Is the Economy Actually Improving?

Some quick reminders before we get into it since there are more of you reading this now than there were last week. First, this is my diary on the market. It is in no way shape or form investment advice. These are the conversations that I am having with myself as I take in all that is happening in the market while trying to square it with the prevailing narratives and fundamentals. I do this to give some clarity to my thoughts. Also, if I didn’t write, Dara would walk by the office everyday and hear me talking to myself. If you like what you are reading, please consider passing it along to others who might like it as well.

Next, if you have an opinion, I would love to hear it, especially if you disagree with something that I am thinking. I promise you that after starting in this business as a summer inter at the New York Stock Exchange when I was 16 years old, I have extremely thick skin.

Finally, a big thank you to my friends Ian McMillan and David Zarling for discussing some of my work on their recent podcast.

I like to use Sundays to take a step back and look at the bigger picture. Monday through Friday, it is easy to get caught up in the day-to-day ebbs and flows of the market only to look back and realize that it hasn’t gone anywhere.

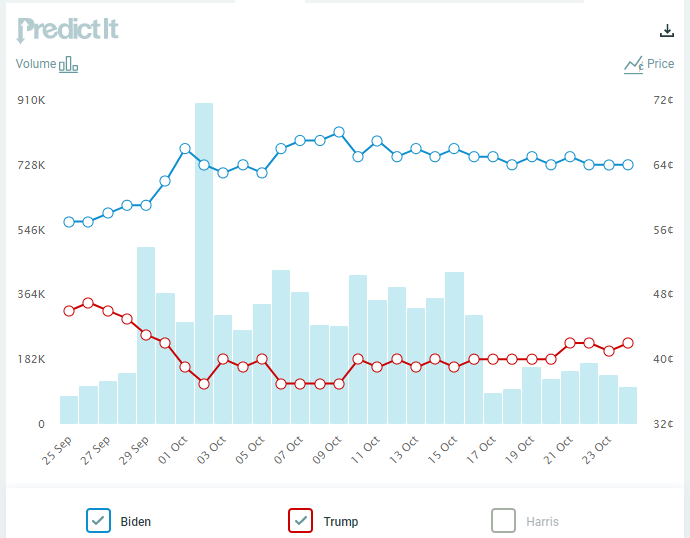

This past week was a lot like that. There was the standard back and forth on the stimulus package but at the end of the week, despite assurances of progress, there was still no deal. We also saw headline after headline relating to the election, made all the more entertaining by the fact that there was a debate on Thursday. It was the last debate before the election and I have to wonder, has a debate or an ad campaign ever changed anyone’s mind regarding their vote. I can only speak for myself when I say it hasn’t. But maybe some people are swayed. Last week at this time, on the betting market PredictIt, you could “buy” VP Biden for $0.64 while President Trump was trading at $0.40. (I love markets, you can make them on almost anything). This week, as I write on Sunday morning, VP Biden is trading unchanged week over week while President Trump is now trading at $0.42. So it would appear that some are convinced that Trump’s chances have improved but ultimately, the view has not been altered that much. So like the market, there was a lot to digest but little in the way of traction. The team at Barron's actually went through the useful exercise of discussing what could happen if the prevailing view (a win by VP Biden) ends up being wrong. I like this idea because there is always a good chance that we are wrong in our views. Rather than remain dogmatic, isn’t it better to think about what you should do differently?

