Pay Attention to Who Has the Attention

In one of my notes last week, I had this quote: “pay attention to who has the attention.” What exactly does this mean and why am I bringing it up now?

First, it means exactly what it says. We live in a world where information is readily available and there are a lot of really smart people who share their ideas everyday. Let me give you an example:

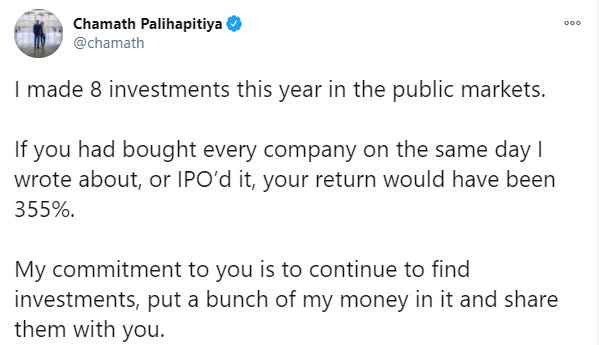

Chamath is on fire. He is an ex-Wall Streeter who made his way to the Valley and landed a role at Facebook before starting a venture capital firm. He is the chairman of Virgin Galactic (SPCE), Richard Branson’s company with the goal of putting people into space. He has over half a million followers on Twitter and can move a stock with one tweet, like this:

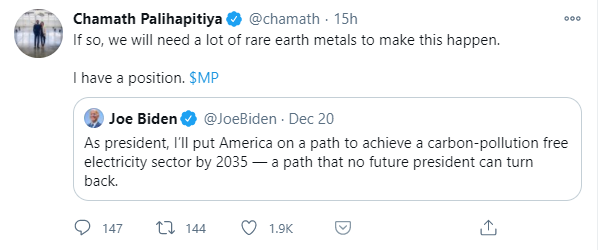

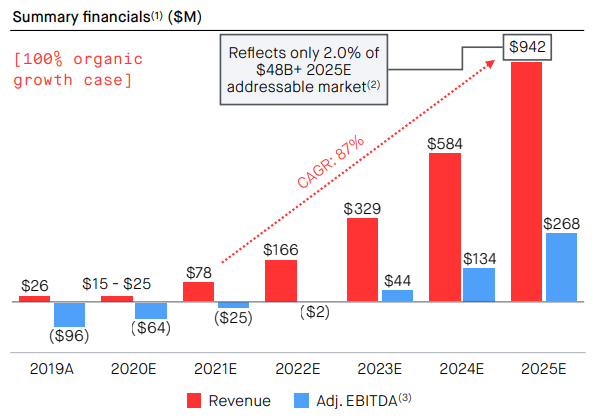

MP Materials (MP) is up over 9% as I write. I don’t own it but I do own a rare earth metals ETF (REMX). Chamath has the attention. I like to follow what he is doing and then do my own work to determine if I want to make an investment. I currently own three names in which Chamath is involved. The most compelling is Desktop Metal (DM). Additive manufacturing and 3D printing are a space that I know well as I used to follow the pioneers such as 3D Systems (DDD) closely. DM is projected to grow their revenues in excess of 80% annually through 2025 and turn profitable (based on adjusted EBITDA) in 2023.

The stock had had a big run so I have been waiting for an opportunity. I got it yesterday when it began to move up from a key level that I had been watching.

I recently bought three companies that are plays on the emerging research being done in psychedelics. That’s exactly what it sounds like, but not exactly what you are thinking. Research has shown that psychedelics can be used in the treatment of some serious disorders that are growing in our society: depression, PTSD, opioid addition and other types of addiction as well as anxiety. Read more here. But how did I learn about this? I have been hearing it come up from time to time over the past year. Then I was listening to this. The host of the show is Anthony Pompliano, he goes by Pomp. Pomp is one of the biggest bitcoin bulls in the world. I read a lot of his research when I was learning about bitcoin. The guest on the show was Kevin O’Leary, Mr. Wonderful from Shark Tank. During the show, the subject of psychedelics came up and O’Leary told the audience about his investment in a company called Mind Med (MMEDF). It’s a small company, but I did some reading and looked at their site where I learned that they are doing work on opioid addiction, adult ADHD and anxiety. The story is compelling because they are going through the FDA and their drugs are strictly medicinal. We are not taking about tripping out on mushrooms for recreational purposes. Pomp and O’Leary have the attention of their audience so I want to follow their ideas and see if they make sense. I have done the work on my own and now own the stock because the chart also looks compelling (the trend is up). The other two that I bought were Compass Pathways (CMPS) and Champignon Brands (SHRMF) though I have sold the latter.

There are a few other people who clearly have the attention of investors. My friend Howard Lindzon is one of them. He has been a fan of Spotify for a long time. It is one of his 8 to 80 stocks. This is a great concept and extremely simple to understand. An 8 to 80 company is one whos products are used by people from the ages of 8 to 80. It lines up nicely with my "invest in what you know" theme. I use SPOT. I see that they are likely going to grow their revenues ~27% this year and 22% next year. They have made a big push into podcasts, bringing Joe Rogan on board and recently made an acquisition in the space. In the third quarter they added six million paying subscribers, ahead of expectations of five million. I like to pay attention to what Howard is doing. I did my own work on SPOT and was ready a couple of weeks ago when it broke above $300 in early December when they released their “year in review” for users who promptly shared the insights on social media, generating a lot of buzz for the company. I am now the proud owner of a stock whose product I use every day.

I could keep going but you get the idea. Why do I bring this up now? Well because it has almost been too easy to make money in the market over the past six weeks or so. It is too easy to follow people into a trade and see it work out. You see, Chamath, Pomp, O’Leary and Howard are smart, and there are many others who are also smart but they are not me. We do not have the same goals or risk tolerance. We do not have the same sets of assets that have to be figured into the equation adding new ideas. If you follow someone into an idea, how can you have conviction in it? How do you know when to get out? Will they always have a hot hand? What happens when they sell? I pride myself on the fact that I have done a good job of curating the people who I follow. However, I would never just blindly go into an idea because someone else pitched it on social media. In every one of the examples above, you can see the phrase “I did my own work.” My friend Brian Shannon is a great trader. I pay close attention to what he is following because I admire his work. He posted a chart yesterday for Microsoft (MSFT) but look at how he ended the tweet… “make the trade your own.” That’s another way of saying, do the work for yourself. I have been watching MSFT for weeks. I want to own but it is not a fit for me right now. I do not operate on the same time frame as Brian and there are a few other technical aspects that I need to see come into line before I will consider the stock.

As one person, I can only follow so much in a day. This is why I have curated a list of people who I think are smart and well respected. They can be a great source of ideas. Pay attention to has the attention, but do your own work. Or work with someone who has done the work. In fact, I am planning on taking a good portion of the next two weeks to weed out the investments that I currently own where I do not have high conviction. I want to focus on more concentration into the ideas that I think will be the best over the next 3 - 5 years or more.

Right now it’s easy…it won’t always be easy.

Let me know if you have someone who you follow who you think is smart on a subject. Any subject is fair game.