The Market Discounts the Future

It was an extremely busy day so this is short and sweet.

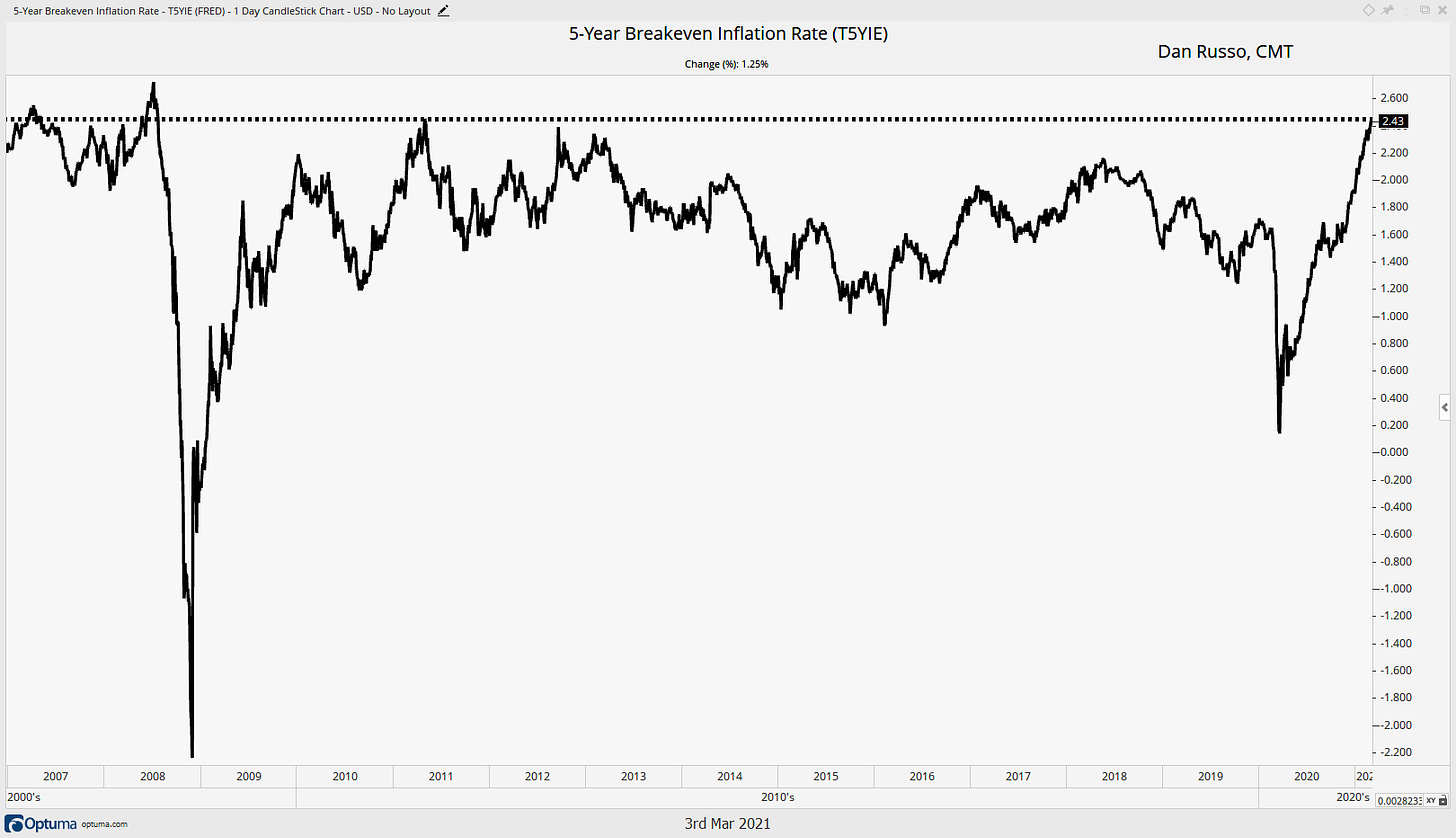

Many of the themes that I have been discussing remain in place. Rates are still moving higher. This is largely because inflation expectations are still moving higher. I think it is that simple. Here is the 5-Year Breakeven Inflation Rate. It is back to towards the highs last seen in 2008, as the financial crisis was unfolding.

The choppy trading as equities digest higher rates continues with the growth stocks continuing to take much of the fire from investors.

