It was not the prettiest of days yesterday with early morning strength, based on stimulus hopes, being dashed as the day progressed. I was not excited at the prospect nor was I upset when it did not materialize. It is not even remotely close to my base case. I never saw stim before the election as a high probability event.

I am slightly more concerned with the fact that the daily charts show me that many of the ETFs that have made new highs recently, did not have those highs confirmed by momentum. Home Construction is a good example. It’s happening on a lot of the major US market ETFs and the country funds as well. I have to watch this closely!

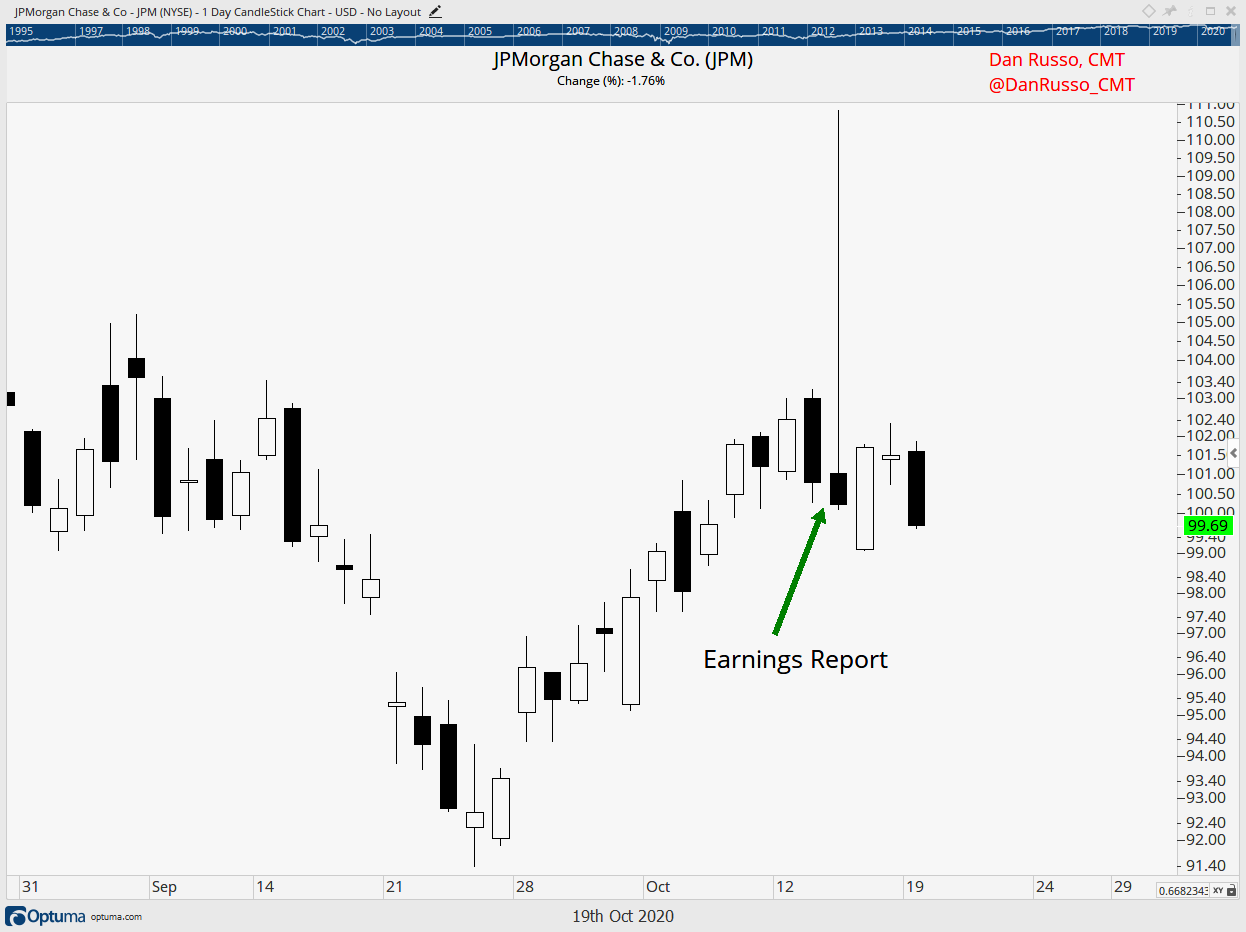

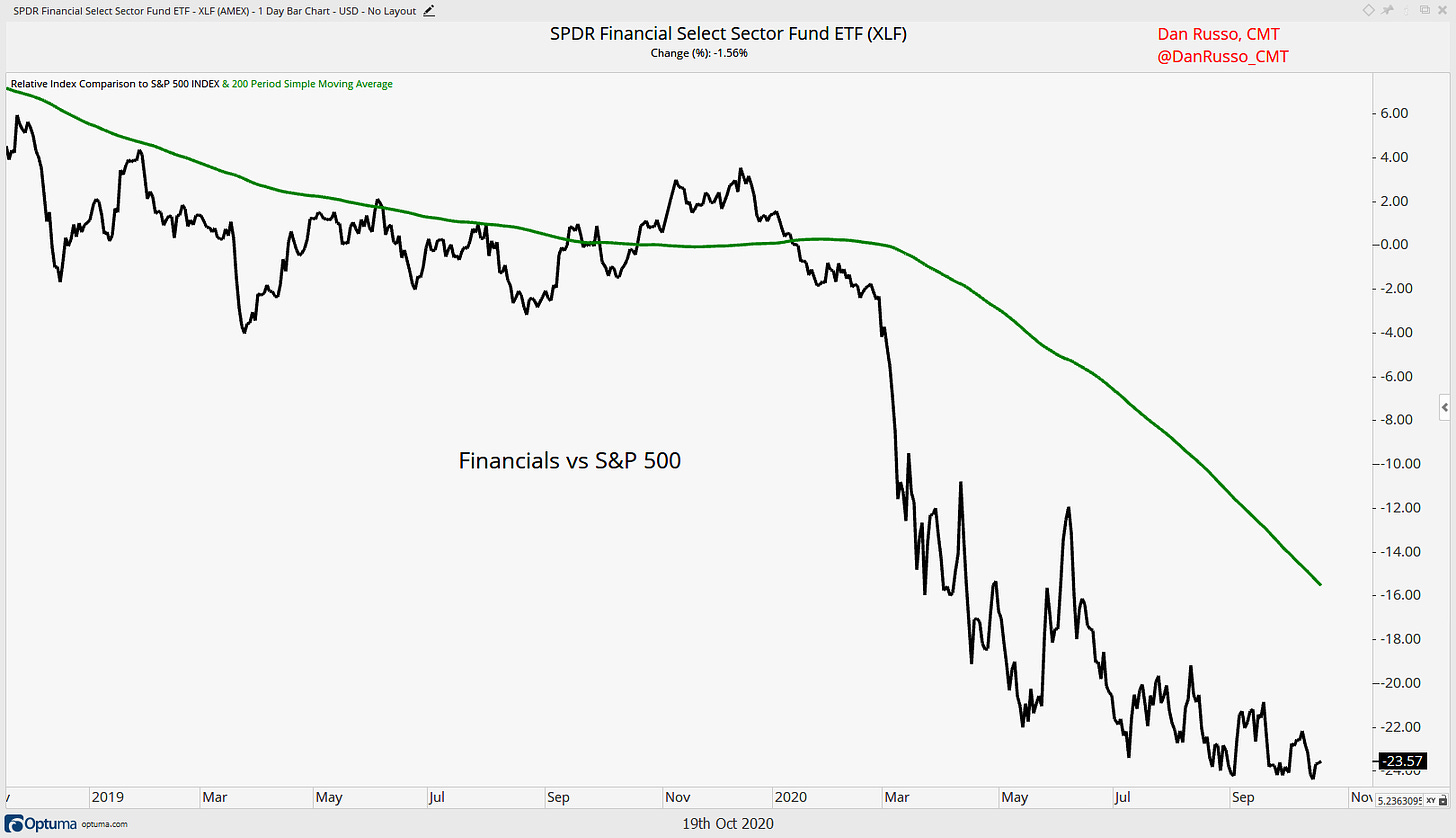

Last week we started to think about earnings season. I was intrigued enough by the banks that I decided to put them on my radar for close observation. I am interested in Financials possibly becoming the next cyclical sector to begin to show some relative strength. We know that fin-tech is a clear winner but I am talking about the old financials, the banks. The first one out the chute, as always, was JP Morgan. They are the monster in the space and we all hang on every word Jamie has to say during the call for interesting reads on their business as well as the economy. Their report beat expectations on the top and bottom line while at the same time, they took less of a reserve for potential bad loans in the future. Sounds great, the stock was down.

