Sticking it to the Man?

Enough has been written about the GameStop saga that I am not going to recap it here. I do have some takes that are not being widely discussed. The drama is being painted as “the retail investor is sticking to the man by harming hedge funds.” It seems that one of these funds lost over 50% in January alone. On the surface, this is an easy narrative to spin and fits with the recent social feelings in this country. But, I have to wonder if anyone has thought of it differently. I will paint a picture that is plausible but entirely made up:

A person joins the Reddit Wall Street Bets site and decides that this is a great opportunity. Buy GameStop (GME) to make some money and at the same time inflict some damage on the greedy hedge fund managers and the rest of Wall Street who never really paid the price for the Global Financial Crisis a decade ago. Sounds good?

Let’s zoom out. What if this person’s father is a police officer and their mother is a school teacher? Both of these are professions that generally have pensions associated with them. A portion of those pension funds is very likely invested in…you guessed it, hedge funds! So by “sticking it to the man” this person just harmed his / her parents.

Lets take it one step further. Now that the hedge funds are sustaining substantial losses, they have to take down their risk exposure across their entire portfolios. They don’t just buy the stocks that they were betting against like GME, but they sell the stocks that they own because they need to reduce risk across the board. If this happens broadly, the whole market can begin to decline as we have seen this past week. But here is the thing. The person who is still “sticking to to the man” has a brother, an aunt and cousin who work in corporate America. These people take a portion of their pay check every two weeks and invest in a 401k. They are not picking stocks, just investing in the market broadly. They are now impacted as the market falls as well.

So, while “sticking it to the man” sounds great, the problem is the implications may be much broader reaching.

Now, I do not have a side here. I am only and always on the side of free markets. If hedge funds want to short stocks, let them…they should know the risks. If a group of retail traders found a way to exploit a weakness in the hedge fund strategy, that’s amazing. I am for anything that brings people to the free market…as long as those markets are kept truly free.

Now, on to the five charts that caught my attention.

The S&P 500 has sustained some damage and I would not be surprised to see the SPDR S&P 500 ETF (SPY) move lower, toward $360 in the near-term. If that fails to hold, $340 is important to keep the uptrend in place. Below $340, the trend becomes Neutral in my eyes and if $320 gives way, then my cyclical bull market thesis becomes invalidated.

Since today is the start of February, it is a good time to look at how the index has performed on average in every month since 1950. Unfortunately, this potential for further weakness in the market comes at the start of a month that has negative returns, on average.

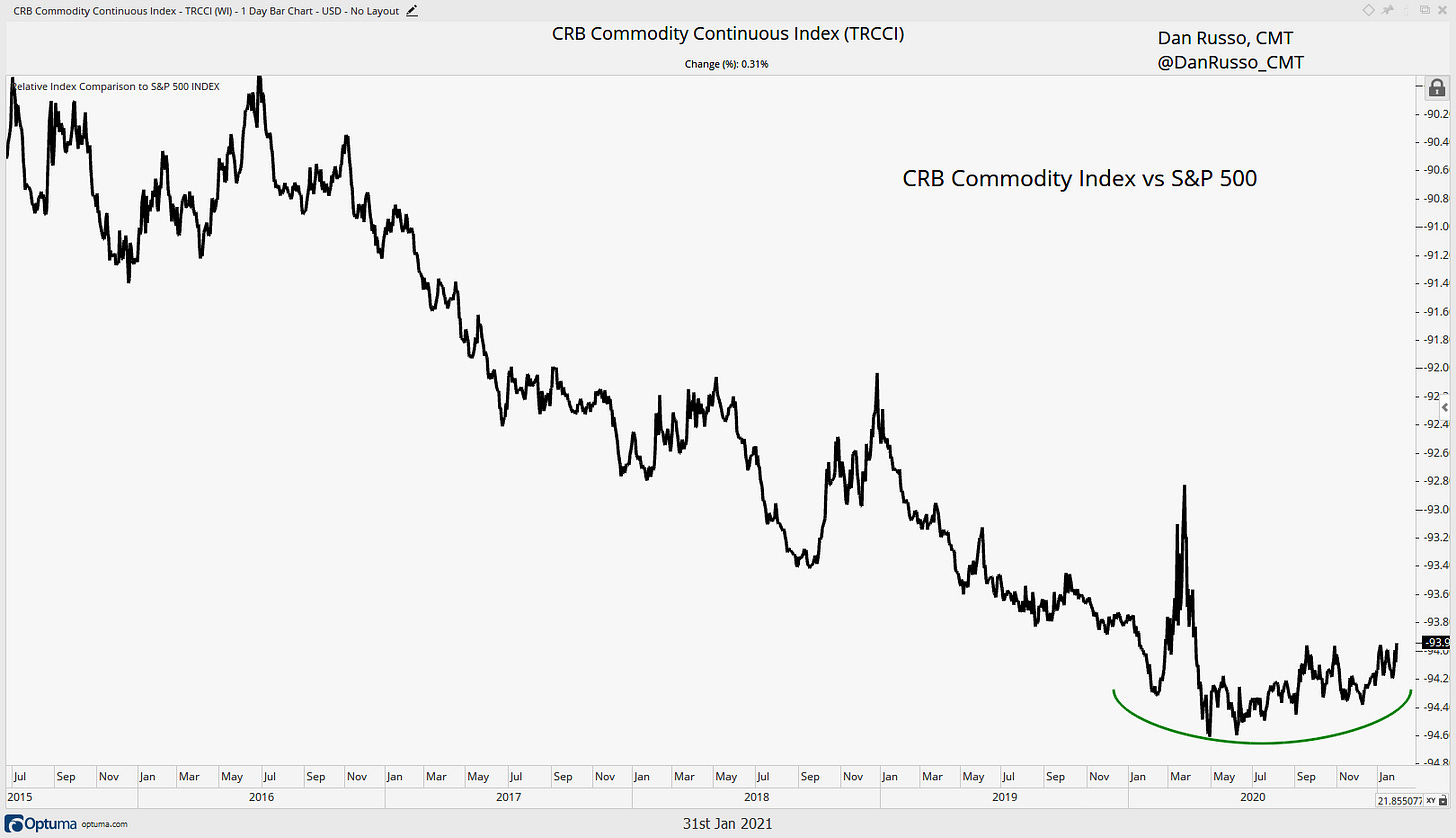

I have been becoming more open to the idea that we are in the early stages of a commodity super cycle. I have written about this in notes for our clients at Chaikin Analytics. The CRB Commodity Index relative to the S&P 500 may be in the process of reversing to the upside after nearly a decade of underperformance. I spend a lot of time looking at model portfolios that are widely used by different investors and one thing that jumps out at me is that they tend to have little to no commodity exposure. This could be a big opportunity if I am right.

Once again, inflation comes into the picture. I think that the catalyst for a commodity super cycle will be rising inflation expectations. The Five-Year Breakeven Inflation Rate continues to run above the Fed’s 2% target and has broken above the highs seen at the top of the last cycle in 2018. Much of this is likely in anticipation of further stimulus.

However, in order for this to play out in a meaningful way, the velocity of money will have to reverse this severe, 14-year, downtrend.

There is potential for this to be a wild week. Let’s enjoy the ride.

*Nothing in these pages should be considered investment advice.