Some quick reminders before we get into it since there are more of you reading this now than there were last week. First, this is my diary on the market. It is in no way shape or form investment advice. These are the conversations that I am having with myself as I take in all that is happening in the market while trying to square it with the prevailing narratives and fundamentals. I do this to give some clarity to my thoughts. If you like what you are reading, please consider passing it along to others who might like it as well.

Next, if you have an opinion, I would love to hear it, especially if you disagree with something that I am thinking. I promise you that after starting in this business as a summer intern at the New York Stock Exchange when I was 16 years old, I have extremely thick skin.

Finally, nothing I write here should be considered investment advice. It is highly likely that I have a different timeframe and risk profile than you do.

Everyone has their own way of looking at markets to get a sense of what is going on. This helps them to connect the dots and formulate a probabilistic framework of what is likely to happen going forward. I have friends who love to go through as many charts as possible. Different stocks, ETFs, commodities, countries, fixed income products. Some people read constantly. They will read over the most recent earnings call transcripts for ten different semiconductor companies looking for an underlying theme. Since semis are so pervasive in the global economy, their comments are likely to provide a good read into a lot of other industry groups. I take a more hybrid approach and I rely heavily on screens. I screen for different criteria. Based on the types of stocks or other assets that pass my screens, I can get a sense of what investors think is happening in the world. Then based on the results of those screens, I can do a lot of reading to determine if the narrative makes sense.

