Warren Buffett's Lost His Touch...Again!

I continued to be impressed at how markets outside of the US are trading. It’s generally good for an asset class to have a broad level of participation. It looks like after spending a few years being the “cleanest dirty shirt” in the global economy, other countries are joining the rally. Here is the iShares MSCI Ex-US Index Fund (ACWX) breaking a two-year down trend.

If the rest of the world is getting into gear, we are going to start seeing headlines along the lines of a “global synchronized recovery.” I will keep my eyes open.

Last week we talked about the how Japan was trading at levels last seen in 1991. After a dismal 30 year stretch of underperformance, the Nikkei 225 is potentially in a position to be an outperformer for equity investors.

There was a lot going on last week so I didn’t immediately make the connection but back in August it was announced that Warren Buffet’s company Berkshire Hathaway had made a $6 billion investment across five of Japan’s biggest trading houses. In this article, the Financial Times describes these businesses as the century-old commodity specialists that are increasingly transforming into global venture capital and private equity businesses.

The reason that this is so intriguing is because just this past summer, the periodic cries that Warren had lost his touch were making the rounds again. In the wake of the COVID pandemic, Buffett came to the realization (again) that airlines were bad businesses. The problem was he owned a lot of them. As the virus was raging and planes were grounded, he sold his airline holdings. Of course, they turned in an epic relief rally which caused some to joke that Buffett “sold the low” in airlines and that he had lost his touch.

The Financial Times highlighted how Buffett was light on tech and heavy on banks and asked the question on June 15, 2020 “has Warren Buffett lost his touch? Here is Value Walk asking the same question on August 5, 2020. Finally, here is what Ken Fisher had to say in an article titled Is Warren Buffett losing his edge to age? Ken Fisher says Oracle is becoming 'inactive'.

“Because of my father when I was young, I got to meet some great investors. The reality of great investors, in my opinion, including my father, is that when they get to a certain age, they lose their edge,” Fisher said. “I am not suggesting that Warren Buffett has lost his edge but I cannot find a history of people his age that don't become relatively static in a crisis, they just tend to be inactive in a crisis.”

Even Dave Portnoy, the founder of Bar Stool Sports (a tremendous media empire that he built from the ground up), who turned to day trading stocks in the pandemic because there were no sports, claimed that he was a better trader / investor than Warren Buffett.

“I’m not saying I had a better career. ... He’s one of the best ever to do it,” he said. “I’m the new breed. I’m the new generation. There’s nobody who can argue that Warren Buffett is better at the stock market than I am right now. I’m better than he is. That’s a fact.”

Now, I am not going to argue with the fact that Warren has underperformed the market in the recent past, he has. Since December 2018, Berkshire Hathaway (BRK.B) has been lagging the S&P 500 (the line moving lower). The good news for Berkshire investors is that Warren does not think in two year intervals, so he is likely not worried about it.

Another reason to believe that Warren is not likely concerned is because he has heard it all before. As the dot com bubble was raging in the late 1990’s, Warren was famously underinvested in technology and internet stocks because he “did not understand” the businesses or their models. For those who have not read it, valuing a company on metrics such as “total eyeballs looking at a web page” was nowhere to be found in Securities Analysis by Graham & Dodd (the book that famously set Warren on his path to investment fame and fortune). Here is a look at how Berkshire performed leading into the bursting of the bubble in March 2000 and how it performed in the two years post burst. So while the whole world was going dot com crazy, Warren sat out the rally, underperforming the S&P 500 badly.

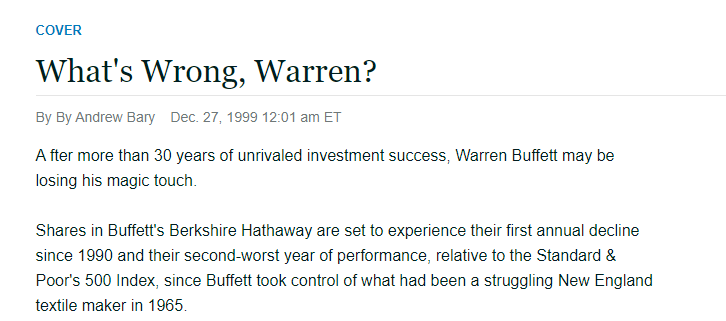

Guess what was being said in 1999 on the eve of the new millennium about the man who admitted that he did not understand the business models of the best performing stocks of the time? Look at the date on this Barron’s cover story!!!

It’s still early and maybe Warren will be wrong on Japan. But I do get a good laugh every time people want to take shots at one of the most successful investors ever.

PS: I bought some of the ETF that tracks the Japanese market that I highlighted here last week. If Warren is wrong on Japan, I will be too!

PPS: I was quoted in an article for CNBC yesterday. Nothing new, I have been writing here for the past few weeks that I think “things” are getting better…at least that’s what the market thinks. As long as price agrees, who am I to argue? Dan Russo, chief market strategist at Chaikin Analytics, thinks the market can weather this latest spike in coronavirus cases, however. “It seems that investors are more focused on vaccine news and are willing to look past the near-term spike in cases,” he said in a post. “If this becomes a cause for concern for investors, it will become apparent on the charts and risk management will take over.”

If you like what you are reading, please consider passing it around!