It's Always All Relative

Yesterday, I took a shot at explaining why I think that people hate Cathie Wood. In a nutshell, it has to do with her performance. Professional managers are in a constant state of competition for assets. They are not only trying to beat the market but the are trying to beat each other. Quite honestly, if I was going to give someone my money to manage, this is exactly what I would expect of them. Come up with a clear objective, then outwork the competition to beat them and that objective.

While the objective can be anything that the client and the manager agree to, most professionals in the equity space are measured against the S&P 500. Think about it, if a manager can’t / doesn’t outperform this index, why would you pay him or her when you can own the SPDR S&P 500 ETF (SPY) for a really low expense ratio? (Before my in-box explodes with cries about risk, goals and objectives of the client, let me cut you off and say “I understand that.” I am making a generalization here. But just because the client is not trying to beat the S&P 500, does not mean that he or she is not trying to beat some benchmark. That is how the manager should be measured).

Last night, I taught what is one of favorite classes of the entire semester, the one on relative strength. The one where I lay out for students the concepts behind the opening two paragraphs of this note. I talk about looking at the market in terms of what is performing the best and trying to gauge how likely something will continue to perform the best.

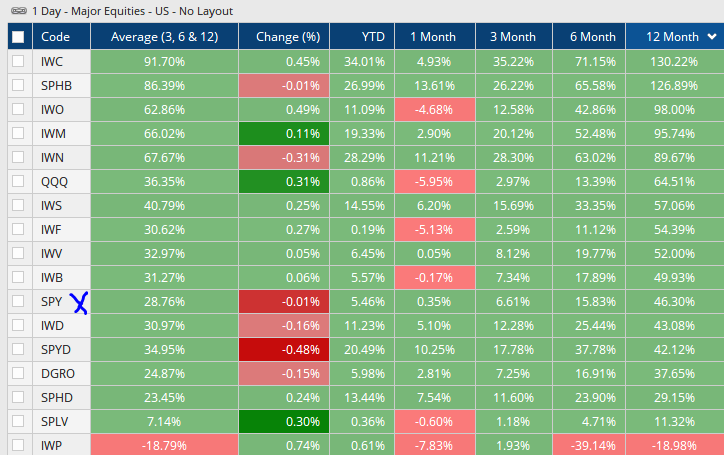

Here is a quick snapshot of what the US equity market looks like based on various look back periods. The funds are sorted by 12-month returns:

I put an “x” next to the S&P 500. Everything above it has performed better over the past year. There is a lot of small cap and there is a lot of value toward the top of the list. A manager who is being measured against the S&P 500 and who has been gradually rotating toward these themes is likely adding value for their clients. The managers who are able to do this on a consistent basis will likely take share from those who do not. Pretty simple right? In theory yes, in practice it is one of the hardest things to do, perhaps on par with hitting a round ball with a round bat….there is a reason batting .300 get you in the Hall of Fame.

But there is more going on here than simply performance. There is also a message. The themes at the top of the list tell us what we need to know about the economy. There is no need to get caught up in the dogmatic rhetoric. Simply take a look at what “is” and many of the answers become clear. It has long been my view that “things are getting better.” The makeup of the market’s leadership confirms that view.

We can learn a lot from relative strength which is why I try to hammer home it’s importance to my students as well as to clients.

Thank you for taking the time to read my thoughts and ideas. Nothing in these pages should be considered investment advice.