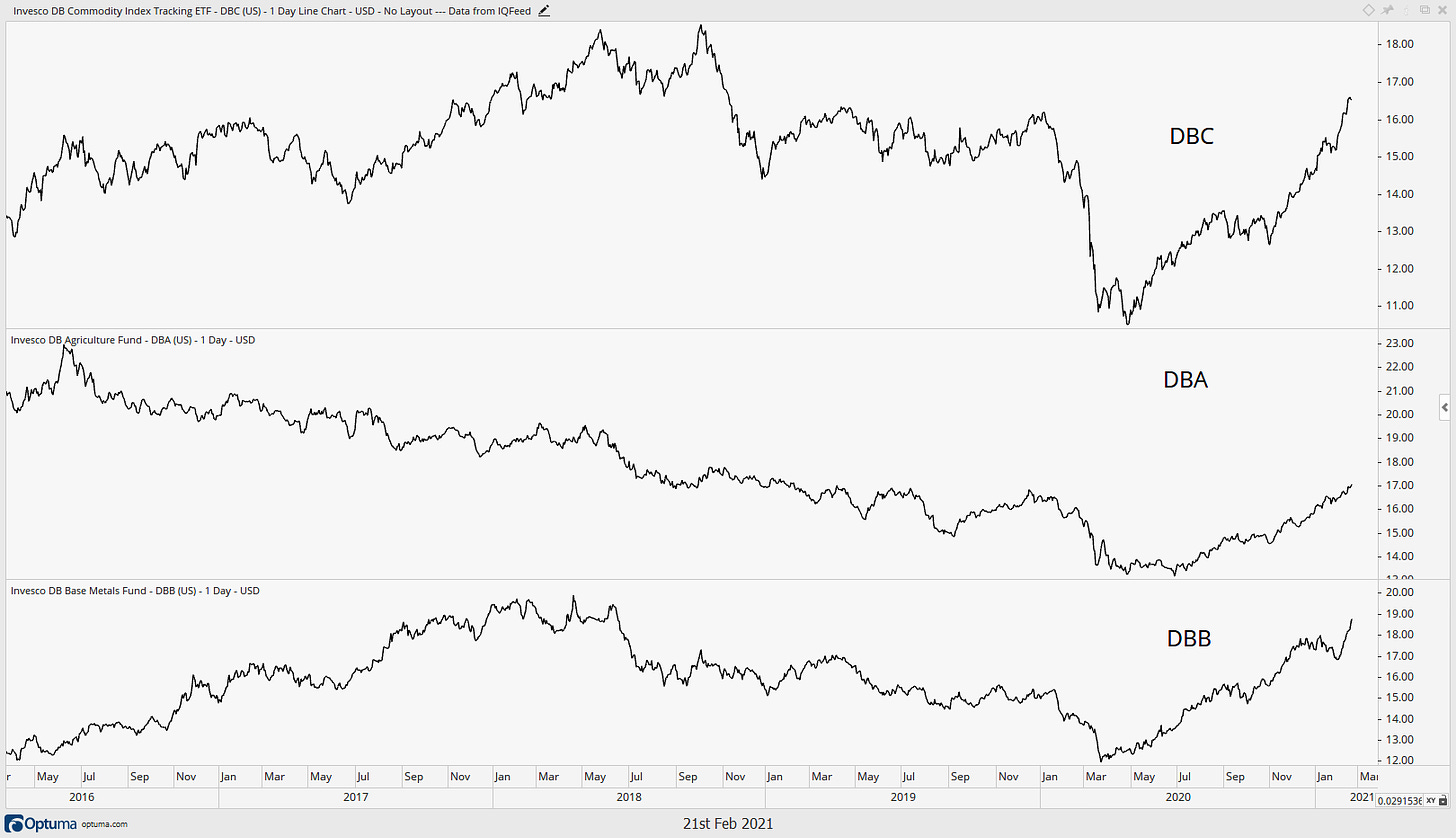

I have been pounding the table about inflation since the middle of the summer. Even in the face of people disagreeing with me, the technical data points supported my view. Given my view, on inflation, I would expect to see commodities trading well. When I run my screens of new 52-week highs, I would expect to see commodities well represented. Last night I ran my screen and three different broad-based commodity funds were on the list: The Invesco DB Commodity ETF (DBA), Agricultural ETF (DBA) and the Base Metal ETF (DBB).

I would also expect to see the major currencies of countries with heavy commodity exposure trading to 52-week highs. Both Canada (FXC) and Australia (FXA) passed the screen that I ran last night.

