COVID Vaccine News and Japan Breaking Out

I generally have an idea of what I want to focus on on any given day. Usually is it something that is playing out within the context of my bigger picture views. Sometimes, a monkey wrench gets thrown in the works and I have to adjust my focus. Yesterday was that kind of day.

Yesterday morning, before the opening bell on a new week, we learned that Pfizer’s COVID vaccine, in partnership with BioNTech, showed an efficacy rate above 90% with limited safety concerns. Dr. Fauci called the results extraordinary. I am not a doctor so I will take his word for it. This is clearly a positive development and the markets seemed to agree. The S&P 500 gapped higher on open, moving out of a consolidation that has been in place since the beginning of September before giving some of the gains back as the day drew to a close…not ideal but moving in the right direction, especially if your timeframe is more than a day or a week.

But it was the action under the surface of the market that was most interesting. The companies who were the most severely impacted by COVID, lockdowns, travel restrictions, etc…all ripped to the upside. Here is Carnival Corp. (CCL). I am not a big fan of cruising but I know many people are and the prospects for the industry probably just become a lot brighter.

At the same time, the work from home / workout from home stocks took a beating. Have a look at Zoom (ZM) and Peloton (PTON). I had some PTON in my portfolio coming into the day, that hurts. I don’t have PTON in the portfolio now…risk management.

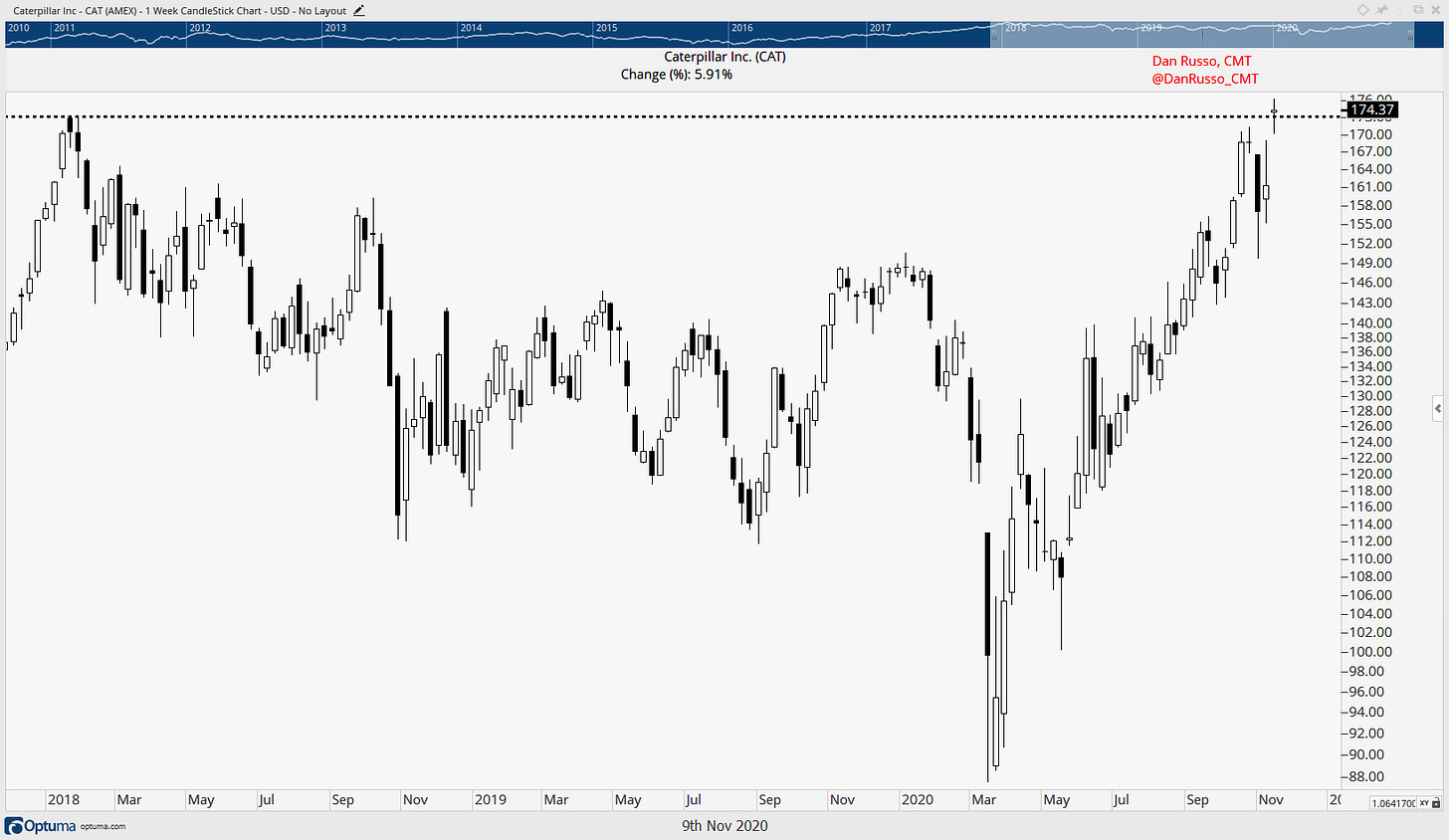

Back on October 26th, I wondered if the economy was actually improving. Since then, we learned that the unemployment rate fell to 6.9%. Stocks leveraged to the economic cycle such as Caterpillar, Inc. (CAT), a maker of heavy construction equipment have moved to new highs and now we have positive developments on the vaccine front. This all points to the answer to my question probably being yes. Will the improvements last? That’s an open question. But with stock markets trading at all time highs, investors seem to think so. Here is a look at CAT.

That brings me to what I actually had in mind for today. Last week, I starter to think about investments outside the US. I included a chart showing a breakdown of the percentage share of global GDP by country. The US is at the top of the list at ~23%. China is in the number two slot at ~15%. Batting third is Japan at 5.7%. Despite being the third largest economy on the planet, the Japanese stock market has been a terrible place to invest for 30 years.

It wasn’t always this way. From September 1982 until January 1990, the Nikkei 225 (the main stock market in Japan) rallied by more than 460%. Throughout the 1980s Japan was a force. Colleges and business schools used case studies of Japanese companies as teaching tools. Companies such as Toyota were models of manufacturing efficiency. The term “business is war” is attributed to a Japanese philosophy for competing internationally.

Japan was literally taking over the world, including “The Rock.” Not the wrestler turned actor, but Rockefeller Center, arguably one of the crown jewels of Manhattan real estate, in October 1989. Japan didn’t make the purchase but one of their leading companies, Mitsubishi Estate Company of Tokyo, did. As is often the case, this high profile deal pretty much rang the bell at the top of the Japanese market. From January 1990 to October 2008, the Nikkei fell by more than 80%. Read about the Japanese bubble here.

Since those 2008 lows, the Nikkei has gained ~250%. That sounds good, but when we consider the S&P 500 has rallied nearly 450% from its own Global Financial Crisis lows, I will stand by my claim that Japan has been a terrible investment. But yesterday, the Nikkei traded at levels not seen since November 1991.

So maybe things really are getting better? If Japan is trading at highs not seen in 29 years, things probably aren’t getting worse. I bought some EWJ, the ETF that tracks Japan.

*Nothing in these pages should be considered investment advice.