We still don’t know who is the winner of the Presidential Election as I write this but the market has certainly begun to express a view. On October 12th I wrote about where the market could be wrong. Or better yet where investors’ views could be wrong based on positioning. At the time my view was that investors were betting on the “blue wave”, a clean sweep by the Democrats on election night. Here is what I had to say at the time:

The fact that this is becoming the consensus view does not make it wrong. It simply sets up a situation where if the election is close enough on November 3rd that Trump’s (or Biden’s if it goes that way) unwillingness to accept the result may be a bearish surprise. In fact, there may be reason to believe that the race will actually be closer than the betting markets and polls suggest.

By the way, kudos to my friend Mike Kramer whose work pointed to the fact that the election may be much closer than the polls projected. Here were Mike's thoughts at the time.

While we do not know who will occupy the Oval Office yet, we have a good sense that whomever it is, they will be working with a split legislative branch. The Senate appears to be staying in Republican hands for now which turns the “blue wave” into a ripple. But thus far, it has not been a bearish surprise…it still may be contested though!

We can now get a sense for where investors got it right and where they got it wrong.

Volatility - the consensus view was that volatility would collapse after the election. This has largely been the correct view but not before volatility spiked ahead of the election as it became clearer that it was not going to be a blowout in either direction.

Stimulus - the consensus view was that a “blue wave” would lead to large stimulus. Perhaps larger than what was being discussed at the time. The jury is still out on this but the market is beginning to come to the conclusion that stimulus may not be as large as was expected. This weighed on the small cap stocks in the market yesterday.

Inflation - more importantly, if true, this throws a bit of cold water on the inflation narrative. I still think we get stimulus, I remain in the when not if camp. The question is how big, and that is now an unknown.

There are countless other situations on which the investors were offsides. We watched the coverage on Bloomberg TV so I could see how markets traded through the night and there was a lot of activity: small caps, the Chinese currency, gold, copper…it was all fascinating to watch this unwind. Given a ripple instead of a wave, what are some of the possible outcomes going forward and how are they being reflected in the market.