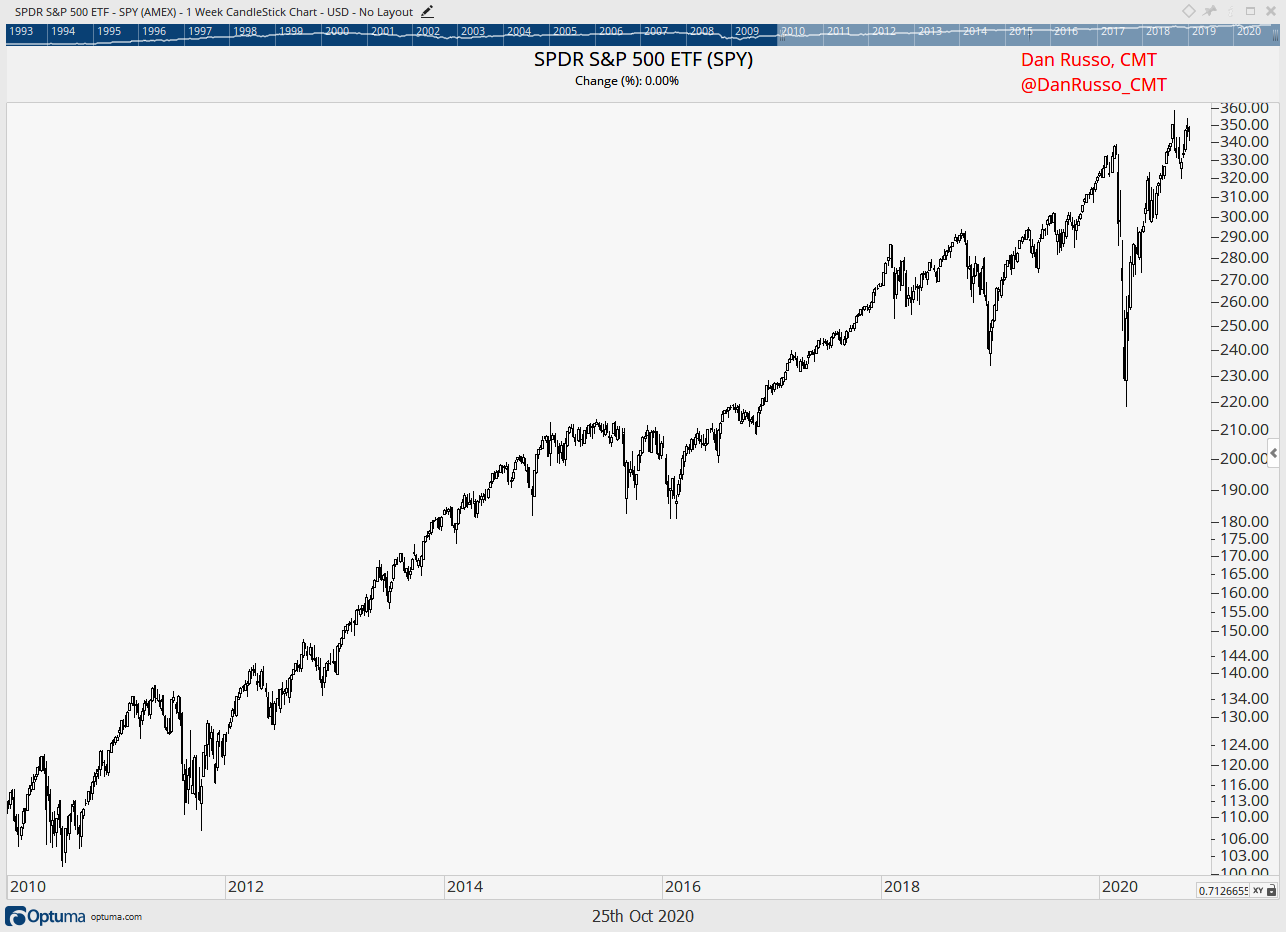

That’s why on Sundays I take a step back and look at things from a broader perspective. I switch all of my charts to the weekly timeframe to get a sense of the bigger picture trend. If I think the of the market as the ocean, the daily fluctuations are the waves, the weekly trends are the tides. The waves crash on the shore and then they retreat, back and forth. But the tide is slower and also stronger. The name of this diary is Marea, which is the word for tide in Italian. Which way is the tide headed for the ETF that tracks the S&P 500? Above $320 and the tide is rising, below that I change views a bit!

