Some Compelling Global Equity Markets

Some quick reminders before we get into it since there are more of you reading this now than there were last week. First, this is my diary on the market. It is in no way shape or form investment advice. These are the conversations that I am having with myself as I take in all that is happening in the market while trying to square it with the prevailing narratives and fundamentals. I do this to give some clarity to my thoughts. If you like what you are reading, please consider passing it along to others who might like it as well.

Next, if you have an opinion, I would love to hear it, especially if you disagree with something that I am thinking. I promise you that after starting in this business as a summer intern at the New York Stock Exchange when I was 16 years old, I have extremely thick skin.

Finally, nothing I write here should be considered investment advice. It is highly likely that I have a different timeframe and risk profile than you do.

It’s a big world out there. Many people tend to invest close to home, possibly missing opportunities around the globe. I would be willing to bet that for the majority of investors in the United States, a majority of their portfolios are invested in the United States. For the most part, over the past few years, that has made a lot of sense. Markets in the US were outperforming markets in the rest of the world. However, I have been of the view that we are in the early innings of a shift in this trend. In my mind, this sets up an opportunity to get in front of the crowd should this shift turn into something more meaningful.

Since it’s a four-day trading week this week, here are four charts that jumped out at me as I was scanning the markets over the holiday weekend. They are a good starting point for potential ideas in the weeks and months ahead.

Chart One: US Against the World. The iShares MSCI ACWI ex US Index Fund (ACWX) has broken to a 10-year high on an absolute basis (top panel). The ACWX is a broad representation of global markets outside of the United States. Over the ten years that this fund went essentially nowhere it greatly underperformed the S&P 500. Over this span, it made sense to have the bulk, if not all, of equity investments in the United States. However, in the middle of 2020, this relationship began to shift slightly toward the rest of the world leading the US (bottom panel, ACWX vs S&P 500). It’s still very early and can certainly reverse, but should this early momentum continue, my thought is that there are not may US investors who are prepared for it.

Chart Two: The Land of the Rising Sun. I have touched on Japan in the past and the upside momentum continues. Warren Buffett recently made a big investment in Japan as well. While this may be a bit overdone in the near-term, I think that as long as the Nikkei holds above the dashed line, odds favor a run back to the highs seen in the late 80’s. This isn’t exactly an new find, a lot of people are talking about the rally in Japan but that doesn’t mean it can’t keep working.

Chart Three: Bias May Keep People From China. During the the trade war, it was easy to spin the narrative that China was / is the enemy. They have been labeled currency manipulators, keeping the Yuan weak in order to increase the attractiveness of their exports. I would argue that most countries are doing all that they can to keep their currencies weak but that’s a story for another time. There are many investors who just “don’t trust” China when it comes to the economic data that they report. I have no way of saying if this argument holds merit or not so I can only defer to what I do know, the trend. These narratives may make some investors skeptical of China. The Xtrackers Harvest CSI 300 A Shares ETF (ASHR) is the first US-listed China ETF capable of accessing the China A-share market directly. The fund just broke to an all-time high.

Chart Four: I Don’t Hear Much Talk of Israel. This is actually a play on global technology in my view. We have all heard of the fabled Silicon Valley in California, but many people probably don’t know anything about Silicon Wadi. "Wadi" is the Arabic word for a valley or dry river bed, also commonly used in colloquial Hebrew. The current rock star fund manager of the moment, Cathie Wood, and her team have a product dedicated to Israel Innovative Technology. The iShares MSCI Israel ETF (EIS) made no progress from 2008 until recently, breaking to new all-time highs.

Ok, fine. Here is a fifth chart that came to mind after reading this article in the FT. My long standing view has been that Asia handled the pandemic better than we did in the west…that includes much of Europe. Markets in Asia have certainly been performing better than markets in the west since the recovery began. But this article broadens the theme out to the emerging countries and economies. This line jumped off the page at me: lacking the money to revive their economies through stimulus, they have little choice but to push productivity-enhancing reform. Many of these countries just don’t have the resources to hand out stimulus checks to the same degree as we have here. Consider this, the $1.9 trillion stimulus bill currently being debated in the US amounts to roughly 25% of our GDP. During the depths of the pandemic, our economy contracted by ~10%. The level of stimulus is massive! Contrast that with China…Rather than promising endless rounds of easy money, China’s central bank is beginning to pare back its monetary stimulus, citing the dangers of rising debt and financial bubbles. Meanwhile, Beijing is proposing ambitious new economic reforms, including a further opening of its financial markets to the outside world.

