What If Stocks Aren't The Best Bet

What if we get to a point where owning equities is not the best alternative? That’s what has been going through my mind as I try to piece together everything that is going on based on what I am seeing on the charts and connecting it with the news flow, narratives and data.

The news these days, at least for markets, is centered on three main issues.

The Election

Stimulus

Rising COVID Cases / Restrictions

The consensus view on the election is for a “blue wave.” I have been talking about this for a while. If that is what plays out, the trends that are currently in place likely stay in place: Stocks can grind higher, long-term bonds likely stay under pressure. The wild card here is the state of the economy after the “wave.” If it is still in it’s current state, perhaps we do not get the tax hikes that everyone assumes would be put in place. I doubt that, they may just come later than the administration hoped, once the economy is showing signs of improvement?

This now gets to stimulus. Back and forth we have been going for the past few weeks with nothing to show for it. Kind of like the market itself. I still think we are going to get stimulus in some form. This has also been my view for a while. I would be happy to see it come before the election but I was never counting on that. The bigger question is does stimulus spur the economic growth that we badly need? I honestly have no idea. I have been in the no growth camp for a while , since early 2019, and that has largely played out. But there are actually some signs that the market may be pricing in a growth scenario. I will have to dig into this over the weekend.

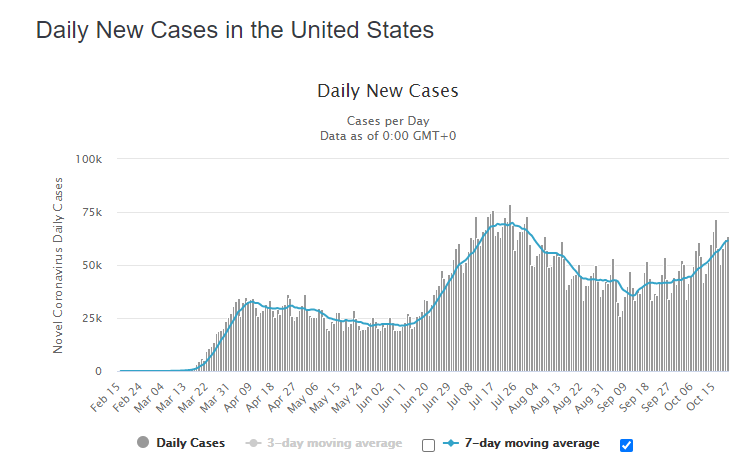

Rising COVID cases is the wild card here. I am inclined to think that we do not have much of a stomach for a full-blown lockdown again. Maybe there are restrictions as it relates to the size of gatherings in public, but I don’t see locking it up again as a high probability event. But, if this curve gets worse, there could be further drag on the pace of the recovery.

I see two possible scenarios. The first, which is the framework I have been using since the beginning of the summer is stagflation: no growth but inflation. I hear the ‘70s were fun. The other is reflation: growth and inflation. There is a common denominator to both of these scenarios.

From a market perspective, I see an class that could benefit in either of these scenarios. Commodities.