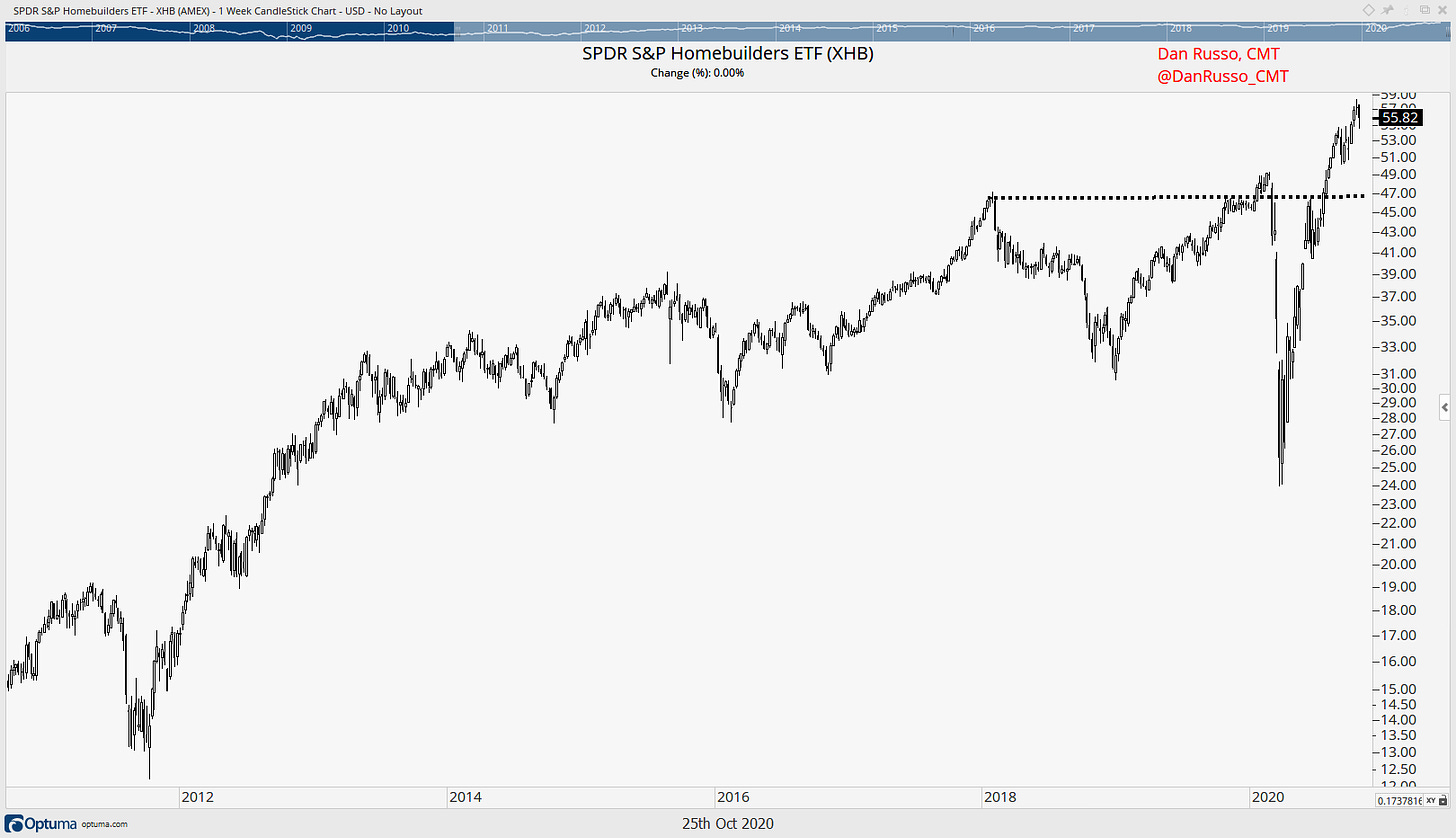

But, the economy is so bad because of COVID. How can the market tide be rising? Yes the economy is bad. However, what if there were signs that it was actually beginning to improve? This week we learned that initial jobless claims ticked lower on the week, the flash readings on the Purchasing Managers Index for October made a new 21-month high and existing home sales for September came in better than expected. Here is what the builders and the housing ecosystem look like as a group.

OK, fine. Everyone knows that the housing theme is hot because no one wants to live in a city and everyone wants to move to the burbs and not be on top of one another. Plus once you get to that dream house outside the city, you have furnish it, fix it up, etc…that explains why Lowe’s (LOW), Home Depot (HD) and Restoration Hardware (RH) have been so strong as well.