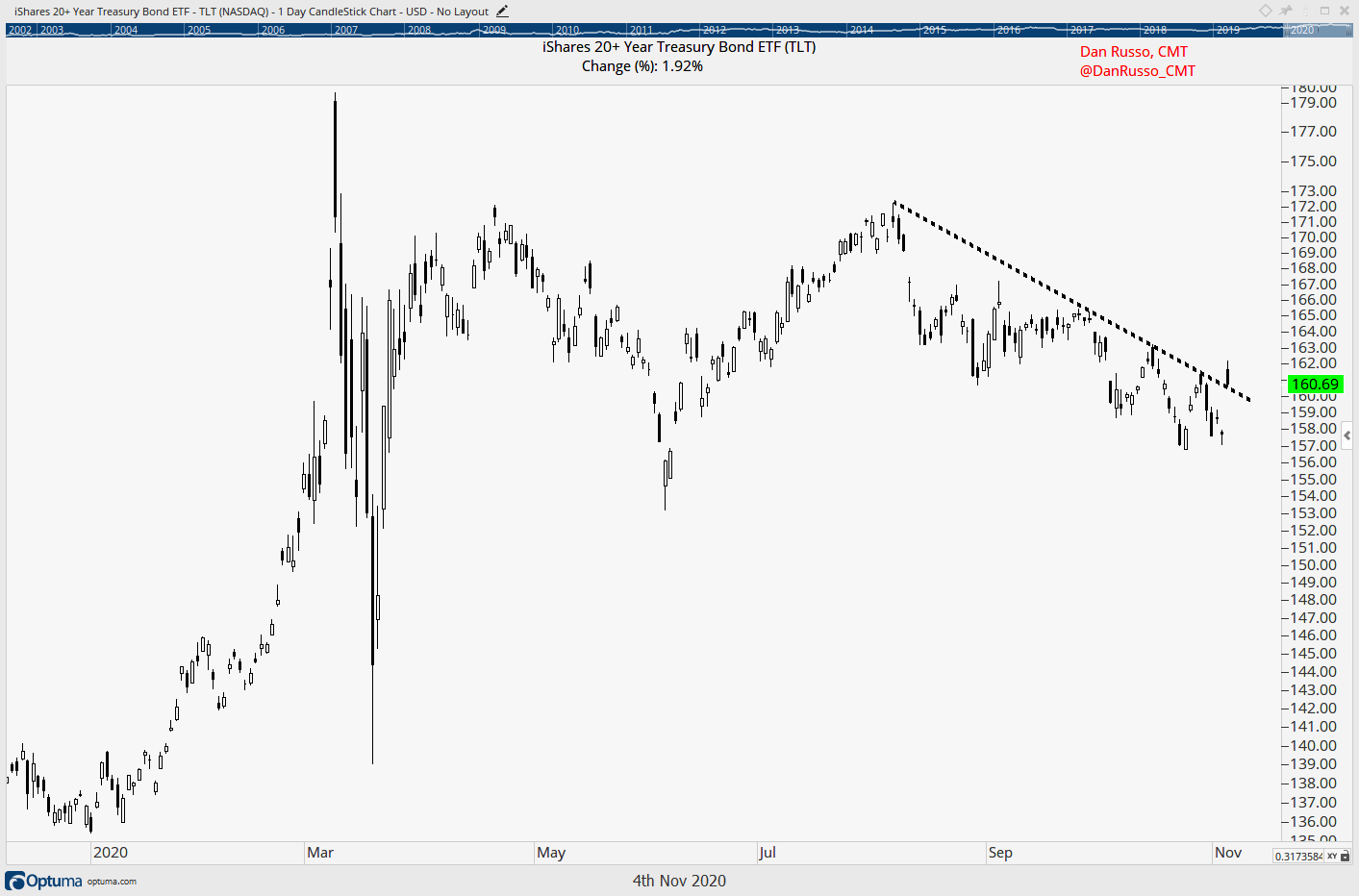

Interest Rates - bond investors were giddy about the possibility of a smaller stimulus package than what was being priced in under the Democratic sweep. Less stimulus means less borrowing means less supply of treasuries coming to market. The long-term treasury bond fund exploded higher yesterday, sending yields lower. Investors seem to be happy that there may be less borrowing but they are also telling us that growth could be an issue. The 30-year bond is yielding about 1.5%. Would you lend your money to the government for that long for such a low rate if you thought there were better growth prospects elsewhere? I am actually of the opinion that growth is improving but it is still very early days and once we move past the election, we still have the impacts of COVID. By the way, there were more than 100,000 cases reported yesterday in the US.

Technology Stocks - they loved the fact that the Senate may stay with the Republicans. Some of the biggest companies in the world have come under scrutiny in Congress as possibly being monopolies. Investors seem to be betting that a divided legislative branch dampens some of that regulatory risk. Also, getting back to the lack of growth theme. If the prospects are for slower growth due to smaller stimulus, investors are more likely to invest in companies that are growing. Finally, remember what I wrote about rising rates and their impact on growth companies? Rates falling should provide a tailwind if it is sustained. The Technology ETF took off yesterday.

