Had a great weekend in the Finger Lakes tasting wine with Dara. Some quick anecdotal observations.

It was not busy despite it being harvest and leaf season. Wineries and restaurants were easy to access and reservations were not needed.

Transplants from big cities are not in a rush to return even when the “busy” season ends.

The food is amazing but these businesses are clearly at risk. They need more help.

Masks were a must everywhere indoors.

It seems that the next four weeks leading up to the election have the potential to keep volatility elevated, will it persist through the end of the year? News of President Trump testing positive for COVID-19 sent markets lower on Friday but I must admit that they held up well.

It is clear that the timeline of events will be important. When did they know Trump was positive? How many tests did he take? Did he know Hope Hicks was positive before embarking to events that would put him in close contact with others? This will be a driving narrative in the days ahead.

If “the market” hates uncertainty, what creates more of it? Clearly the president being in the hospital creates uncertainty. But, does a recovery lead to more uncertainty? Will there still be a close election that leads to us not knowing who the winner is on November 3rd? If Trump loses, will he accept the results? These are all questions that don’t have an easy answer at this point.

On top of that, where do we stand on more stimulus? The house passed a $2.2 trillion bill but that is likely to fail in the Senate, which is going to recess until October 19th. Is there still a chance that we get a bill before the election? I still feel that investors have low expectations so this is likely a positive surprise for the market if we get something. It will come down to size and scope. The polls continue to point to a Biden victory. What will happen in the senate? Is a Biden win good? There will likely be more stimulus but is that offset by higher taxes?