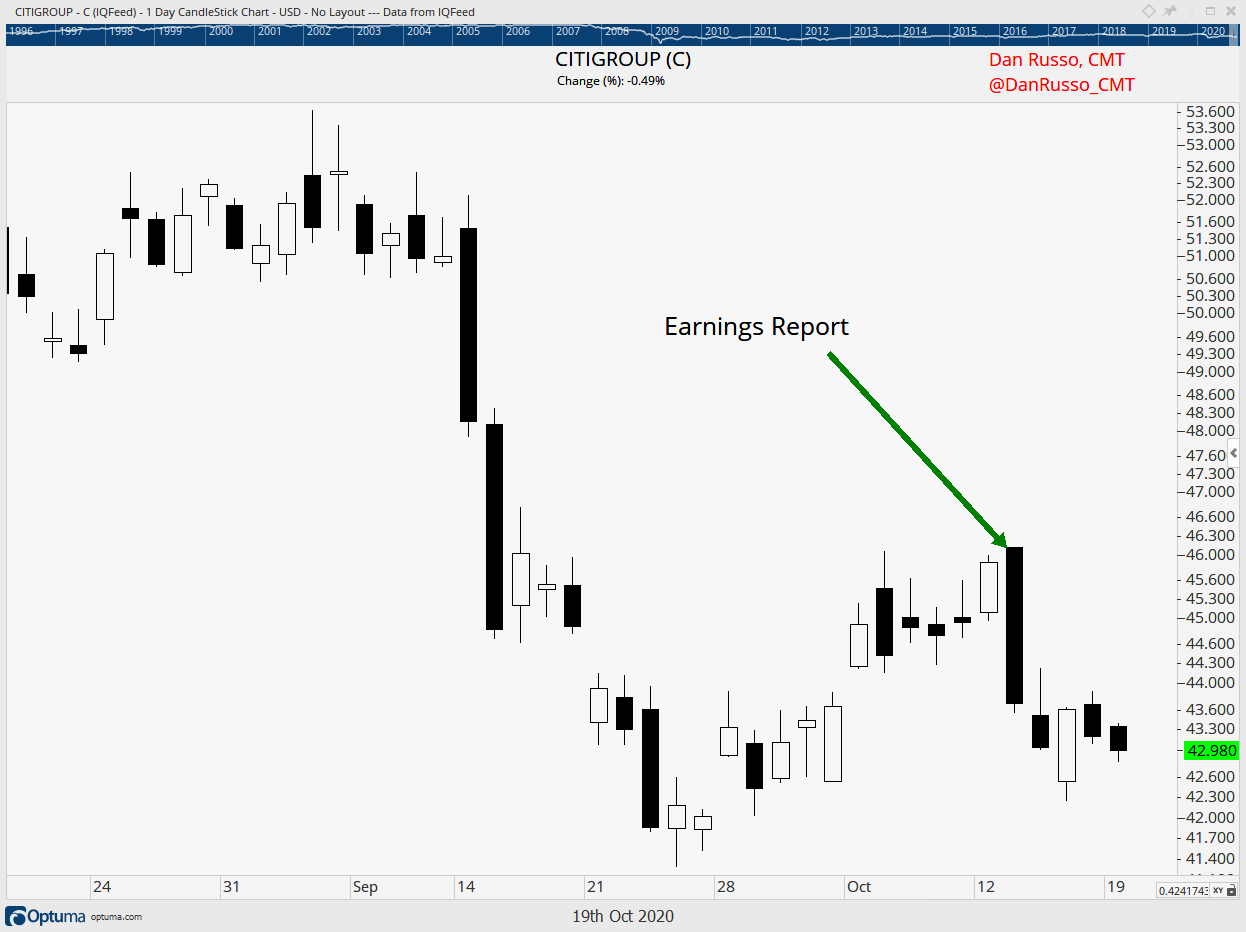

Wait what? The stock was down because expectations are going up. At the same time, the picture offered up about the future, which is all we care about, was roughly the same as what they had told investors in mid-September. So after reporting results that were better than we thought they would be, they did not carry that through the rest of the year and the stock went down. The same happened to Citi Group (C).

What’s going on here? First stocks are discounting mechanisms and investors are forward looking. We really don’t care how well you did over the past three months, that is probably already reflected in the stock price. We care about the future and we care about it being brighter than we had originally thought! In the case of Financials, where this did not play out, the relative trend remains in a consolidation (at best), providing another solid example of why we wait to see trends develop rather than try to “guess” at when they may change. For now, the fins remain on my “do not touch” list.

Now, take the entire S&P 500. On September 30th, analysts expected all of the companies in the index to report earnings that were down 21% from the previous year. That sounds terrible and it is terrible but we all know why and we are looking past it. During the first quarter and the second quarter, the economy was so bad that simply surviving was likely good enough to have your company’s stock move higher. But now investors are looking ahead. In the fourth quarter, we are looking for earnings to be down 11% year on year (bad but getting better) then in the first two quarters is 2021, we are looking for a return to growth. What does this mean? The bar for stock prices to go higher solely based on earnings is moving up. My friend Andrew Thrasher and I were chatting about this before the start of the season and this is exactly the point he made to me.

While it is early, it is being born out in the stock performance as well. Of the 10% of the index that has reported thus far, those that have beaten estimates are not being rewarded more than they have in the past but those that miss are being punished more than average.

So let’s begin to string this all together and look at possible scenarios. In particular the ones that can hurt my prevailing view on growth stocks in the market, which is currently bullish! Market expectations are elevated as they relate to earnings. Stocks that miss get hit. Expensive, momentum stocks that do not live up to expectations get hit harder. Remember FSLY? I have an allocation to the growth areas of the market in my “stock” strategy! This is a great time to make sure that I am comfortable owning the stocks that I do and feel confident that I am not going to be surprised. Can I be 100% sure, no? But I am 100% sure that if I am surprised, I know where I am selling my stocks to manage my risk. The risk management portion of the strategy is firmly in place.