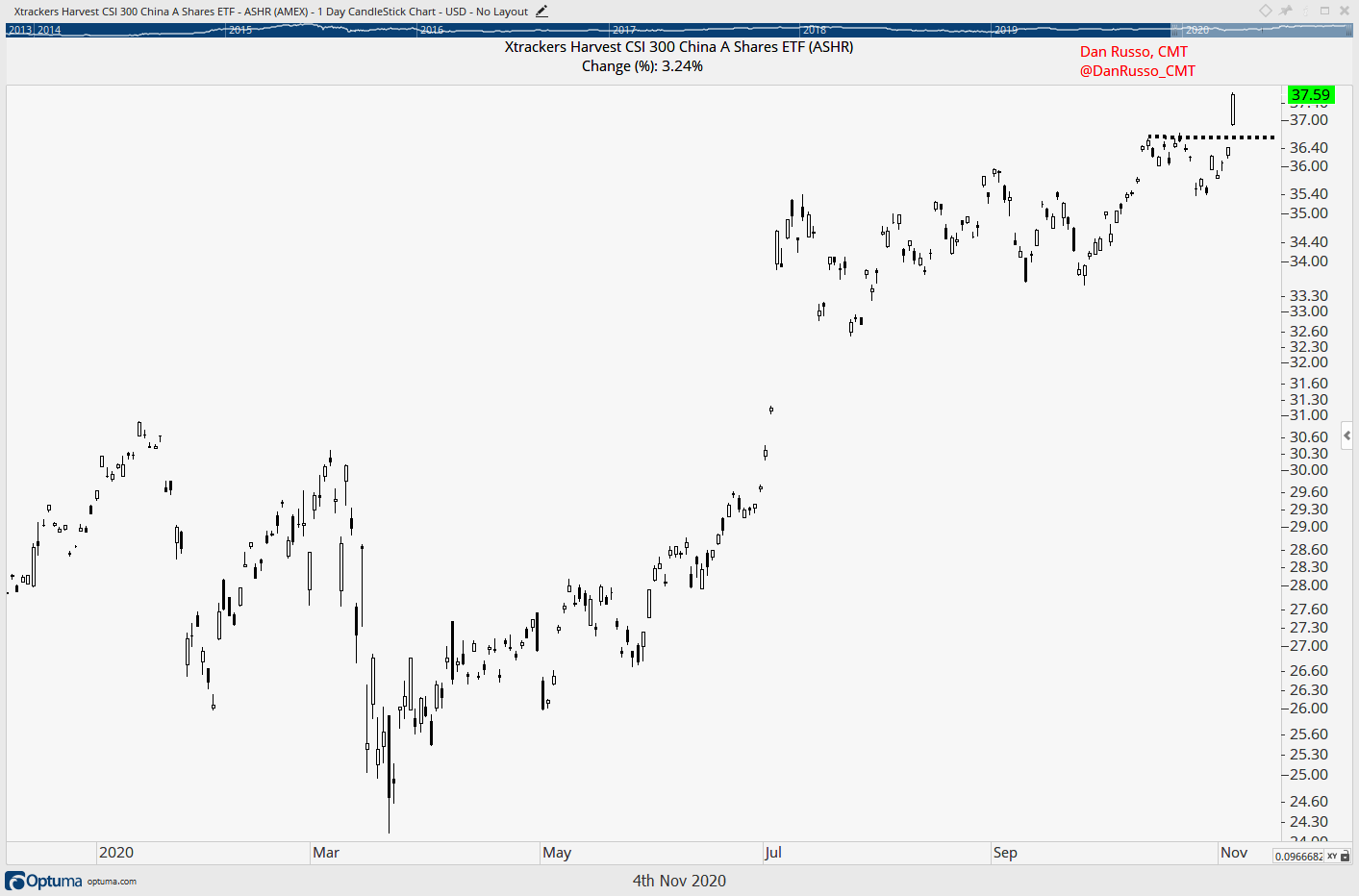

China - this one is always a bit of a hot button issue and I am not going to get burned on the issues, I am simply going to look at the facts. Right now, it appears that VP Biden is in the lead (this is clearly subject to change). Under President Trump, the US and China are not what you would call “best buds.” Remember the trade war? The thought of a change in the Oval has led to a breakout to new highs for Chinese stocks based on trading in the Xtrackers Harvest CSI 300 China A Shares ETF (ASHR). Yesterday, I wrote about being open to opportunities outside the US and wondered if the election could be a catalyst. Perhaps we are beginning to get an answer? I also think that if going abroad, Asia is where the relative strength can be found.