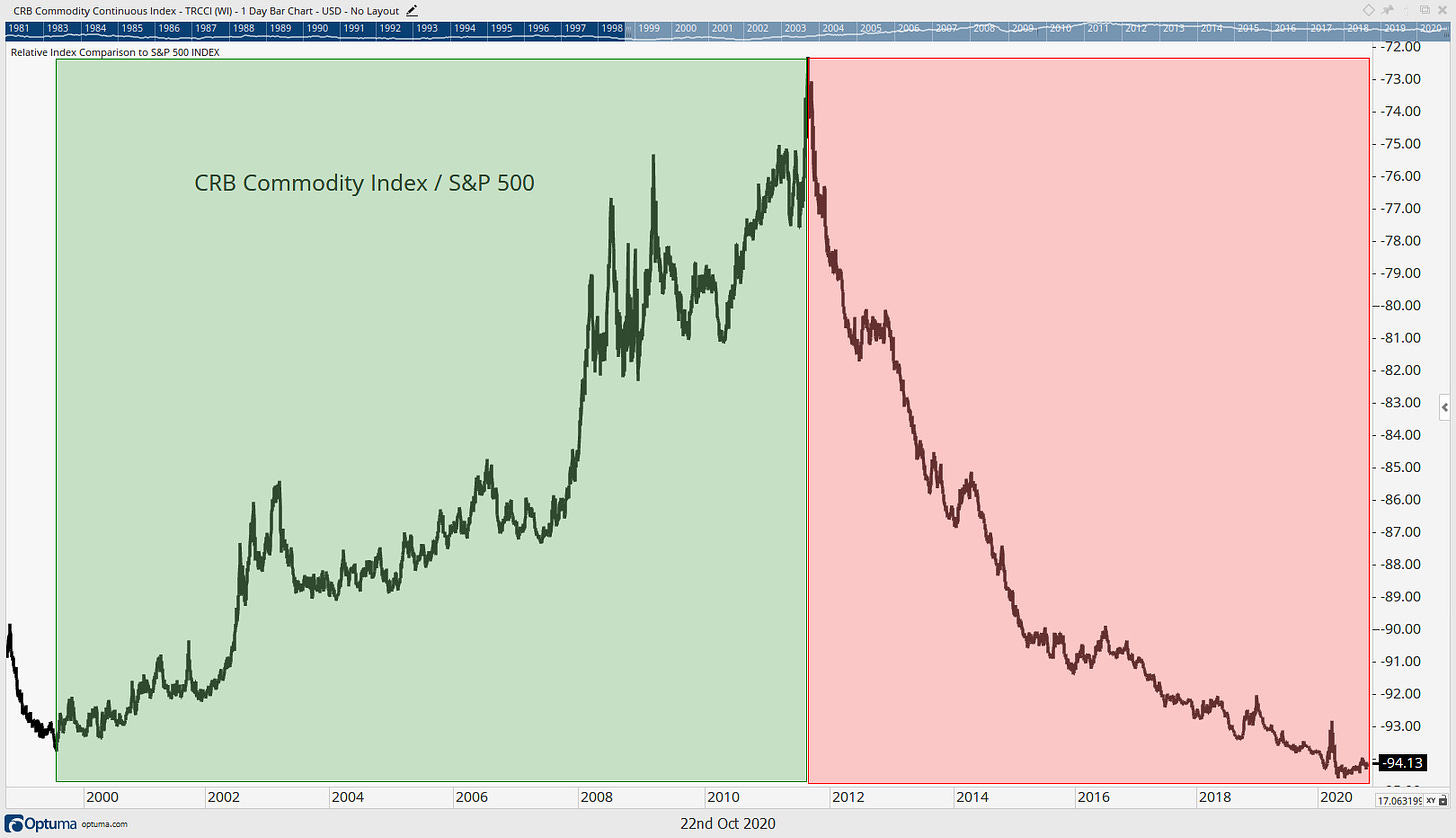

Unpacking commodities, there are times when it actually makes sense to own them and, for some, to own more of them than equities. Additionally, the trends tend to play out in long cycles. Based on relative trends, from 2000 to 2011, the case can be made that investors would have been better off favoring commodities over equities (all else equal), Then from 2011 until now, investors would have been better off owning equities over commodities.