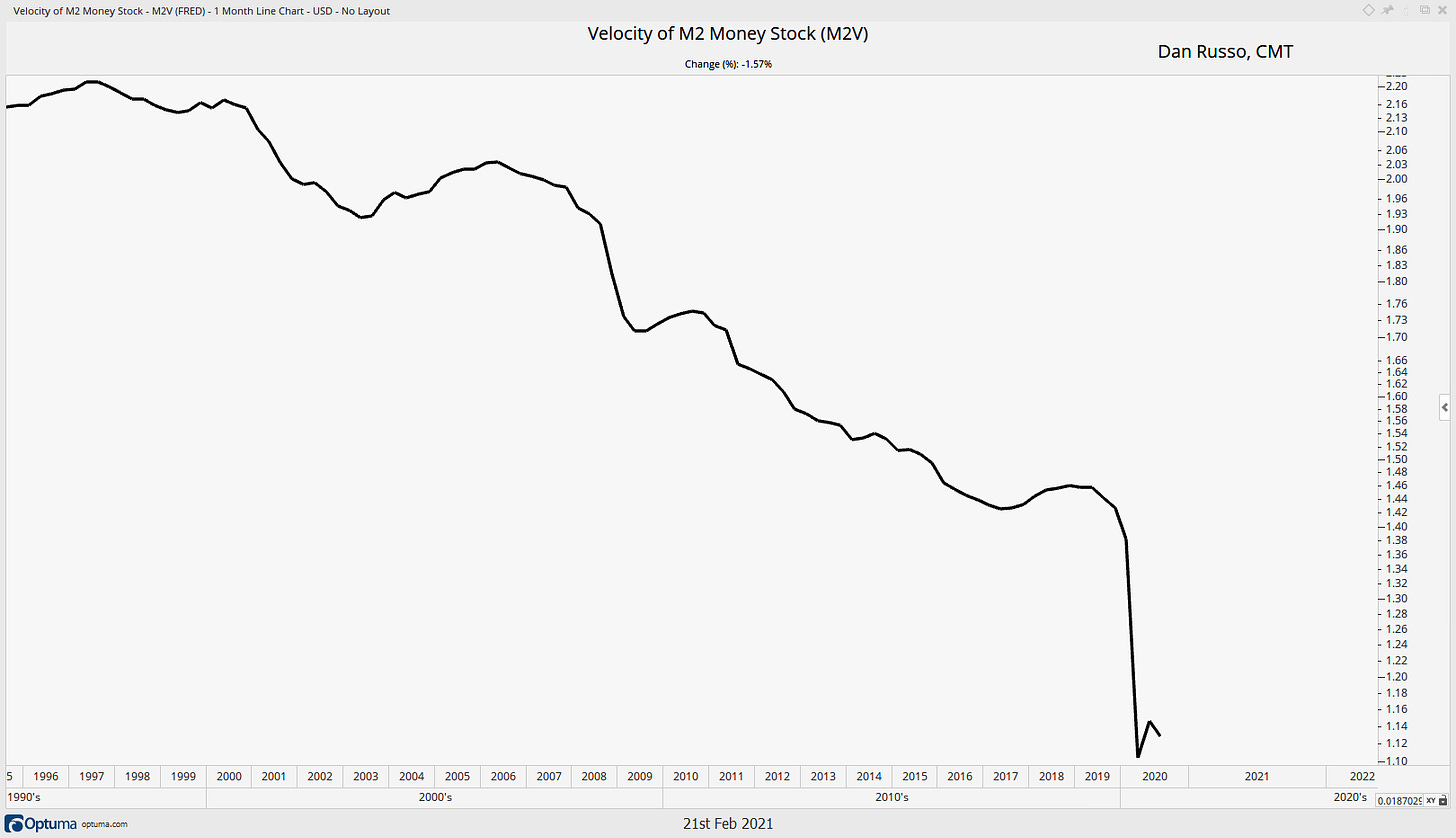

The question is, where am I wrong on this view. I think that if I am wrong, it will be due to the fact that stimulus does not work it’s way into the real economy. We have been printing huge sums of money since the Global Financial Crisis but have not created much in the way of inflation away from asset prices. The process is complex but can best summed up as money goes where it is treated the best. Since the GFC, we have been printing but the money has stayed in the financial system. Asset prices have gone up a lot. Equities are in a secular bull market. The year 2009 was probably a generational buying opportunity. Real Estate values have rocketed higher in the wake of a housing collapse. Art, fine wine…all much higher. This has been great for the people who own assets and terrible for those who do not. Some even posit that this is a big reason for the inequality that we have witnessed in this country and was a major spark for much of the civil unrest that we had over last summer. How do I know that the money we have been been printing did not make it into the real economy? The Velocity of Money. How fast (or slow) does money move around the economy? It’s been declining for years. The small blip to the upside last year is when people received their $1,200. As we know, If You Give It, We Will Spend. A round of stimulus went out in January and there is more to come when the next relief package is passed. If this line does not begin to move higher, I am probably off in my inflation views.

Speaking of the Global Financial Crisis, one of the companies that was certainly front and center was Morgan Stanley (MS). Since the crisis they have done a great job of changing the emphasis of the business from the cyclical lines of trading and investment banking to focus more heavily on wealth management, which is a much better business when you look at the drivers and the recurring nature of revenue. The stock is on the verge of clearing the pre-crisis highs. Goldman Sachs (GS) has already done the same. The GFC is highlighted in red.

