Congratulations to the people who did the work and made an investment in bitcoin. It traded to a new record high on Wednesday. That brought out two types of people, the owners who were giddy with excitement. Many of these investors held on since the prior high in 2017 and they are now back in the money. Good for them. The other type of person who comes out is the person who missed it. Invariably, these people now call it a bubble. I am not going to single anyone out, but they are out there and you don’t have to look too hard to find them. Most call it a “bubble” and think that is has to pop and pop now. I push back on this in a big way. The same way I push back on people who are calling the stock market a bubble, but I will address that another time.

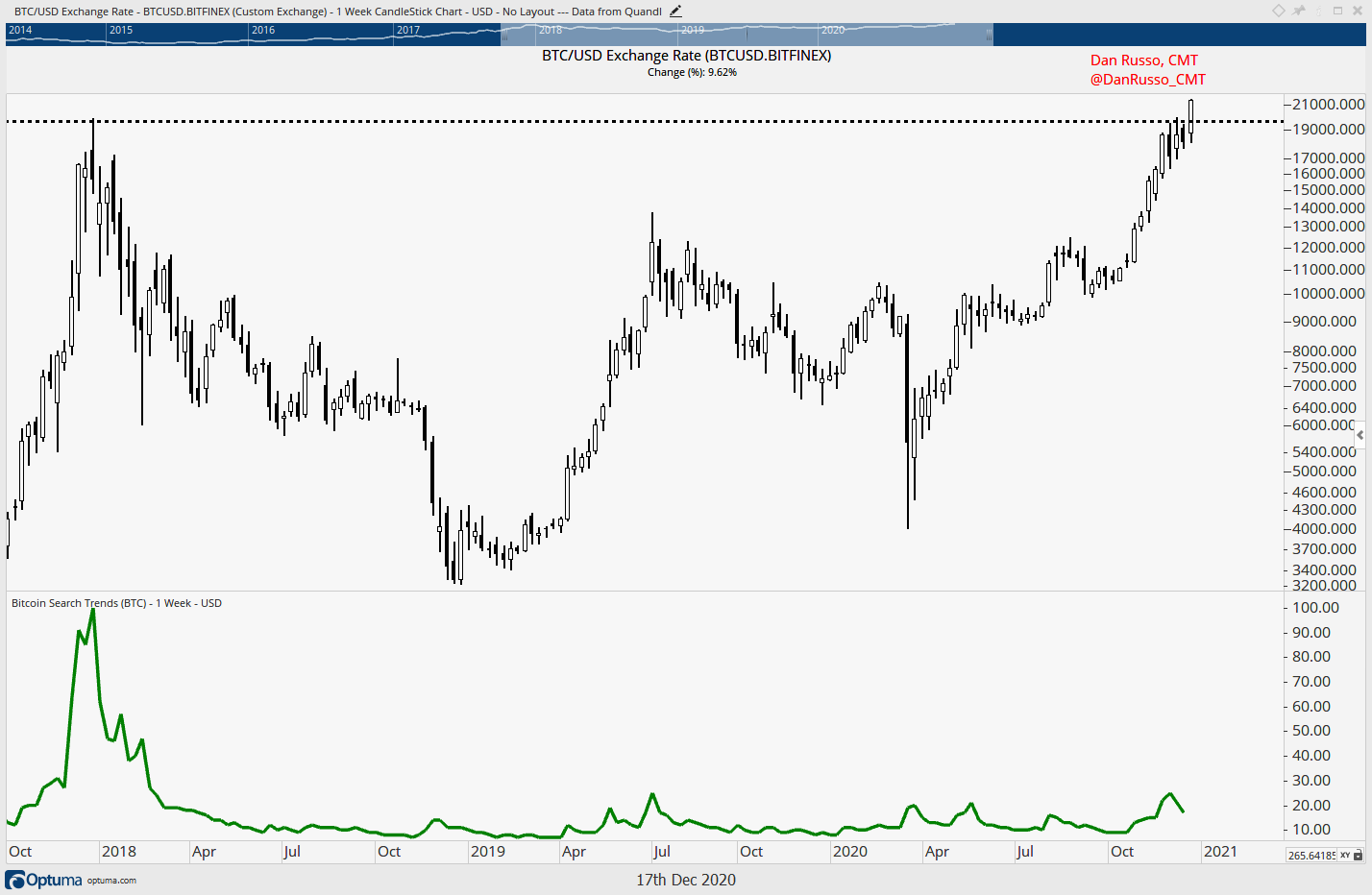

The simple fact of the matter is, bitcoin went nowhere for nearly three years. It is just breaking to new highs now, this week. That is probably not a bubble. At the same time, there is not as much interest from the general population as there was at this time three years ago. I touched on the Google Search Trends here. Meanwhile the demand side of the equation is getting stronger with bigger institutions and corporates warming up to the idea of bitcoin and actually doing something about it. See here and here.

Yes there are risks, no bitcoin is not going to up in a straight line. I could even be completely wrong and this latest break to new highs could be one big false move. But right now the trend is up and odds favor higher both from a technical and fundamental perspective. At least that’s how I see it. By the way, Google Search Trends are still not spiking as of December 13th (the green line on the chart).

PS: The Fed just told us that they are going to remain accommodative through 2023 despite an improving outlook for growth and employment. The dollar didn’t take that too well and traded to a new 52-week low. As the dollar loses it’s purchasing power, that is usually a positive for hard assets that can’t be inflated. Bitcoin is a hard asset that is actually designed to be deflationary. Checkmate?

Thank you all for taking the time to read my thoughts every day. If you find them helpful, please consider sharing this note. Have a Great Weekend!

***Nothing in these pages should be considered investment advice.