Risk Management

Let me share a cautionary tale about risk management. I know, yesterday I was talking about it was becoming too easy to make money in the market, today I am talking about cautionary tales. Actually, it’s because of what I wrote yesterday that I am writing this today.

I will never forget the story of the hedge fund, Long Term Capital Management. I was a senior in college and very interested in a career on Wall Street. One of my teammates from the hockey team who is a year older than I am had just started working at LTCM that summer. This was an amazing opportunity for him. The firm employed Nobel Prize winners and was run by arguably one of the most successful bond traders on the street.

After a few years of success, LTCM was the envy of Wall Street. Investors were clamoring to have the fund take their money and college grads with an eye toward The Street sent resumes to LTCM in the hopes of landing a position, any position. But then, the unthinkable happened and the fund began to lose money and, given their leverage, ultimately shut down in spectacular fashion. The story has been well documented so I am not going to rehash it here. If you are interested in the full story, I highly suggest ”When Genius Failed,” by Roger Lowenstein. I have actually read it more than once.

It turns out that this experience actually was a great opportunity for my friend, just not in the way that you (or he) would think. If he was paying close attention, he would have seen that in order to have success and longevity in investing, you have to manage the risk. It always struck me as odd that these titans of Wall Street and Nobel Prize winners did not have a risk management system in place that would prevent them from imploding.

Risk management is arguably more important than selecting the right investments. I run two separate accounts for myself. One invests only in ETFs based on a momentum strategy that I built for myself. I manage risk in this account in two ways. First, through asset class diversification. I own a mix of stock, fixed income and commodity ETFs. I add another layer of diversification by allocating a portion of the stock investments outside the US. The second way that I manage risk is by evaluating the entire portfolio once a month in order to see if there have been any shifts in momentum. If something I own is no longer among the leading ETFs in its asset class, I sell it and buy a fund that is a leader in that particular asset class. This keeps me from owning something that may continue to move lower and / or underperform its peers. This strategy is systematic with a set of rules from which I do not deviate. I spend a fair amount of my free time trying to find ways to make the strategy better but the bulk of that time is spent trying to find ways to get out of a potential loser quickly.

The other account that I manage for myself is where I pick individual stocks and make other thematic investments. The criteria for my making an investment here is a bit more subjective, but there are still rules from which I try not to stray. This is where I will own stocks like Apple (AAPL) because I like the fundamental story and because the technical trends look compelling. But even the best fundamental stories can go out of favor. Sometimes it is because of missteps by the company itself, other times it is because of general market conditions. Regardless of the cause, I don’t want own something if the weight of the “technical” evidence supports lower prices. That is why I have a predetermined level where I will exit, regardless of how good the story may seem. In a perfect world, where I pick perfect ideas, this level will rise along with the stock price for a very long time before the price rolls over and the level is breached…we don’t live in a perfect world!

