Inflation Confirmation?

Stocks moved higher in the US led by the small caps and high beta. The main market ETFs (SPY, QQQ and IWM) retook their respective 50-day moving averages. Energy led at the sector level proving that a broken clock is right twice a day. Technology also traded well. REITs and Staples lagged.

I have said that if I am wrong in my stagflation view it is in “flation” part of the argument but today, at least, I am very right. Commodities ripped higher led by the energy patch. Silver went along for the ride as well. Copper trading lower confirms my view further, speaking to the slowing global growth picture. Base metals also underperformed the broader commodity complex.

What mattered today and was it confirmed in the charts? The big story of the day was President Trump’s release from the hospital. But I can’t really call this a market driver, it was becoming clear that he was improving over the weekend. The biggest story is the betting markets have Biden opening a bigger lead as of yesterday. The prospects of a Biden win with a blue wave in the senate opens the door to further stimulus, which is inflationary. This put a bid under the equity market and I can’t help but laugh at the fact that Trump used the stock market as a scorecard for this presidency and here is the market moving higher as he trails in the polls. The wider the margin of victory for Biden, if that is the outcome, the less likely that there will be grounds to contest the election. But of course it’s 2020 and anything can happen.

Commodity currencies built on Friday’s strength and the dollar weakened overall, falling back into the August / September range. There is still a chance that support could hold but I don’t think that is the high probability bet right now.

It wasn’t just the buck that was signaling the inflation call is the right call. Yields moved higher across the treasury curve with the most pain felt at the long-end.

To add to the narrative further, Chicago Fed President Evans made comments that the Fed should be willing let inflation run hot before raising rates. He also reiterated the persistent drumbeat from the Fed speakers calling for more fiscal stimulus. The simple fact is that stimulus is a matter of when and how big, not if. It’s hard to makes the case that this is anything but inflationary. The problem is the obvious trades are just that. From Fact Set:

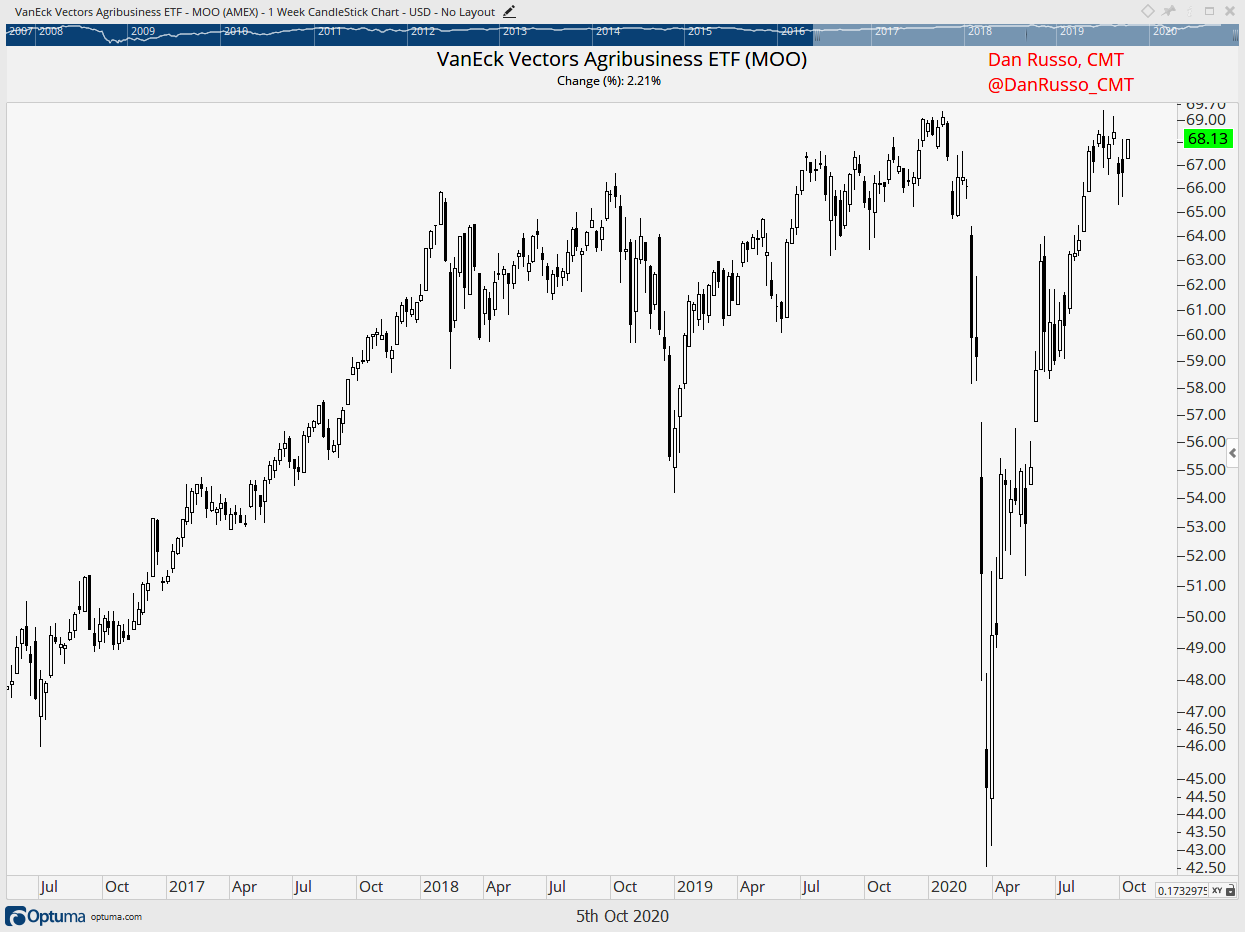

I hold my view that the closet trade is in the ags. Direct payments to citizens will likely do more for inflation than QE has done for the past 12 years. The money will actually be spent in the real economy rather than stay trapped in the financial markets. The Agribusiness ETF (MOO) has eyes for new highs.

We should also be looking at the ag commodity ETFs: CORN and WEAT look like they want to go higher. SOYB is on the verge of a breakout. Have to do more work here. Biggest issue is that positioning looks offside for now. For now I am content to play in the equity market through fertilizer names like Mosaic (MOS).

To recap: Dollar down, commodities up, rates up.

The inflation portion of the narrative is playing out. The question now is will stimulus spur growth. The jury is still out and I continue to lean in the direction of no. The stagflation theme is alive and well.

There is really no reason to change my prevailing view on the market at this point. I am firmly in the stagflation camp until there is proof that this is not the right view.