Five Charts to Start the Week

Some quick reminders before we get into it since there are more of you reading this now than there were last week. First, this is my diary on the market. It is in no way shape or form investment advice. These are the conversations that I am having with myself as I take in all that is happening in the market while trying to square it with the prevailing narratives and fundamentals. I do this to give some clarity to my thoughts. If you like what you are reading, please consider passing it along to others who might like it as well.

Next, if you have an opinion, I would love to hear it, especially if you disagree with something that I am thinking. I promise you that after starting in this business as a summer intern at the New York Stock Exchange when I was 16 years old, I have extremely thick skin.

Finally, nothing I write here should be considered investment advice. It is highly likely that I have a different timeframe and risk profile than you do.

Weekends are for Weekly Charts. I zoom out from the day to day noise to get a view of the underlying trends in the market…the Tides. More importantly, I want to try to get a sense for the ones that could be changing. Looking across different themes and asset classes, I look for where the shifts are occurring and what they could possibly mean for the bigger picture. What kind of environment do investors think we will have in the next 6 - 12 months based on what they are doing now?

As I wrote last week, we know that investors have been putting money to work. The BAML Fund Managers Survey told us that cash levels are fairly low by historical standards, down to about 4.1% of assets under management. While that is somewhat helpful to know, the real value is in determining where exactly that capital is being deployed. What areas of the stock market? Where is money being invested in fixed income? Are investors betting on commodities? Which ones? Are global markets beginning to come on strong? Which countries are benefitting?

Here are the five charts that stood out to me as I was doing my work this weekend.

