Seeing the bigger picture rather than going for the short-term quick hit gain. Setting an eye on a prize that is a little further off in the distance. Taking the time to get to know and understand a company and seeing it as more than a ticker symbol, slinging around the screen.

I am talking about Disney (DIS). I am not going to do a lot of single stock thoughts here but what is happening with Disney right now is a good example of how investing should work, in my opinion. Especially when we are talking about an iconic brand that has made it onto the radar of thoughtful people.

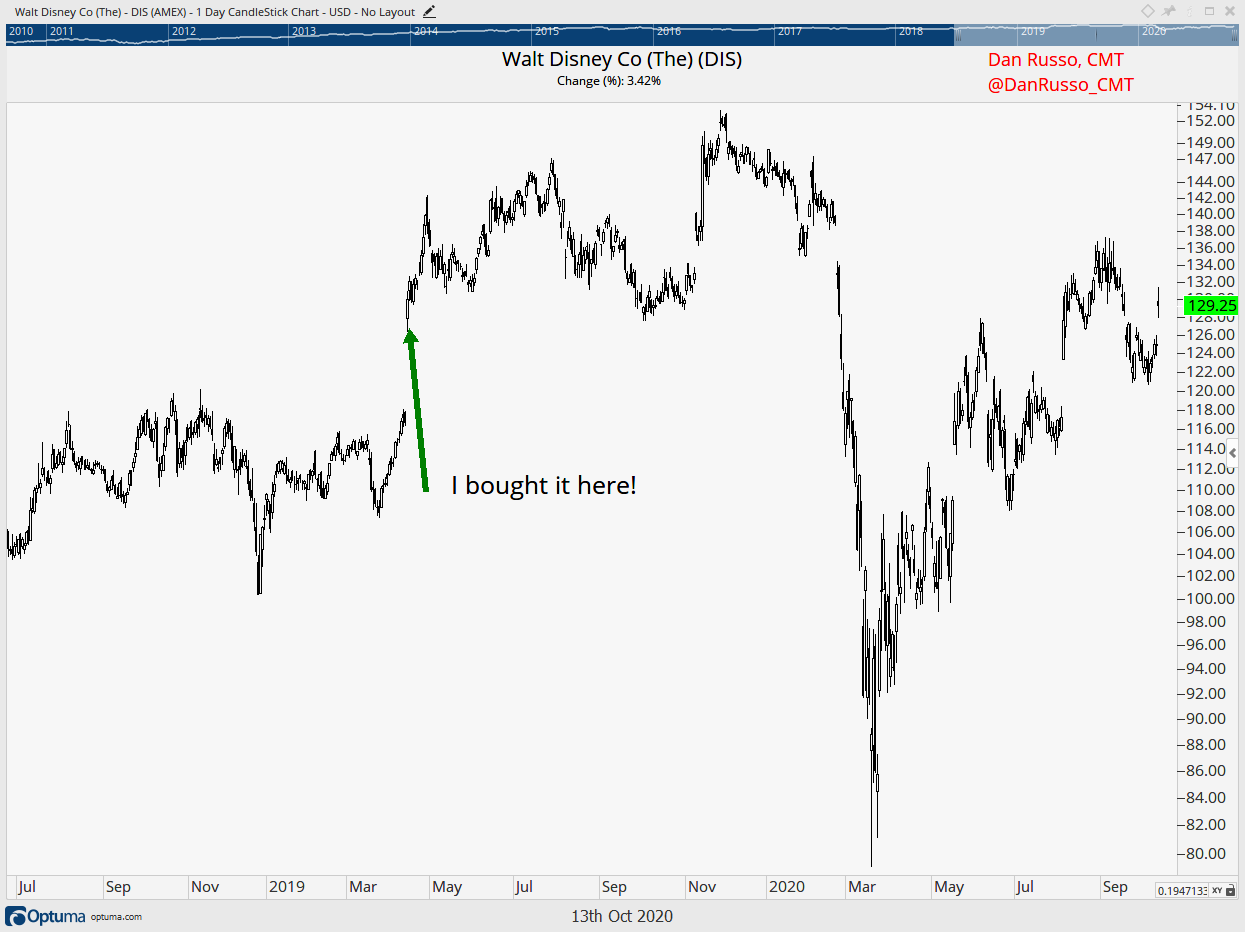

The Mouse House is one of the names that is always top of mind for me. With two daughters who fight over which one of them will watch which show first on Disney +, how could it not be. Add in a basement full of “Frozen” leggo sets and other toys from the many movies that I have not seen and I have to wonder why I am not already a shareholder. The fact is I was, I bought the stock while on my honeymoon in April 2019 (thankfully Dara understands where I am coming from) the day that pricing for the Disney + package was announced. I was standing in line at Starbucks (SBUX, I am an owner) and saw the news. Hopped into my account and pulled the trigger. I had been eyeing the $115 level for a while, so naturally it could not trade there, it had to gap higher. I sold the stock as the COVID news was getting worse.

I have been watching it out of the corner of my eye but have not been able to create a compelling story and the chart is not exactly screaming “I’m in an uptrend!” The bear case on stock is pretty well understood:

They own theme parks in the age of COVID

They release big, blockbuster movies in theaters…in the age of COVID

There may be some problems brewing under the surface at ESPN (as laid out here by Joe Pompliano)

Then I read a note from Scott Galloway that made me sit up a take a another look. Scott is a marketing professor at NYU and is fairly thoughtful in his writings. (Truthfully, this is all I want, thoughtful, I am not interested in the calls that people make on stocks or investments. I want to hear a different view). Scott’s take can be summed up like this:

Disney has kid’s attention

Disney has a ton of great assets under one roof

The assets are not being well managed now

Disney should expand its subscription model to better monetize those assets

Disney should roll out an education product - Boom!

The last one is the one that made me think differently. Scott calls it Edutainment and he makes a pretty compelling case here.

So now DIS is back on my radar. But I was never going to buy that chart. I am still a CMT before an MBA. Enter Dan Loeb an activist investor who runs a firm called Third Point. Dan is a legend in the hedge fund space and he has been building a position in DIS to the point where it is now more than 8% of his portfolio. Dan sent a letter to the management team of Disney urging them to forgo paying a dividend and use the cash to make and buy more programming for its Disney + streaming service. Here is the quick bull case from Deal Book

Mr. Loeb’s math: By permanently cutting its dividend — worth about $3 billion a year — the company could more than double its Disney+ content budget of about $1 billion a year. Combined with raising the service’s monthly fee, currently $6 a month, and reducing so-called churn, or subscriber defections, the hedge fund thinks that the “lifetime value” of a Disney+ customer could rise to $500, from $100 today. (Third Point says the market values Netflix customers at about $1,200 apiece.)

Dan sees the big picture. He can step back and view the company as an outsider. None of the projects or business lines inside of Disney have any special meaning to him. He looked at the company, saw the opportunity and pitched it.

This is not the norm for an activist, giving up near-term opportunities (the dividend) for the prospects of a bigger win down the line. This certainly goes against the image of the hedge fund trader who only cares about the next quarter or two. This is intriguing, this is thoughtful. This is having a low time preference. This is where the prospect of multi-baggers begins to take shape.

Monday night, according to Fact Set, Disney announced an organizational restructuring to accelerate its direct-to-consumer streaming (DTC) strategy. The move will separate content creation from content distribution, with the former to be managed under three groups: Studios, General Entertainment and Sports.

The full press release is here. The company is holding a virtual investor day on December 10th which may now be a catalyst for the stock price.

Disney management seems to get the message. I did add a little to my own account. I will add more when/if the technical side of the bet gets in line, getting over $136 would be a good start.