That Didn't Take Long

Well it didn’t take long for a central bank to step in. It only took a little bit longer for investors in a different region to wonder when their central bank would step in. And here in the US, the chairman of our central banks has repeatedly told us that he is not going to raise rates anytime soon, and I would be shocked if he let our 10-year yield get much above the 1.75% level.

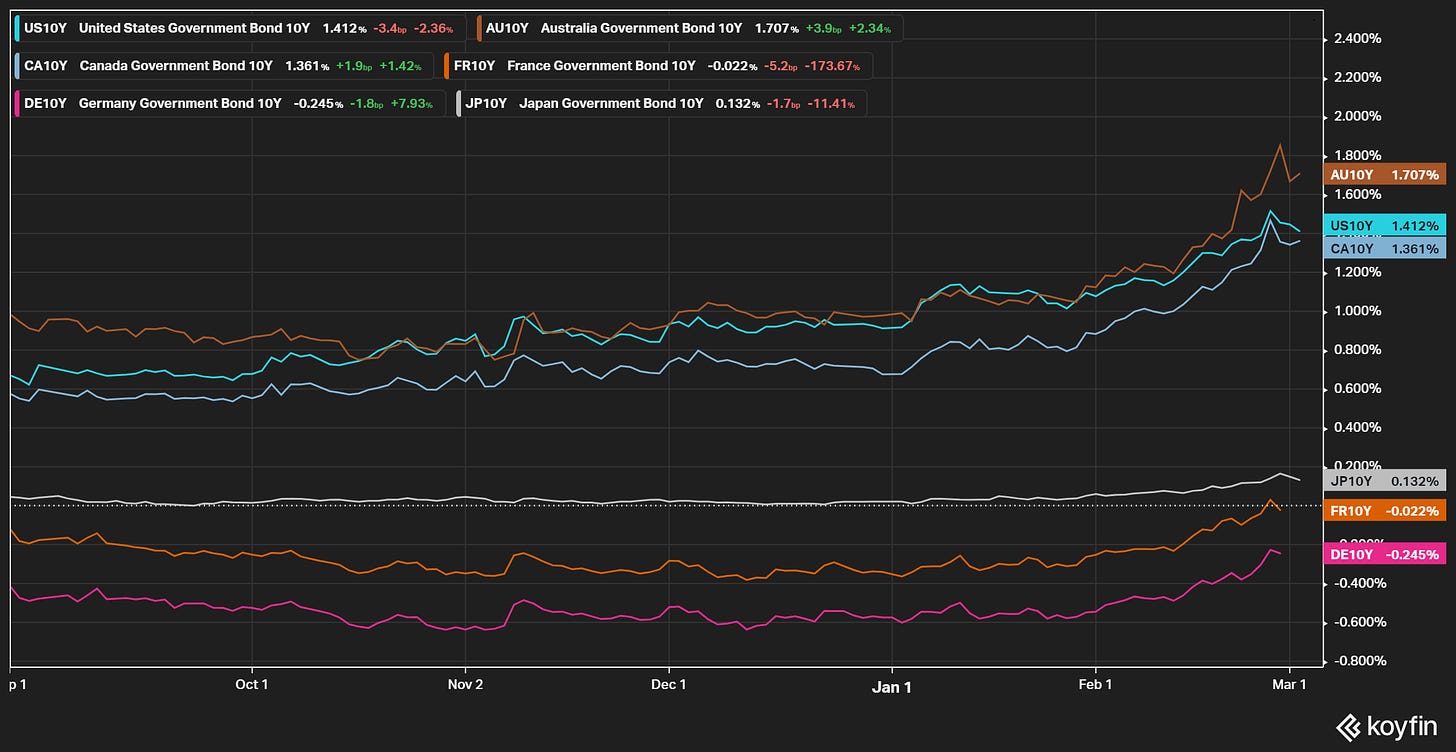

The rise in interest rates that I, and everyone else, have been discussing is not isolated to the US. It is happening all over the globe. Here is a quick chart that I put together. It has the 10-year yields for Australia, the US, Canada, Japan, France and Germany.

On Monday, there was an article in the FT talking about how the Reserve Bank of Australia was stepping in because of the back up in yields. Yesterday, this article appeared in the Wall Street Journal, talking about how investors were looking for the ECB to intervene…mind you, rates in the France and Germany are NEGATIVE. People give money to the government and are willing to pay a small fee to be sure that they will get it back.

Given this backdrop, is it plausible to think that the Fed will not step in if rates move much further to the upside?

Even with the economy here improving, it may be hard to get rates to move much higher. Speaking at the Council on Foreign Relations, Fed Governor Brainard reiterated it will take some time to meet the Fed's conditions to scale back asset purchases. However, she said the speed of last week's Treasury market moves has caught her eye, and that she would be concerned if she saw disorderly conditions or tighter financial conditions that could slow progress toward the Fed's goals. Now, this does not mean that rates have to move lower, they can simply sit here…yielding next to nothing.

The implications of this seem pretty clear, assuming it continues to play out. Holding cash will be a losers game because of inflation. Holding treasuries will be a losers game because the “income” will not keep pace with inflation but there is still a chance of price appreciation. Stocks and alternative assets may the best way to preserve purchasing power. How long this lasts, I have no idea.

But, many are still seeing a bubble everywhere, my thought is that there is still time for risk assets to move higher.

Nothing in these pages should be considered investment advice.