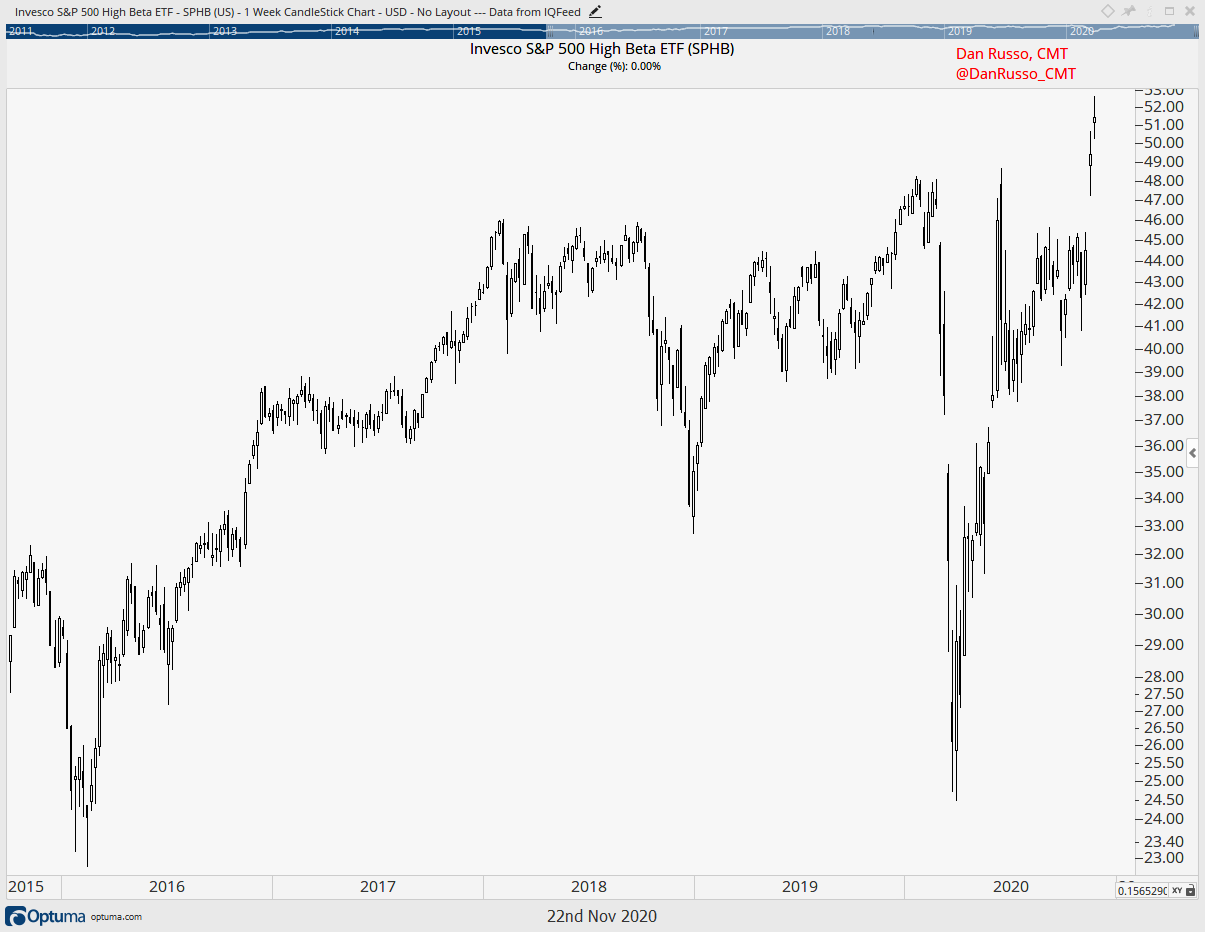

In the US, rotation is the biggest theme playing out right now. Despite the rapid rise in COVID cases, investors appear to be looking further into the future, to an environment where the economic situation could be better. The chart that I think paints this picture the best is the one of the Invesco S&P 500 High Beta ETF (SPHB). High beta stocks are the ones that move more than the overall market. If the S&P 500 moves 1%, a stock with a beta of 1.5 will likely move 1.5%. So if investors are betting that the market will move higher, many will want to own the stocks that have a good chance of moving up more than the market itself. Of course this is a double edged sword. If they are wrong and the market moves lower, these stocks will go down more, on average. The SPHB fund is interesting because when I drill down on what is actually inside the fund, I can see that the three biggest sections of the market that are holdings of the fund are Financials, Consumer Cyclicals and Energy. What these three groups have in common is that they are leveraged to an improving economy. Over the past two weeks, where we have received positive news on two different COVID vaccines, this fund has gapped higher and is now trading at record levels after going virtually nowhere for the past two years.