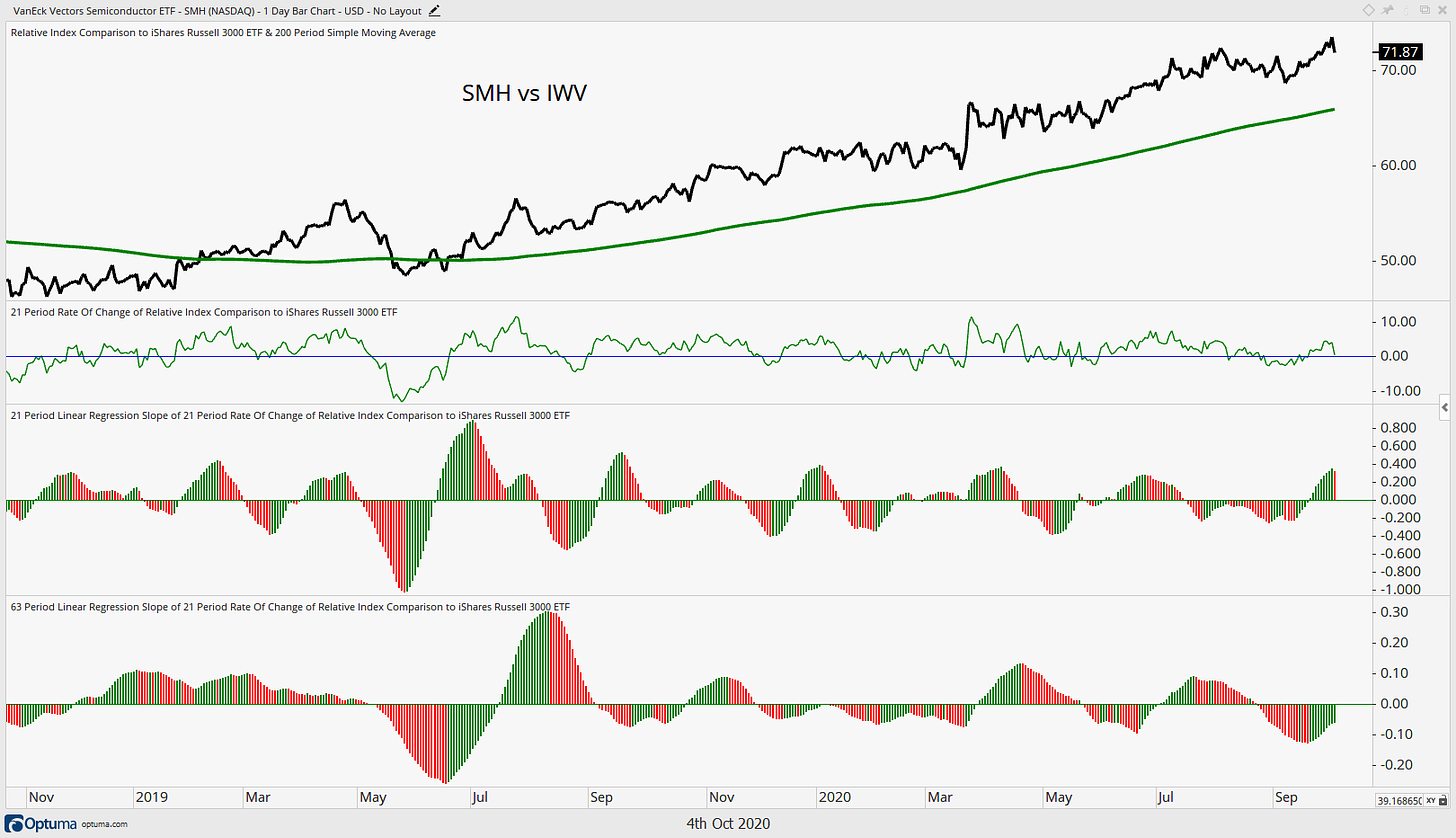

What does this all mean for the markets? Unfortunately, the message is pretty mixed. Utilities are beginning to outperform, with a near-term break of resistance. The copper / gold ratio is dancing with a declining 200-day moving average but momentum is turning up in the intermediate term. Semis are outperforming but Friday showed some stalling activity for the ratio and the intermediate term trend of ROC is still negative, short-term is positive.

The R2K is flat vs the S&P 500…no real tell here. Same goes for High Yield vs Treasuries. Meanwhile, the VIX is holding above 25. I can argue both the bull case and the bear case in a fairly convincing manner.

US Equities

Growth had a solid week with QQQ, IWF, IWP and IWO moving further above the 21-week MAs. These remain leadership. Small caps and Value remain trendless with a downside bias. Dividend plays are weak. Sector trends reflect what is happening at the index level. Note improving relative strength in Utes. Is this is a shift toward more defense?

Solar, continues to torch the competition as traditional energy remains a mess. Builders are strong. Both groups made new highs last week. Miners trying to stabilize. Some positive signs in select health care industries, not pharma though.

Commodities

The commodity ETFs continue to show momentum is with the metals in the intermediate-term. Silver holds the breakout level, GLTR holds the 21-week MA. Gold funds do the same. Copper is trying to hold on but is under pressure with signs that the uptrend is waning. Does this speak to a slowing growth picture? Are investors concerned about a “second wave” of COVID? The recent move lower in oil points to growth fears. Ags are still trying to shift the trend from bearish to bullish, momentum is on their side for now. Do they need a new round of stimulus?

Fixed Income

The long end of the curve came under pressure again last week and did not catch a bid with the news of the positive COVID test for the president. They remain in a consolidation, looking for a break here. Yields actually moved higher across the curve. This is more in line with a stagflation theme. The long-end holds the intermediate momentum but short-term favors corporates and high-yield. Edge goes to the investment grade corporates though, high yield trend is still flat at best. Tips are still holding across timeframes. What does this say about the stagflation theme?