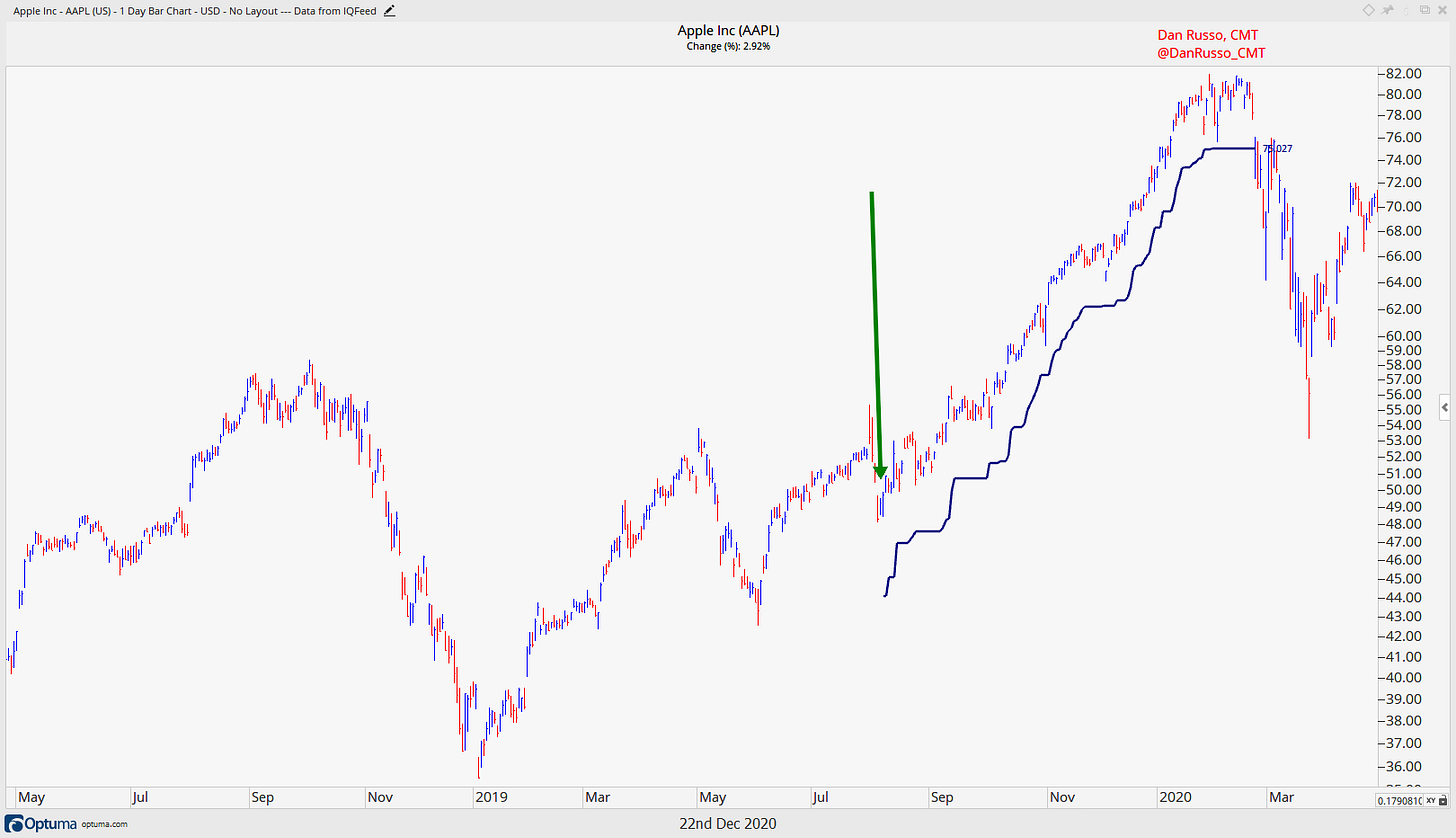

Let’s say I really liked AAPL and I bought it at $48 in August 2019, the green arrow. The predetermined level where I would sell if I am wrong is $44, the start of the blue line under the price. But, I was really smart and AAPL went up. The blue line follows the price higher until AAPL begins to rollover in early 2020. The blue line is my stop, the price where I sell regardless of the fundamental story. As the pandemic becomes more intense, AAPL falls further and moves below $75, where I would sell the stock. From there, I would reevaluate the situation with a clear head and decide if I want to get back in. (yes, I own AAPL. No, this is not how I traded it).

The purpose of the stop is to make a predetermined admission that we can’t see the future. If AAPL went straight down after the purchase, we would sell it. We are admitting that we could be wrong and we are making a rational decision to get out of the way because we don’t know how far it could fall if we are wrong.

How about Amazon in 1999 / 2000? It is easy to look back now and say that it was “pretty clear that AMZN will take over the world.” In fact, some may have had that view when they paid the high price of $113. From that high, AMZM traded to near $5, a loss of more than 95%. Even if you firmly believed that they were going to be the dominant force that they are today, odds are that holding through that decline would have been painful. Some may have even gone as far as selling at the dead low (someone has to). But, having a risk management process similar to the one above, the sale could have been made at $73 or so, saving us from a lot of emotional damage.

We are not always going to be right when we make an investment and we can’t control what happens to the stock after we buy it. We can, however, control how much we are willing to lose or give back. Know where you are getting out before you get in…it’s called risk management and it is more important than picking the right stock.

Tomorrow is going to me the last note for the year. I am taking next week off. Unless something compelling happens that is worth writing about, I will be disconnected.