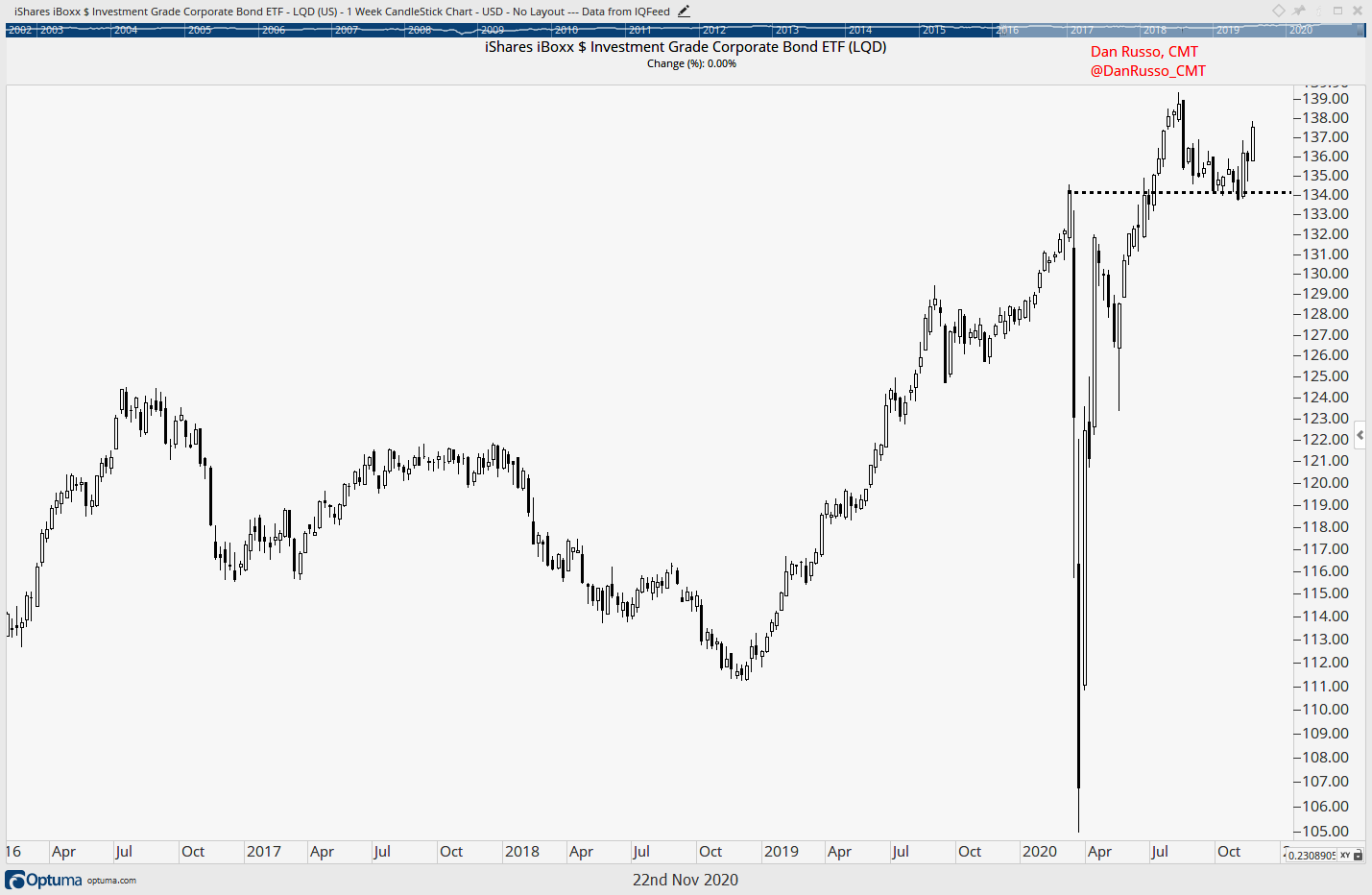

In fixed income, investors had spent the better part of two years leading up to the pandemic flocking to the safety of US Treasury bonds. If you are concerned about slowing economic growth, there is likely not a better place for conservative investors to place their money than with Uncle Sam. Now, with an eye toward an improving environment, Corporate Bonds, which are more risky than treasuries, are performing well and are on the verge of reaching new highs.