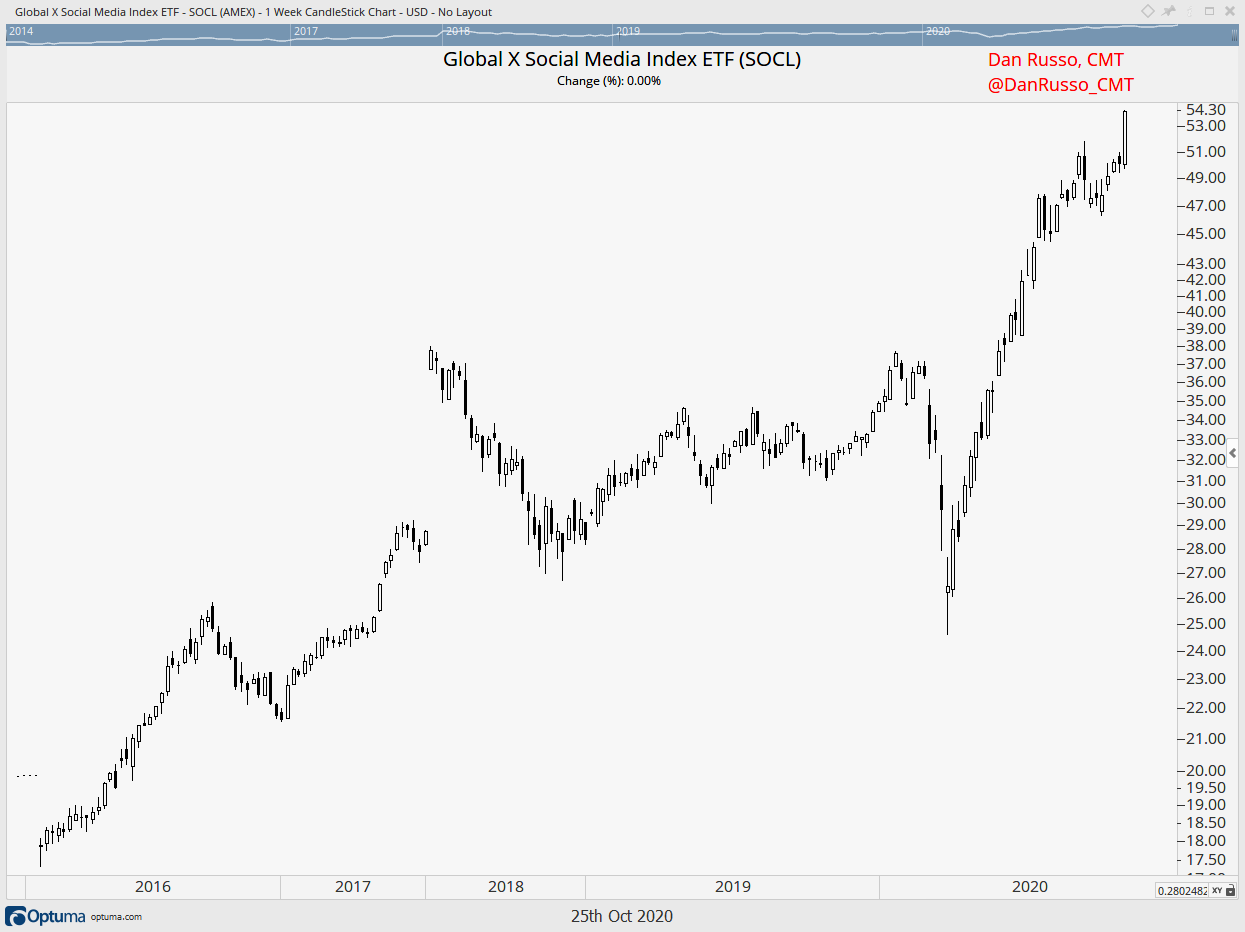

But wait, there’s more. I would argue that advertising is one of the more economically sensitive areas of the economy. If brands think that things are going to get worse, they tend to pullback on their ad spend, save some of the budget for when the outlook is less cloudy…makes complete sense. Last week, Snap (SNAP), the company behind Snap Chat (I am not a user) traded higher by more than 50% after announcing their results for the third quarter which beat expectations with revenue growing by nearly 40% year over year. Where does SNAP get their revenue?

So the “snaps” are a nice idea but at the end of the day, this is an advertising company and business appears to be booming! In fact, most social media stocks have an ad-driven revenue model. Here is what they look like as a group on a weekly chart. That’s an all-time closing high for the Global X Social Media ETF (SOCL) which holds a basket of stocks that make the bulk of their money selling ads. By the way, I watched The Social Dilemma on Netflix and I will just say I am rethinking how I use these products.

So zooming out provides clearer look at the prevailing direction of the market. This is the time frame that I use for the bulk of my investments, especially the ones that are in retirement accounts and I won’t be touching for a long time. This way cuts through the noise (the waves) and helps keep me moving with the tide!

PS: If you care about the waves, I write about the day-to-day shifts here.