It Was Always When, Not If!

The big news toward the end of the day was President Trump’s tweet that he is calling off stimulus talks until after the election which sent the S&P 500 to a 1.4% loss on the day. Comes after Chairman Powell again did not miss an opportunity to stress that more fiscal stimulus is needed. President Trump wants the senate solely focused on the confirmation of his pick for the SCOTUS seat left empty by the passing of RBG. Quickly trying to walk through the game theory here, it looks like DJT wants a “win” in the form of a confirmation heading into the election. According to Fact Set, CNN said that a new nationwide CNN Poll conducted by SSRS showed that Joe Biden's advantage over President Trump has widened to 16 points, his largest of the cycle. I really have no idea what the thought process is, just trying to game it out in my head. Probably a useless exercise.

I have written recently that we are in for headline volatility for the next month plus, so this plays along with the script. Over the past few days we have seen the President test positive for COVID and be admitted to hospital, Biden’s lead has widened, Trump has left the hospital and promptly calls off stimulus talks. In that time, the SPY went from a close of ~337 on October 1st to a close today at ~335, a move of less than 1%. Taking a step back, the fund still has support down near $320 and resistance near $343. In between it’s a trader’s market. Breaking this range will set the trend going forward. For now, nothing has changed from a trend perspective.

The news put a bid under the long end of the curve and the dollar which bounced from support and was especially strong on the commodity currencies. The curve steepener trade was crowed as we learned in the Bloomberg article yesterday. I have always seen the ag trade as the less obvious play and we actually saw CORN, WEAT and SOYB close higher on the day.

Pronounced weakness in the commodity currencies and the move higher in long bonds tip the market’s hand in my view, the inflation theme rests on fiscal stimulus. Again, I am in the when, not if, camp and have always viewed stimulus ahead of the election as a potential upside surprise if it were to play out. In my mind it is simply delayed.

Actually, Christine Lagarde gave the US cover for further action, not that it was needed, in my view. Here is an article from the Wall Street Journal

Opening paragraph: European Central Bank President Christine Lagarde said the bank is ready to inject fresh monetary stimulus to support the eurozone’s stuttering economic recovery from the Covid-19 pandemic, including by cutting a key interest rate further below zero.

So the stimulus narrative has likely not been changed, simply pushed out. Moves by the ECB to take rates lower speaks to continued slow growth globally?

Truthfully, I am more concerned by this story from the FT.

A 449-page report released on Tuesday by the Democrat-controlled House of Representatives antitrust subcommittee amounts to a justification and a road map for what would be the biggest assault on corporate power in the technology industry since the 1990s. The report said: “By controlling access to markets, these giants can pick winners and losers throughout our economy. They not only wield tremendous power, but they also abuse it by charging exorbitant fees, imposing oppressive contract terms, and extracting valuable data from the people and businesses that rely on them.”

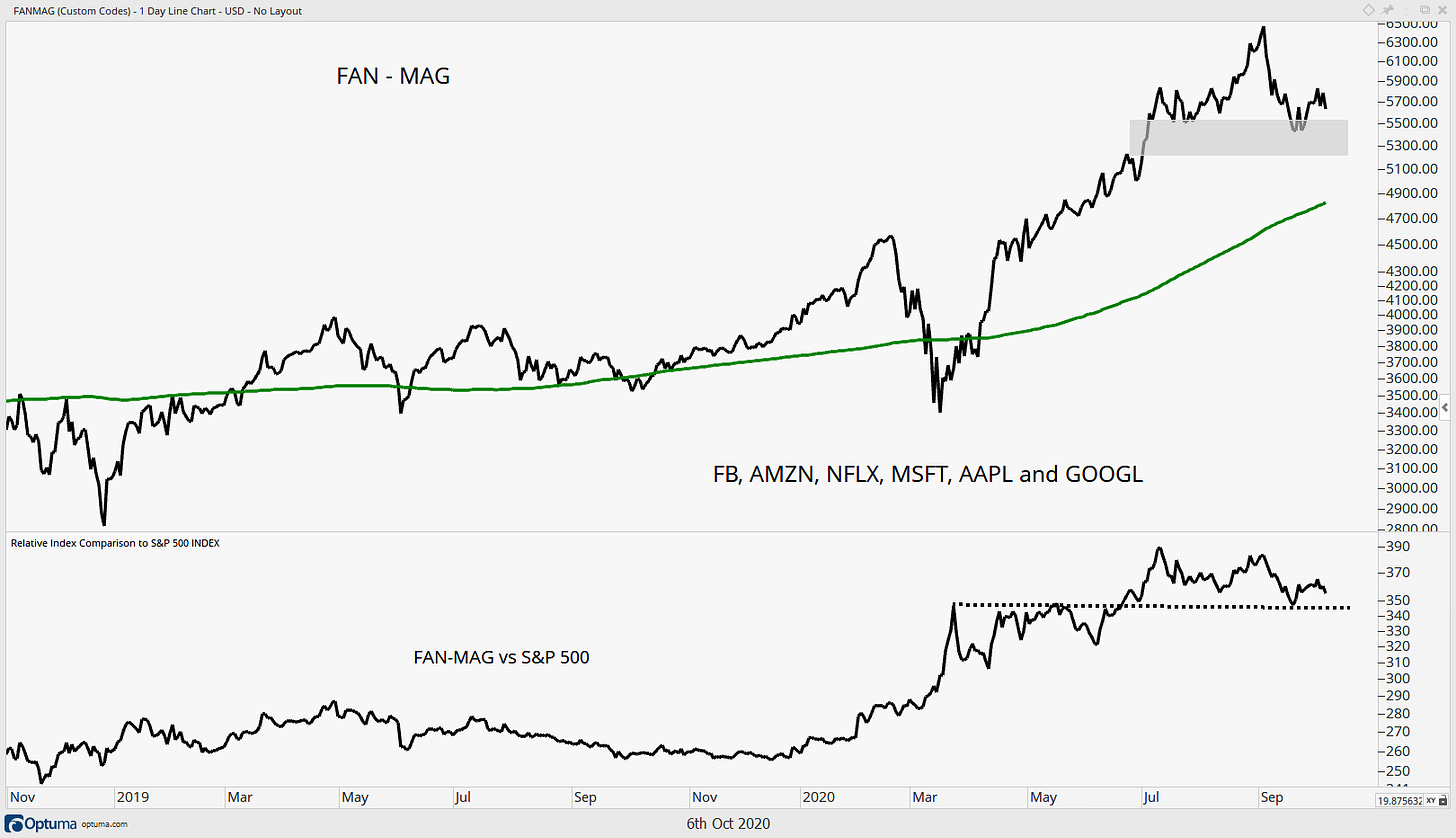

They aren’t mincing words here. FAN-MAG stocks look to be stalling out as a group on an absolute and relative basis. These are the largest stocks in the market, is there another group that can pick up a dropped ball here, if it plays out? Semis come to mind.

So the stage is set for headlines to whip the market until the election. Knowing levels and timeframe will be the most important aspect of trading.