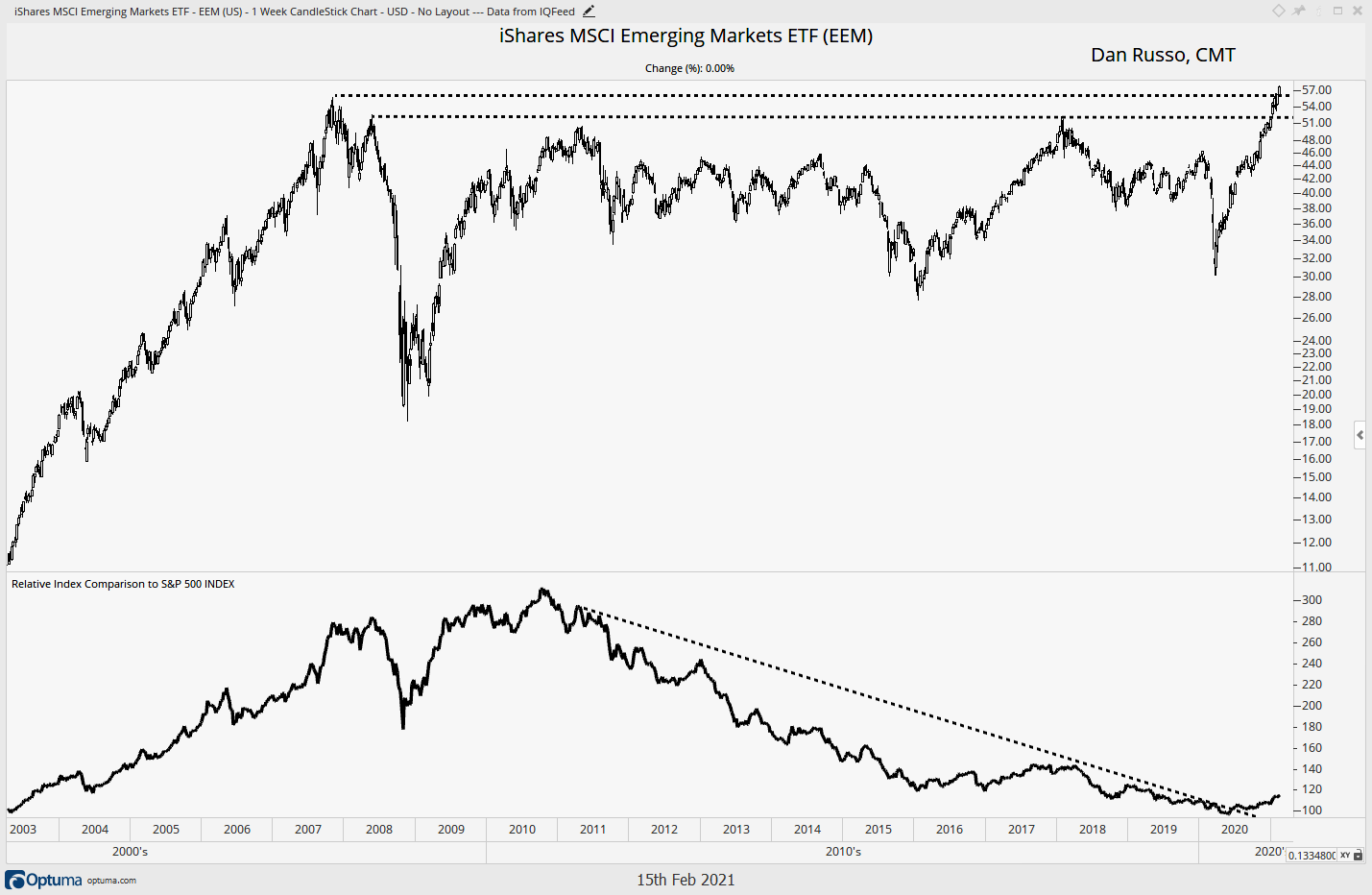

Chart Five: The Emergence of Emerging Markets. The iShares MSCI Emerging Markets ETF (EEM) has recently traded past the highs from 2007. At the same time, the fund may be shifting to outperformance vs the S&P 500 (bottom).

I own this one in one of my personal accounts. Admittedly, many people have been highlighting this strength over the past few weeks, but I can’t argue with the fact that this is a 14 year consolidation that may be coming to an end.

Each of these brings their own risks as it relates to regulations, governance and geopolitics, but the these are also big shifts that appear to be playing out, making them worth the time and effort of extra attention in the research process.

This feels, to me, a lot like commodities. Global equity markets could be an under-owned asset class that will surprise a lot of investors if they begin to outperform US equities for an extended period of time.