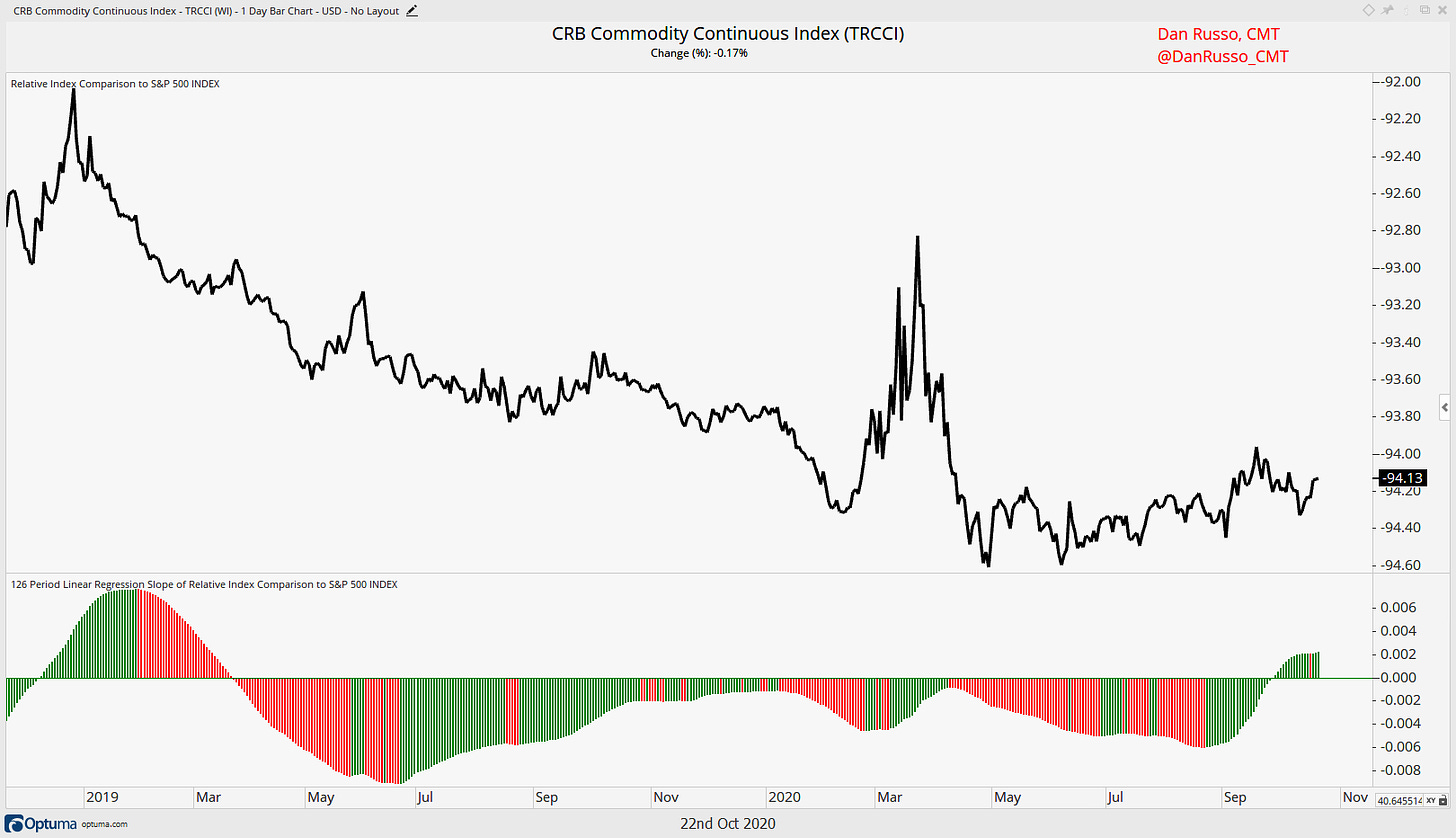

I think, that based on the prospects for inflation, we could be at an inflection point that tilts the field in favor of commodities once again. Looking more closely, I see higher lows and higher highs, when the line is going up, commodities are leading. The bottom of the chart is a measure of the six-month trend.

Could I be wrong? Yes. But if I’m not, this is a group that is fairly under-owned, setting the stage for a long rising tide. Step one is to stop going down and that might be under way.