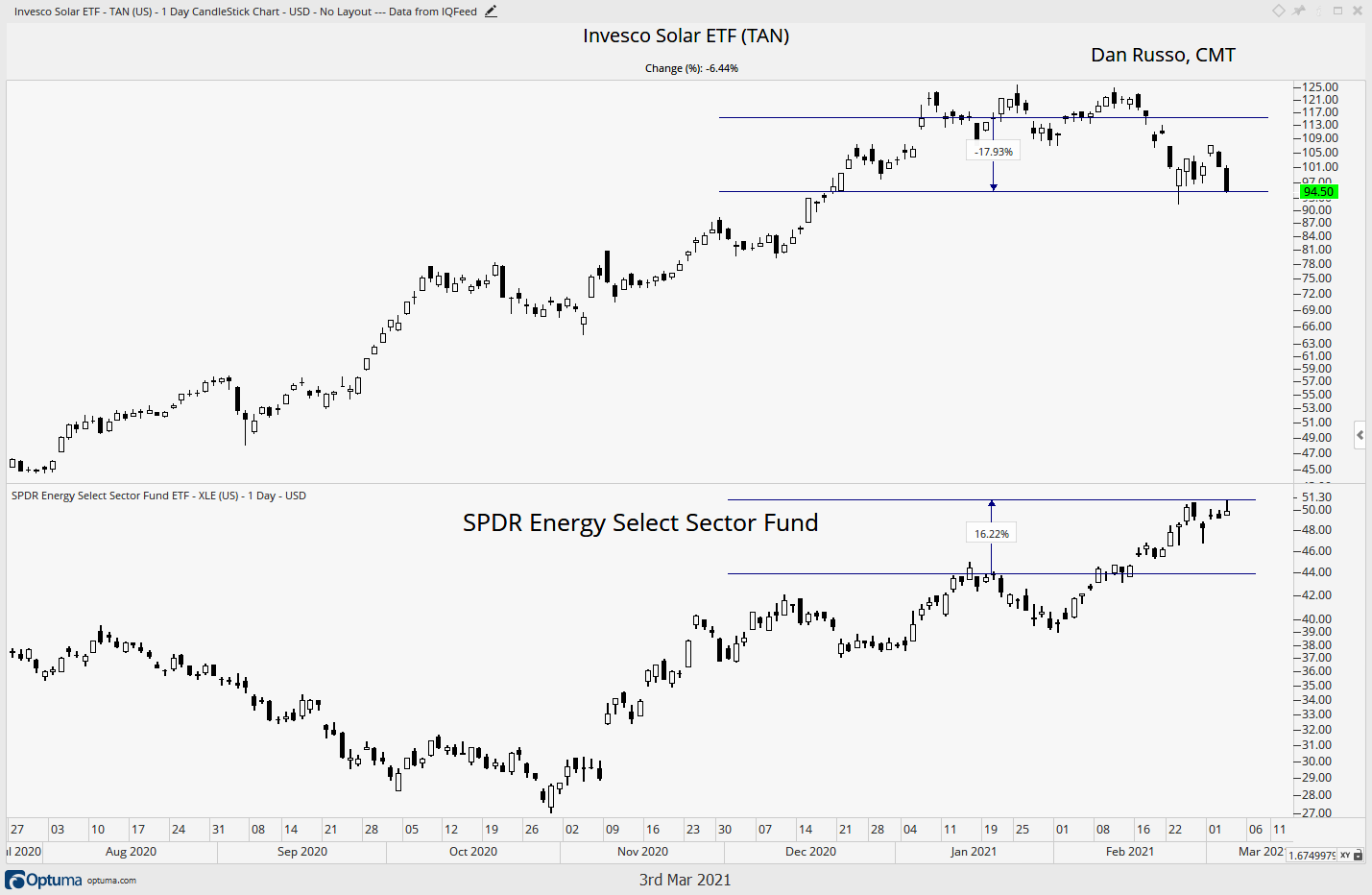

Something that I do find interesting is how the market never ceases to remind us that its job is to discount the future. A Biden White House and a Blue Wave in congress could not be more positive for clean energy,, in theory, and could not be more negative for oil and the traditional energy companies, again in theory. Yet, since inauguration day, The SPDR Energy Select Sector Fund (XLE) is up 16% (bottom panel) while the Invesco Solar ETF is down nearly 18% (top panel).

The Market Wins Again!

*Noting in these pages should be considered investment advice.