now 1.3% is still pretty low by historical standards but the fact that yields are now moving up COULD BE a concern. The reason we stress could be, is because the impact of rising yields, in my opinion, is path dependent. In particular, how fast do they rise? The market does a good job of absorbing gradual changes. A slow drift from 1.3% to 2% would probably not be that big of a deal for risk assets if it happens over the course of the next six to nine months. If that same movement happened over the course of six to nine days, the stock market would likely throw a tantrum.

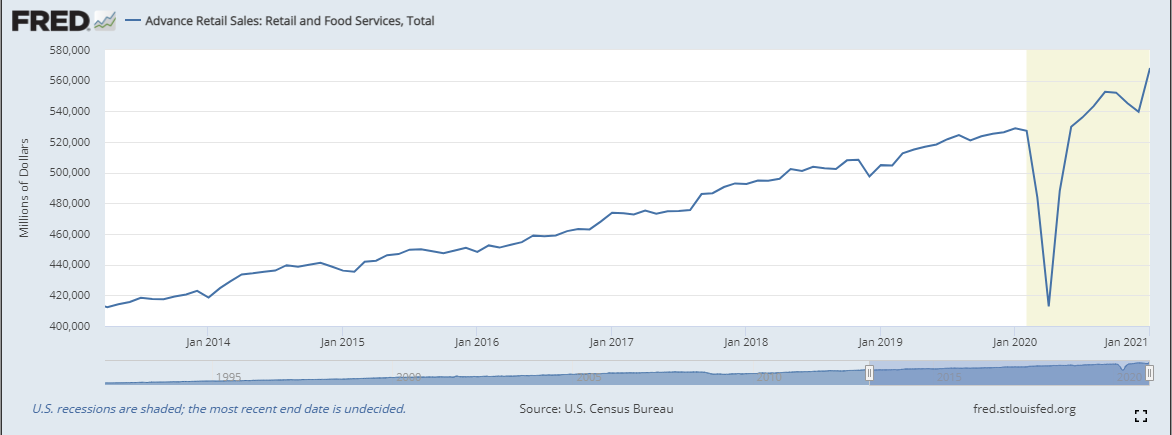

Lest people begin to worry about a rise to 2%, that’s where rates were prior to COVID. Rates were at 2% and heading lower. Have a look at the big picture trend in the chart below. So it’s possible that the market is simply getting back to trend after a massive dislocation. Look back at the chart of retail sales…it also looks like it getting back to trend after the big spike to the downside during COVID.

Back to yields, I would be shocked if the Federal Reserve let rates rise much past 2%. They have been telling us for months that they are going to remain accommodative. I guess it will come down to the market vs Fed and we will see who has more firepower.

So if rates are rising because “things are getting better” and they rise slowly, the stock market and other risk assets should continue to do well. Haven assets such as treasuries should continue to do poorly. One area of potential concern would be in the growing number of stocks that are not yet profitable. Bloomberg’s Dave Wilson shared this chart. It is the performance of an index of technology stocks that do not make money. If we reframe these, not as stocks, but as long-duration, high-yield bonds (profits are well off in the future and not guaranteed), then rising rates will not treat their prices well. The speed at which rates rise will determine the size of the potential headwind.

I have a feeling that if these stocks begin to roll over, there will be a lot of pain in the retail investor community. Many of these are likely to be story stocks that capture the imagine but it remains to be seen if they will capture profits. Undoubtedly, some will. Many will not. Amazon, Apple, Netflix, Tesla, Google were all once in this category. But so were Pets.com (remember the sock puppet?), Webvan.com (who?), theGlobe.com (social media before My Space), Flooz.com (online currency…maybe they were trying to be bitcoin?) and drkoop.com (precursor to WebMD).

As with most aspects of the market, there is not a black and white conclusion to draw. In the meantime, things are getting better and the trend is up.