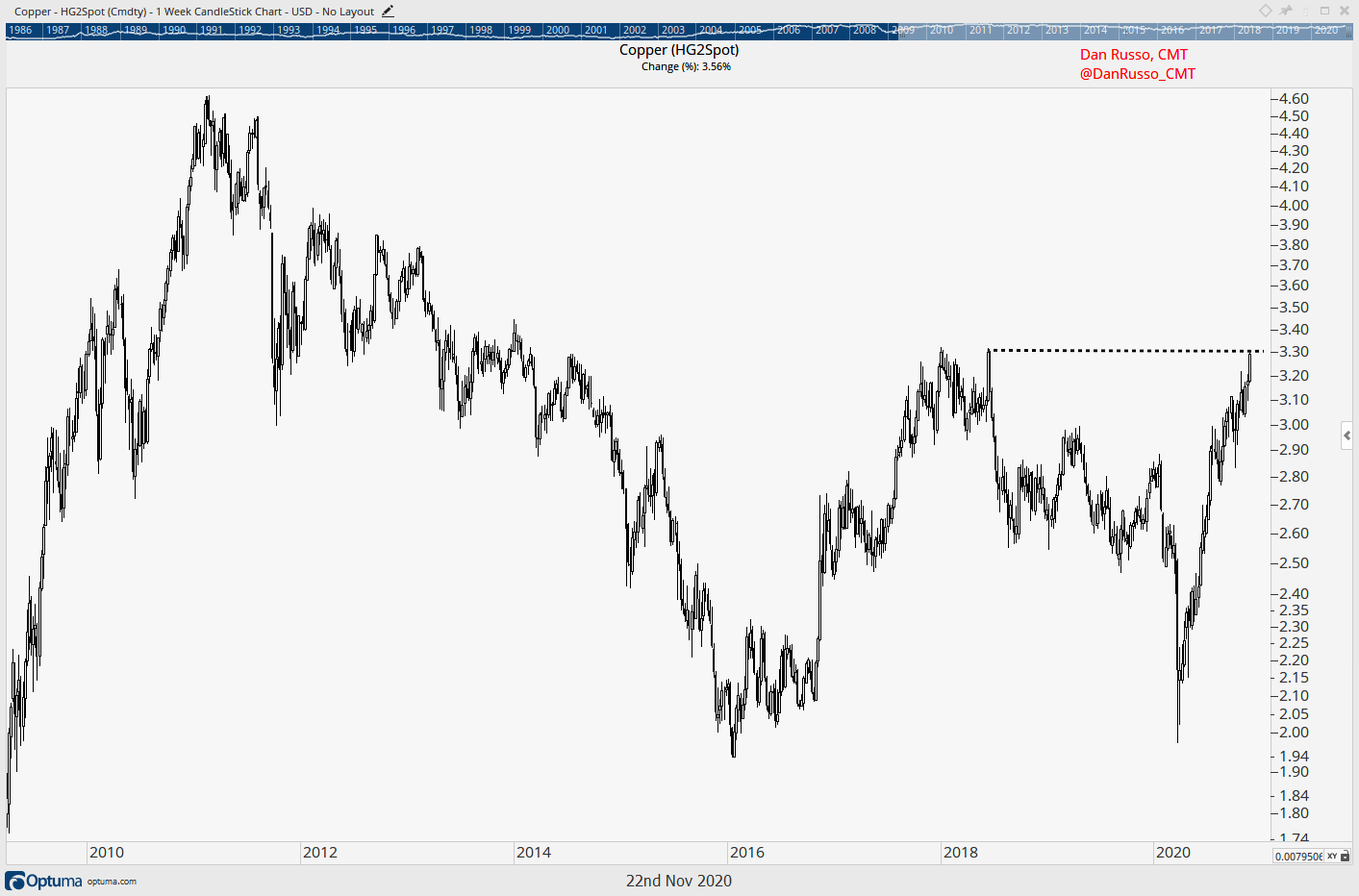

In commodities markets, Copper has been strong and is on the verge of breaking above the highs that were last seen in 2018. Copper has many industrial uses around the world, and the fact that it has been acting well, sends an important message about the prospects for the global economy.

Outside the US, we have been impressed by the move to 29-Year highs in Japan but that is just one market. We have seen strong markets across most of Asia and we have even seen Europe begin to improve. These are geographies that receive a lot of attention in the financial media. One country that does not get much attention is India. But maybe that is about to change. The NSE Nifty 50 Index (India’s main stock market) traded at a new all-time weekly high for the second consecutive week. This is while India is the number two country in the world for COVID cases based on data from Worldometer. The US is number one and our markets are trading at record levels as well.

The last chart that has my full attention is the one of the US Dollar Index. From 2018 until the onset of the pandemic this measure of the US Dollar against a basket of other major currencies was in rally mode. This makes sense on the surface. I have made the case that growth was slowing globally long before the pandemic. The US Dollar is the reserve currency of the world and in times of uncertainty, it can be a haven asset. I have also made the case that the pandemic, may have been the capitulation low in a bear market and that a new bull market is beginning now. If I am correct, I would expect to the see the dollar weakening and that is exactly what has played out since December. If I am going to continue to be correct, I the dollar will likely move lower still. It has been going sideways since August. A move below 92 would add support to my current views.

Right now, the market is moving in the opposite direction of the prevailing narrative in the main stream media. Turn on the TV and you will see the stories of rising COVID cases, lines of cars with people waiting for food, Thanksgiving limited to 10 people or less and who knows what the year-end holidays could look like. As a human, these stories are heartbreaking. As an investor, however, they can not impact the decision making process. In fact, in all likelihood, when the news is getting better, the market will be heading lower. I wish it wasn’t like this, but I don’t make the rules!

I finished reading Bitcoin Billionaires over the weekend. It was a quick fun read and if you are interested in the story at all and have some downtime around the holidays this is worth a read. I use Gemini for my crypto transactions. It is the firm started by Cameron and Tyler Winkelvoss. They are twins who are famous for allegedly having the idea for Facebook stolen from them by Mark Zuckerberg. Give it a look.