Dollar

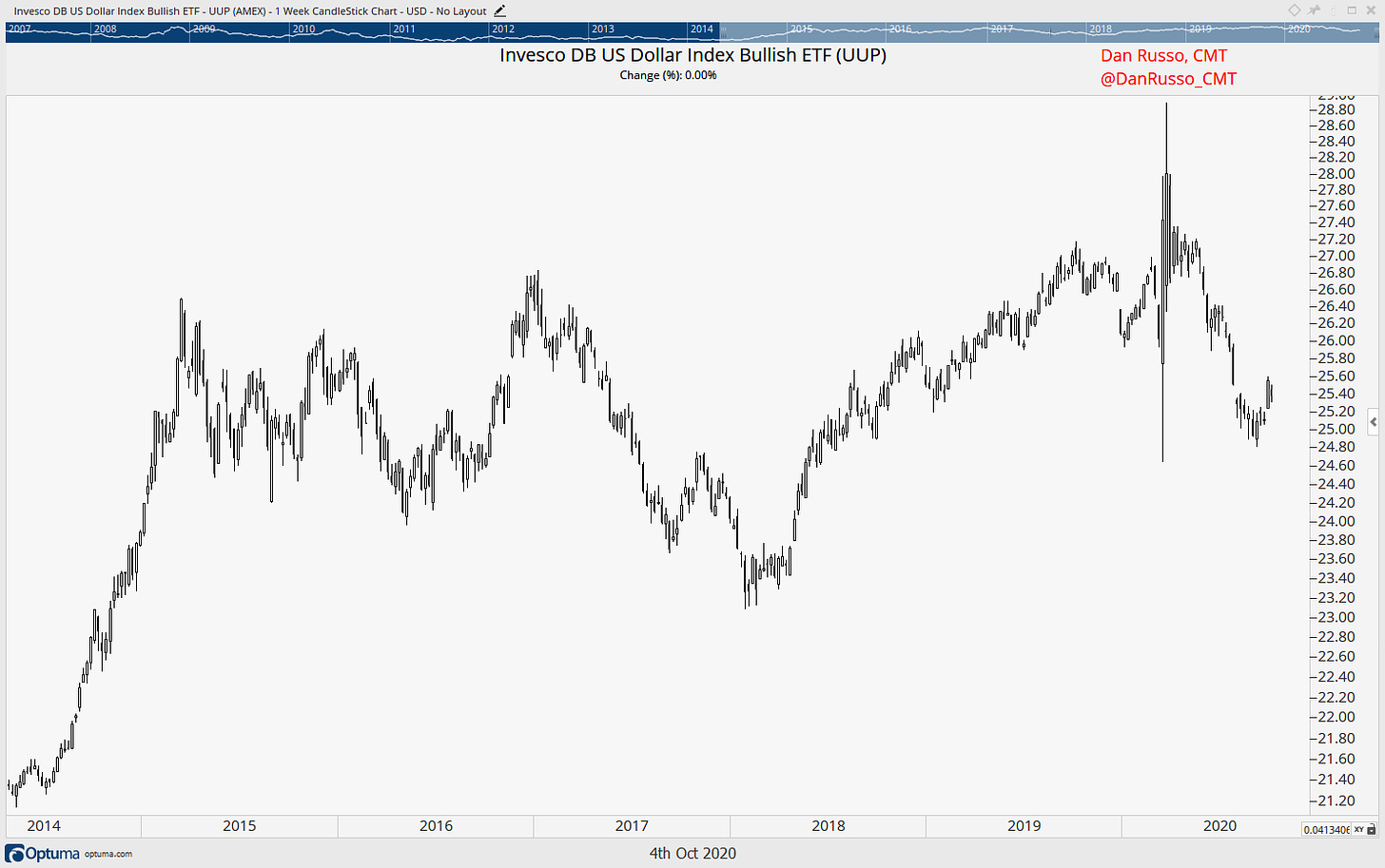

Renewed weakness on the part of the dollar. But, the short-term breakout level has held thus far. Euro rebounds slightly. Commodity currencies also rebound vs the dollar. Truly, I don’t know how this one will play out. Is the dollar a safe haven in the face of uncertainty? What do the commodity currencies tell us? Zooming out shows us a flat dollar trend.

Foreign Equities

Asia is the best of the bunch outside the US. Pockets of strength in Europe are centered in the scandies: Denmark, Sweden and the Netherlands. Europe as a whole is bad and the virus is picking up again. Overall, the US is the best game in town. Does this last?

COVID-19

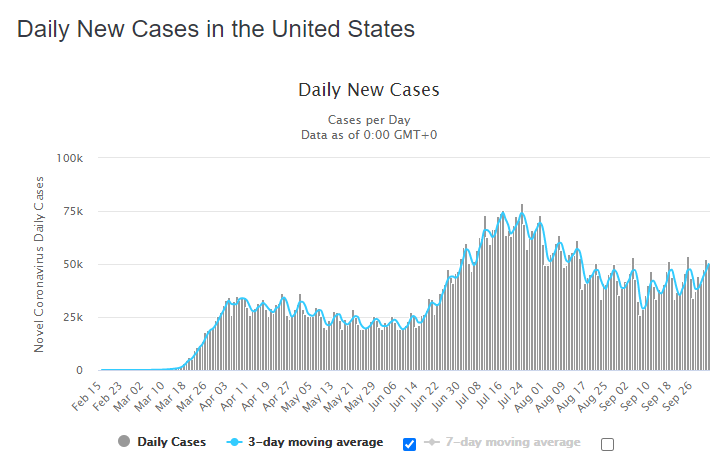

Cases are on the rise again in the US and there is a move higher for the 7-day moving average, Worldometer below. New York City is planning to reinstate some lockdowns. https://www.ft.com/content/96aa45e9-feb9-41e0-8744-040087539d91

The NFL has postponed some games after seeing an uptick is positive COVID tests. Some neighborhoods in NYC are closing schools and non-essential businesses in Brooklyn and Queens neighborhoods. These headlines will be with us for a while.

Wildcard: President Trump has mostly downplayed the virus. Does his positive test change this view? Does this lead to wider use of masks and more caution on the part of US citizens? Does a fast recovery only serve to embolden the president on his current line of thinking? If there is not a fast recovery, will that tilt us toward more lockdowns?

Big Question: are we shifting from stagflation to deflation? If I am wrong, it is likely in in the inflation portion of the equation. Growth continuing to lead points to the lack of economic growth globally. So does the copper / gold ratio. Lack of a stimulus bill tilts the odds of deflation higher in my opinion.

Prevailing trends mostly remain in place for equities. They continue to point to stagflation. Growth over value, large over small. Watching the early defensive shift.

The long-end of the curve remains weak in the near-term. Also a stagflation data point.

Will precious metals regain their mojo? Ags are the closet inflation play.

The dollar is the biggest wildcard and the hardest to handicap at this point.

Take Away: Last week produced more questions than answers. I am inclined to stay bullish on equities in the US until the trends break, the prevailing tide is still rising but the winds are shifting into in the face of the bulls. All the news flow will likely lead to choppy trading but thus far the trends have not broken. Stagflation or Deflation? The market keeps pointing to the former but lack of stimulus could lead to the latter. I am completely at a loss when it comes to the dollar and this is the most important trend to get right. US yields should have fallen on Friday but didn’t. Inflation? The market will give us the answers as the trends unfold.