Powell Stuck to His Job Description

Stocks investors were mad at Jerome Powell, but I am going to argue that the he did his job yesterday.

In a mid day speech at the Wall Street Journal Job summit, the chairman of the Federal Reserve reiterated his current stance on monetary policy. He is going to to keep rates lower for the foreseeable future. Here is the sub-headline from a WSJ article:

“Fed chairman says economy is far from employment and inflation goals; he gives no sign the central bank would seek to stem rise in Treasury yields.”

Many were disappointed that he did not ease the tensions in the equity market due to the recent spike in yields. The Federal Reserve actually has a stated mandate:

Since 1977, the Federal Reserve has operated under a mandate from Congress to "promote effectively the goals of maximum employment, stable prices, and moderate long term interest rates."

Employment and Prices (ie: Inflation), that’s it! Nowhere is it stated that the Fed is supposed to make comments to soothe investors who are overly exposed to stocks that are trading at absurdly high valuations. But that is what everyone, including myself, was expecting today. In fairness, I am not overly exposed to these stocks, but I have enough exposure to them that the past two weeks have not been the most fun. I know the mandate, but I was still expecting some sort of soothing comments.

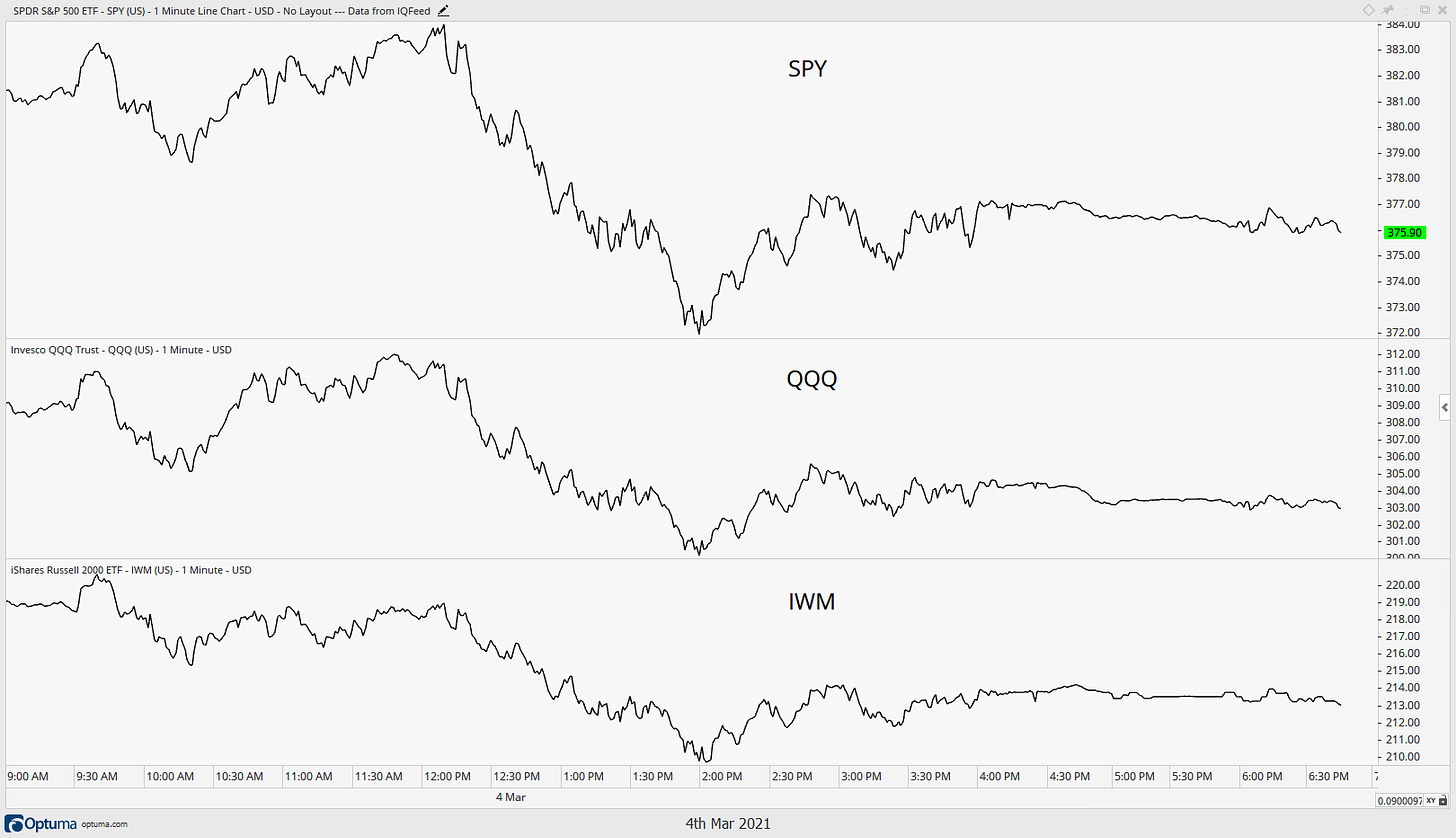

But since the equity market did not get some sort of reassurance from the Fed during the speech, it threw a tantrum. Here is the one-minute chart of the S&P 500 ETF (SPY), Nasdaq 100 ETF (QQQ) and the Russell 2000 ETF (IWM). Take a guess at what time Chairman Powell spoke.