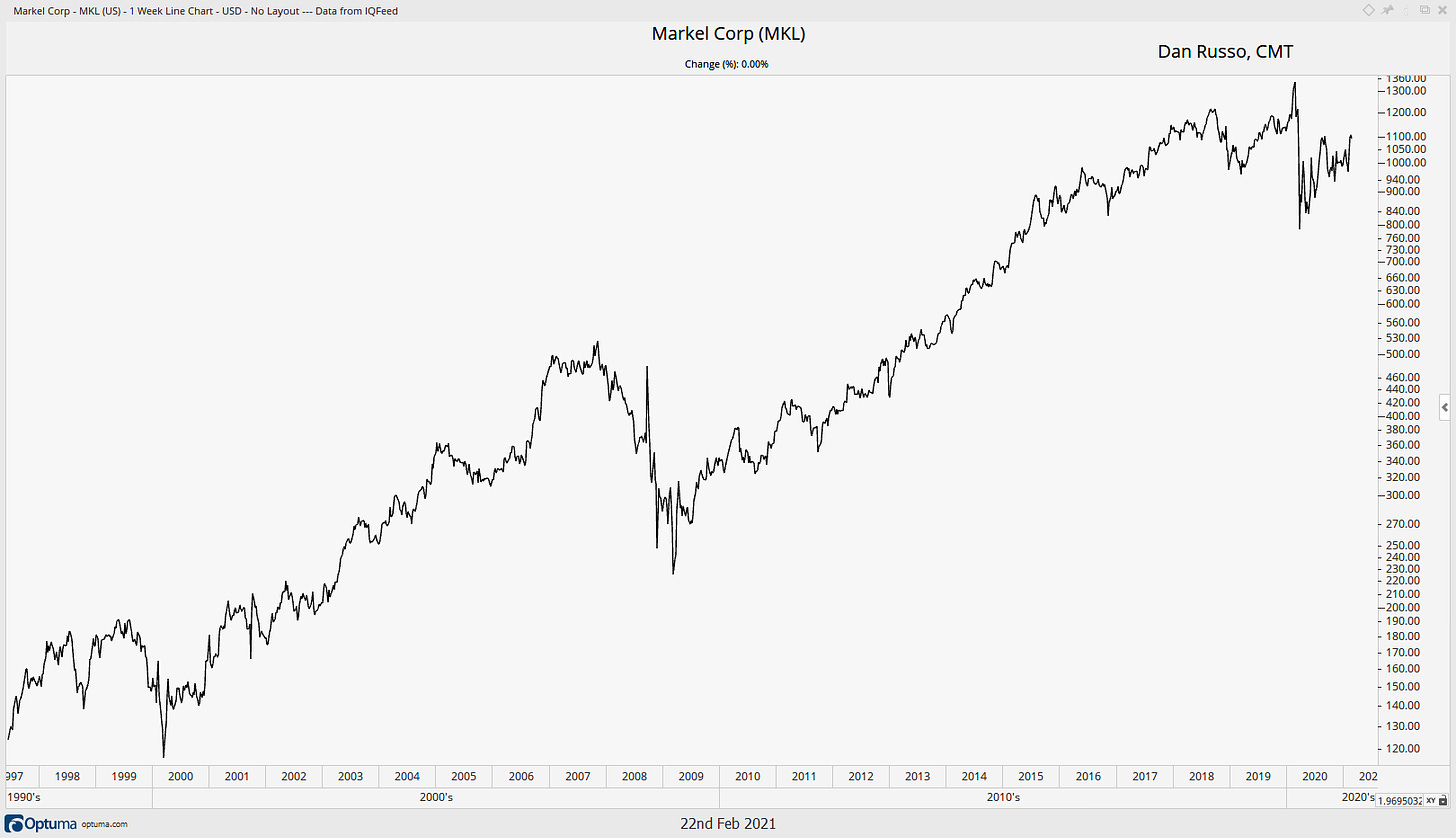

Finally, something unrelated. Next weekend anyone who cares about investing will go through the annual February ritual of waking up on Saturday morning, getting a cup of coffee and downloading, printing and reading the Berkshire Hathaway Annual Letter. People will hang on every word Warren Buffett writes. And for good reasons: he is one of the best investors to ever live, the notes are educational and entertaining (depending on who you ask. But what if there was another insurance company which had a model that similar to that of Berkshire? What if this company also publishes an annual letter in February with a lot of great insights and thoughts on investing? And finally, what if I told you that the stock of this company has done much better than Berkshire over the past 20 years? For a time when I was trading at the NYSE, I was the market maker in this stock. I have been reading their letters ever since and Markel Corp. (MKL) published theirs over the weekend.

*Thank you for taking the time to read my thoughts. As always, nothing in these pages should be considered investment advice.