I am about to make your head spin, but it is to prove a point so allow me some latitude. These are the opening paragraphs from an article in a financial publication:

U.S. retailers and manufacturers slumped in February due to winter storms and supply-chain disruptions, but a broader economic rebound appears poised to accelerate this spring because of the easing pandemic and another round of government stimulus.

Retail sales—a measure of purchases at stores, at restaurants and online—fell by 3% in February compared with the prior month, the Commerce Department said Tuesday. The decline followed robust January sales that were propelled by stimulus payments to households from the December pandemic-relief package. January sales advanced a revised 7.6%, up from the earlier estimate of a 5.3% increase.

Sales at food and beverage stores were unchanged, while sales at gas stations were up strongly, by 3.6%, as gas prices have accelerated this year.

Despite the February decline, retail sales were up 6% over the last three months compared with the same period a year earlier, according to the Commerce Department.

February is typically a quiet month for retail sales, as stores gear up for the spring selling season, including Easter. Economists expect spending to accelerate in the coming months as additional government stimulus is distributed and Covid-19 vaccinations lead to a corresponding decline in cases and pickup in employment levels as businesses open up more fully.

So to be clear, retail sales were down in February because they were up a lot in January. But the reason that they were up a lot in January is because of stimulus checks. But don’t worry, they are going to rebound because the economy is getting better and there are more stimulus checks. Oh, and Easter is a big spending holiday? But another reason that retails sale were bad in February was because of the bad weather in parts of the country. So that can still be a risk, right? It’s not like March is the most tranquil month on the calendar. But after March the weather will be warm and have the vaccine so get ready to go shopping all summer long?

Honestly, this could have been just about any story. It just so happened to be that yesterday was retail sales day so it provided some good fodder for me to pick on. I think that is one of the biggest problems that investors have is that they are always looking for a “why.”

Why is the market up today?

Why is oil down today?

Why are semiconductors lagging today?

People love narratives. We need to know the story. Log on to social media and you will see it all day. The narrative is great for the person spinning it. It is great for the media It is great for getting clicks.

But here is a little secret, the narrative does not get the investor paid. I can sit here and spin a great market story. I could even weave in some foreign markets and really spice up the story because I know that if I include some China news and a spin on the Yuan / Dollar exchanges rate my audience will be going crazy for more. The more exotic the story the better, but…

NONE. OF. THAT. MATTERS.

None of it! The only way to get paid in the market is buy something now and sell it in the future at a higher price. The reason that the price went higher is not all that important. You see it all the time. I once had someone tell me that the only reason that the market was higher was because the Fed was printing money. I said “Ok, does that mean I have to give back my profits?” The person didn’t have a good answer.

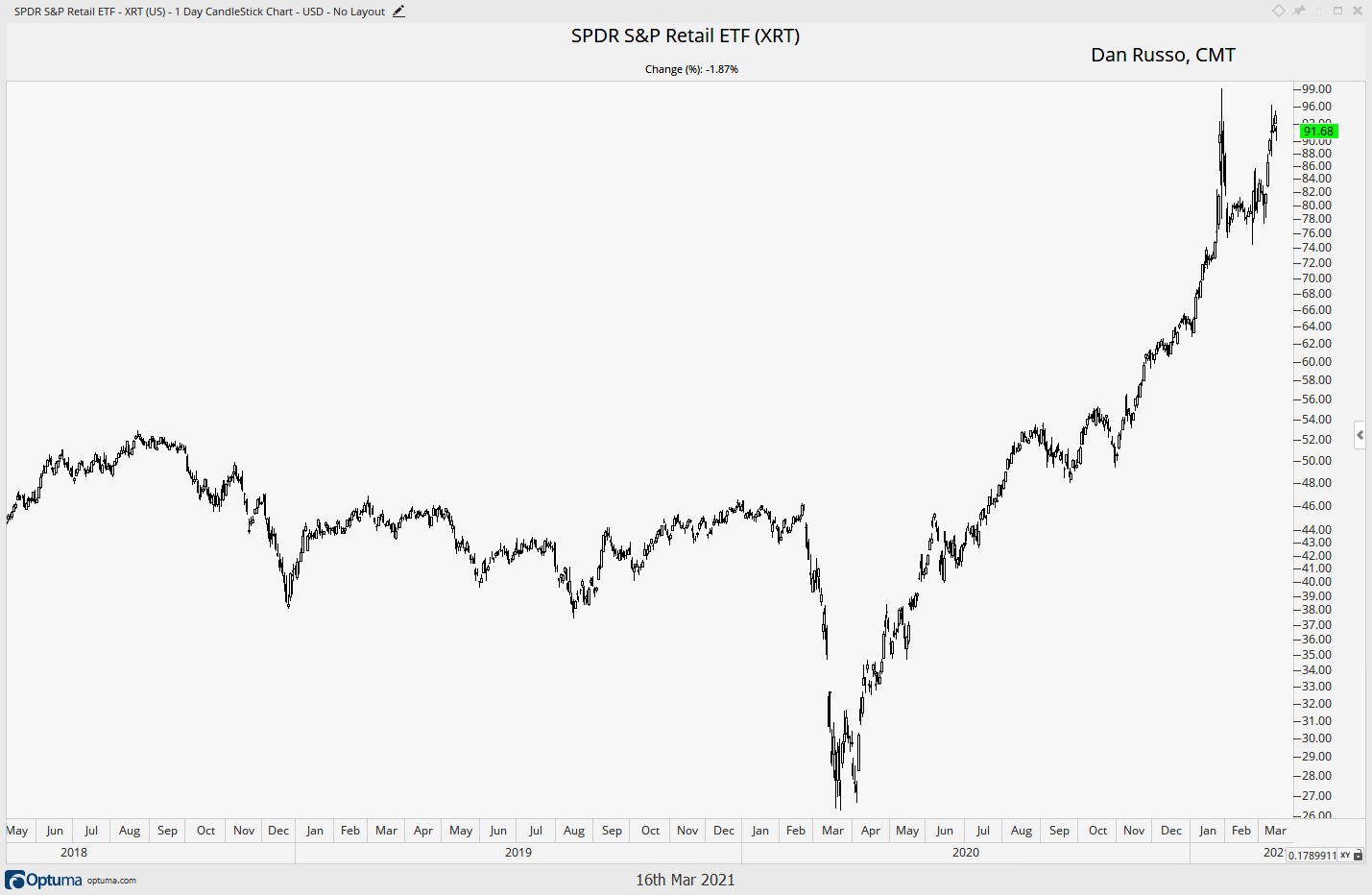

Here is what I know about retail stocks…they are going up and have been since March 2020. Here is the SPDR S&P Retail ETF (XRT). It is less than 10% from an all-time high. If it breaks above $99, it is probably going to do up more. If it moves below $80, it will likely go down more.

I also know that XRT is part of a group of industry ETFs that I watch closely. Based on two custom ranking systems that I have built, it is currently the second or third highest ranked fund in a field of ~50 funds.

I don’t have to know if and when stimulus check hit peoples’ accounts. I don’t have to know if temperatures are climbing in Texas. I certainly don’t have to know when is Easter. In fact I did not even need to know that the retail sales figures were being released yesterday.

Now, don’t get me wrong, I like to be aware of these releases, but my point is that they are not all that helpful. What is helpful, is knowing the trend and gauging how likely it is to persist, that is where my custom system comes into play.

*Nothing in these pages should be considered investment advice.