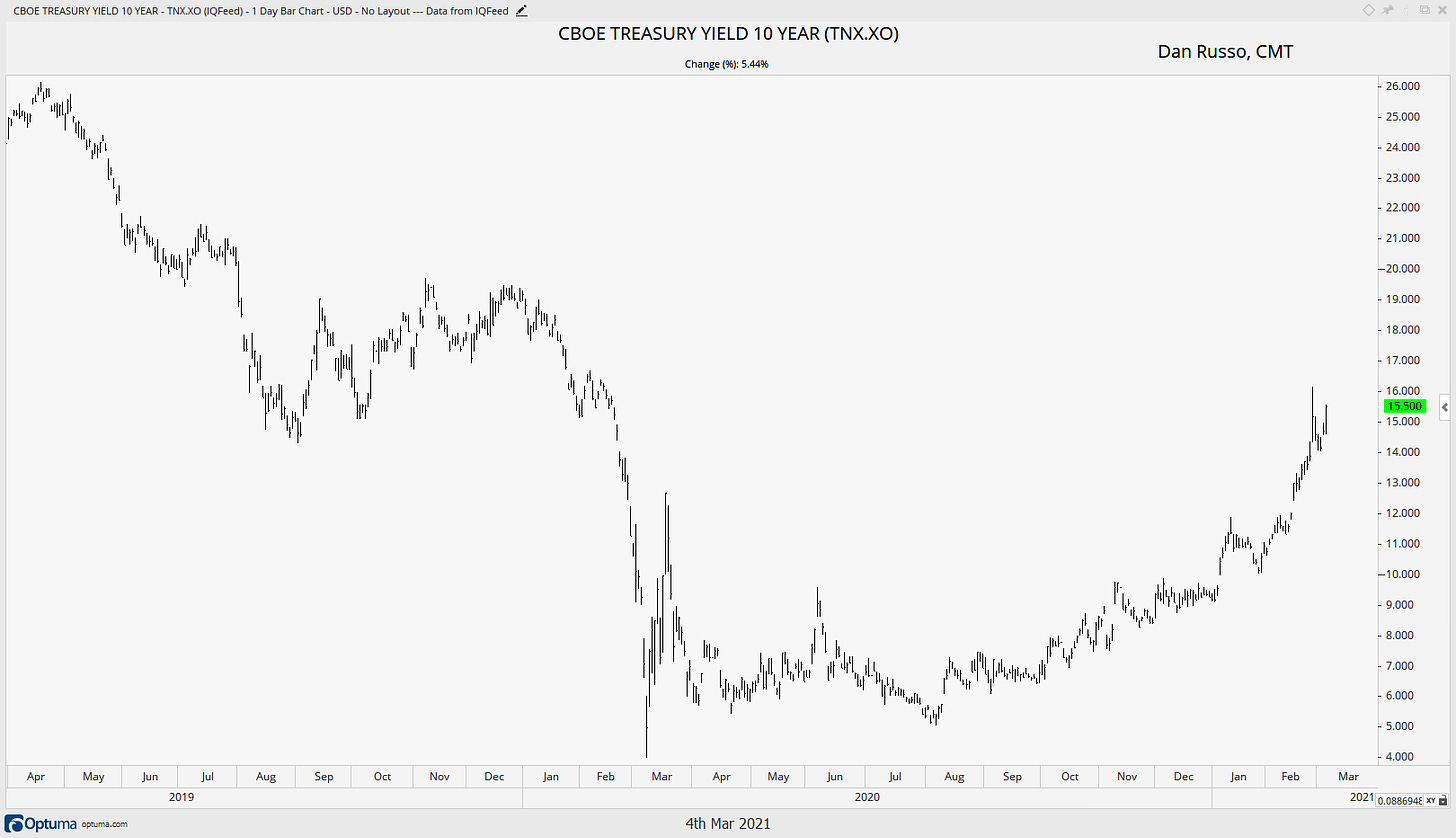

What about rates? Well the 10-year yield spiked higher again yesterday, to finish at ~1.55%.

Now what? That is the question that I and many other are going to get. My answer will be what it always is, “I have no idea.” I can’t see the future and I can’t predict anything. Because of this, I have a disciplined risk management process. Some of the stocks that I owned have traded down to levels that tell me to get out of them. It does not matter that I may like the products or think that the story is great. The price action dictates my actions. That same price action will tell me when, if ever, to add those stocks back to my portfolio. Those are the rules and I don’t break them. Other stocks that I own are doing just fine. I have been arguing for a balanced approach to equity exposure for a while now. Days like yesterday are the reason why.

And that’s really the point. Having a process and sticking to it. If stocks continue to fall from here, I will have raised cash at higher levels. If stocks rebound from here, I have a process that tells me to start putting that cash to work.

None of this will be dictated by what I hope the Fed says next or what I think should happen. It will be dictated by the price action…at least until I find that crystal ball that can tell me the future.

Thank you taking the time to read my thoughts this week, have a great weekend!

*Nothing in these pages should be considered investment advice.