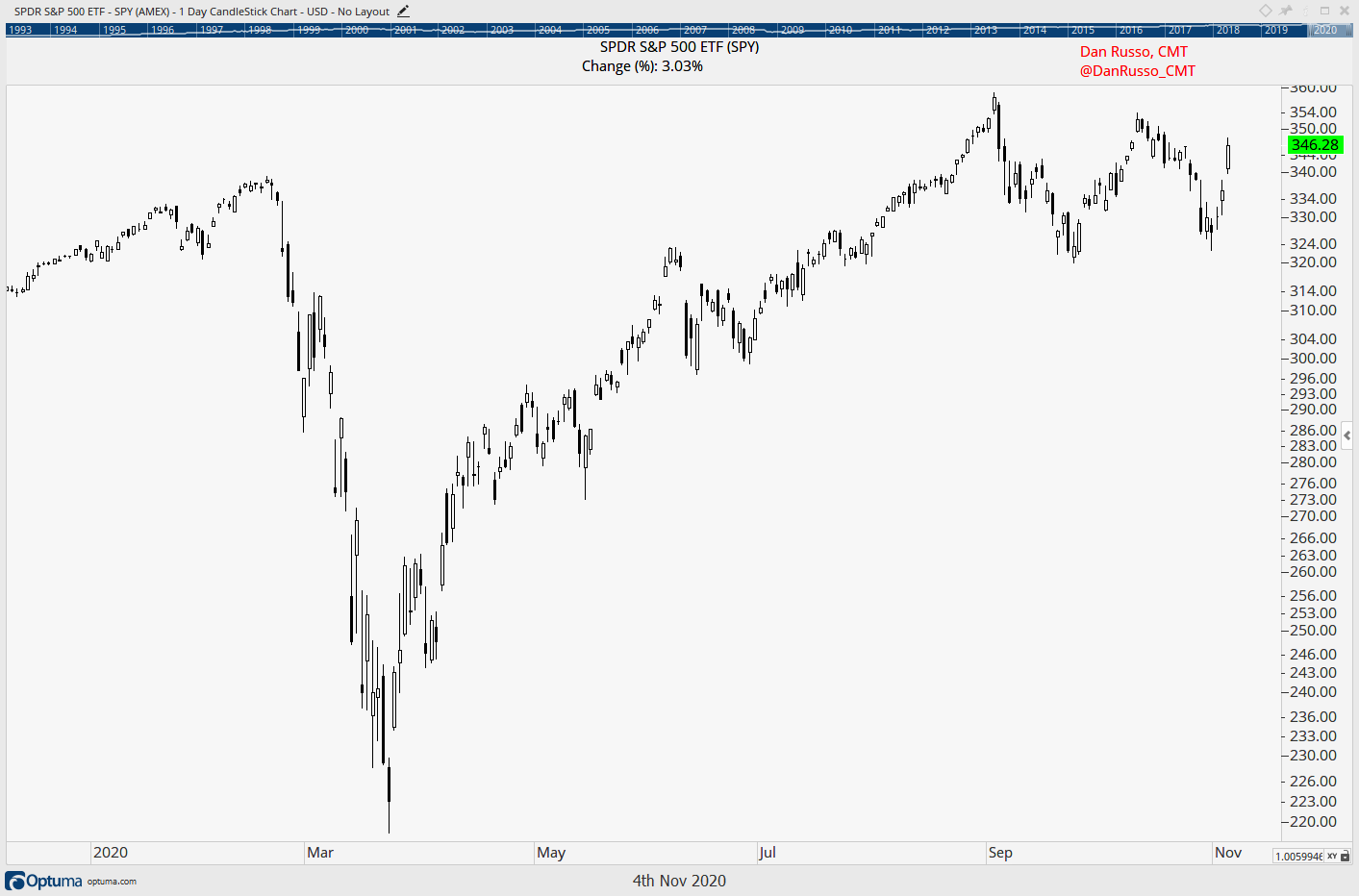

So why are stocks moving higher if we still don’t know who is the President? While no one ever knows for sure, my thoughts are that a divided legislative branch means that there are greatly reduced odds of drastic and or sweeping changes to the status quo, especially as it relates to taxes. Remember, VP Biden was going to roll back President Trump’s cuts and possibly introduce higher taxes in other areas of the economy. That will be much harder to do if he ultimately prevails. Also, getting back to interest rates, with them low and possibly heading lower, investors with long-term goals will likely have to continue to allocate a larger portion of their portfolios to stocks due to their “growth of capital” prospects. I have to imagine it will be hard to meet those goals with a lot of money invested in products that are yielding 1.5% or less. Here is the S&P 500 ETF moving higher.

Yesterday seemed a lot like short-term investors readjusting their portfolios as the “blue wave” thesis did not play out. All of this could change in an instant and there are a lot of moving parts still in play (there is still scope for this to be contested), but in the meantime, here are my take-aways:

Diversify - those who were “all in” on the “blue wave” just learned that childhood lesson of not having all your eggs in one basket. This is why I have some exposure to different themes in the market now.

Keep an Open Mind - there is a movie that I like called This is Where I Leave You. Rose Byrne’s character has a line that I think is fitting now: “Any thing can happen, anything happens all the time.”

The “Experts” are Human - they get it wrong. The polls had this election as a blowout and many people took them at face value…again. We all make mistakes. Move on!

Trends - the funny thing is that for all the back and forth and for all the hype, much of what we saw yesterday were simply movements in the direction of the longer-term trends. Stocks have been going up since 2009. Treasuries have been going up (yields have been falling) since the early 1980s. Chinese stocks have been going up since early 2019. Technology stocks have been rising since 2009. When they shift we will likely know it.

Know Yourself - if you are a trader, trade! This is an environment that suits you, the market has been choppy for more than two months. If you are an investor, invest! The big picture remains largely unchanged (for now).

Thank you all for reading about my thoughts everyday! Remember, this is not advice. If you are enjoying this note, please consider sharing it.